by Calculated Risk on 8/23/2023 09:02:00 AM

Wednesday, August 23, 2023

Black Knight: Mortgage Delinquency Rate Increased Slightly in July

From Black Knight: Black Knight’s First Look at July Mortgage Performance Data: Foreclosure Inventory Hits Lowest Level in 15 Months, While Serious Delinquencies Continue to Decline

• While the national delinquency rate edged up 9 basis points in July to 3.21%, it was down 12 basis points year over year and remains within 12 basis points of March’s record lowAccording to Black Knight's First Look report, the percent of loans delinquent increased 2.9% in July compared to June and decreased 3.6% year-over-year.

• Meanwhile, serious delinquencies (90+ days past due) continued to improve, falling to 468K – the lowest level seen since the pre-Great Financial Crisis housing market peak and down 161K (-26%) from July 2022

• 30-day delinquencies rose by 35K in the month, with 60-day DQs rising by 17K (6.4%) – while those 90+ days past due fell by 3K (-0.6%)

• Loans in active foreclosure fell to 220K – the fewest since just after the end of federal foreclosure moratoria – and remain down 63K (-22%) from February 2020, prior to the pandemic

• July’s 26.3K foreclosure starts were 4% below the average number of such actions over the preceding 12 months and remain 39% below pre-pandemic levels

• Foreclosure starts equated to 5.6% of 90+ day delinquencies – still more than three percentage points below pre-pandemic foreclosure referral rates – while July’s 6.1K foreclosure sales (completions) nationally were down 11% from June

• Prepayment activity fell under easing seasonal home buying pressure along with interest rates briefly rising above 7% and ending July at 6.88%, with prepayments still down 28% from July 2022

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.21% in July, up from 3.12% the previous month.

The percent of loans in the foreclosure process decreased slightly in July to 0.42%, from 0.42% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2023 | June 2023 | |||

| Delinquent | 3.21% | 3.12% | ||

| In Foreclosure | 0.42% | 0.42% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,700,000 | 1,650,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 220,000 | 224,000 | ||

| Total Properties | 1,919,000 | 1,874,000 | ||

MBA: Mortgage Applications Decreased in Weekly Survey; Purchase Applications "lowest level since April 1995"

by Calculated Risk on 8/23/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 18, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week and was 35 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 30 percent lower than the same week one year ago.

“Treasury yields continued to spike last week as markets grappled with illiquidity and concerns that the resilient economy will keep inflation stubbornly high. This spike pushed mortgage rates higher last week, with the 30-year fixed rate increasing to 7.31 percent – the highest level since December 2000,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Applications for home purchase mortgages dropped to their lowest level since April 1995, as homebuyers withdrew from the market due to the elevated rate environment and the erosion of purchasing power. Low housing supply is also keeping home prices high in many markets, adding to the affordability hurdles buyers are facing.”

Added Kan, “The ARM share of applications increased to 7.6 percent, the highest level in five months, and the number of ARM applications picked up by 4 percent last week. Some homebuyers are looking to lower their monthly payments by accepting some interest rate risk after the initial fixed period.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.31 percent from 7.16 percent, with points increasing to 0.78 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 30% year-over-year unadjusted.

Tuesday, August 22, 2023

Wednesday: New Home Sales

by Calculated Risk on 8/22/2023 08:16:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 701 thousand SAAR, up from 697 thousand in June.

• Also at 10:00 AM, the Bureau of Labor Statistics (BLS) will release the 2023 Preliminary Benchmark Revision to Establishment Survey Data.

• During the day, The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

Lawler: More on “R-Star”

by Calculated Risk on 8/22/2023 01:26:00 PM

Last week, housing economist Tom Lawler wrote: Is The “Natural” Rate of Interest Back to Pre-Financial Crisis Levels?. Here are some additional comments from Lawler:

While NY Fed President Williams recently argued that “there is no evidence that the era of low natural rates of interest has ended,” (which many including myself would say is not accurate), other analysts at the NY Fed who oversee its “Dynamic Stochastic General Equilibrium” (DSGE) model suggest otherwise, at least for the “short-run” measure of the natural rate of interest, or “r-star.” In a recent post on the Liberty Street Economics blog, economists Katie Baker, Logan Casey, Marco Del Negro, Aidan Gleich, and Ramya Nallamotu discuss some of the reasons why their DSGE’s estimate of the short-run natural rate of interest (in inflation-adjusted terms) increased from 0.81% in December 2022 to an eye-popping 3.57% in March 2023. (The post is available at The Evolution of Short-Run r* after the Pandemic) The latest results from the DSGE model project that r-star will decline to 2.22% at the end of 2023, 1.77% at the end of 2024, and 1.47% at the end of 2025.

Here is the last paragraph in the blog (my bold).

“In sum, to make sense of recent developments in the U.S. economy, we must explain the fact that the economy remains quite strong in spite of the FFR being more than 500 basis points higher than it was a little more than a year ago. The model rationalizes these developments by postulating that the short-run natural rate of interest has increased considerably over the past year. This, in turn, has implications for the speed of the decline of inflation toward the FOMC’s long run goal and for assessing the stance of monetary policy.”

Now I’m not a big fan of DSGE models, and I’m certainly not a big fan of the HLW model that was the basis for NY Fed Governor Williams’ assertion that there is no evidence that the natural rate of interest has increased meaningfully, if at all. There are, however, many reasons to believe that the natural rate of interest HAS in fact increased significantly, including but not limited to market-based signals.

Not surprisingly, of course, market participants are quite uncertain as to “the Fed’s” current view is on the “natural” rate of interest, as there is conflicting evidence not just within the NY FED but from research at other regional Federal Reserve Banks.

Some are hoping that the Fed Chairman Powell may address the “r-star issue” at Jackson Hole this week, or at least express his views on this issue, though given the conflicting evidence I’m not sure whether he will provide much clarity save that the level of r-star is “highly uncertain” – which is certainly the case!

But I think there is a strong case that the “natural” rate of interest is back to levels just prior to the 2008 financial crisis.

NAR: Existing-Home Sales Decreased to 4.07 million SAAR in July; Median Prices Increased 1.9% YoY in July

by Calculated Risk on 8/22/2023 10:56:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.07 million SAAR in July; Median Prices Increased 1.9% YoY in July

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in July was $406,700, an increase of 1.9% from July 2022 ($399,000). Prices rose in the Northeast, Midwest and South but were unchanged in the West.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and bottomed at down 3.0% in May 2023. Prices are now up 1.9% YoY. Median house prices decreased 0.8% from June to July and are down 1.7% from the peak in June 2022 (NSA).

The median price tends to lead the Case-Shiller index, and this is further evidence that Case-Shiller will likely turn positive year-over-year soon.

Note that closed sales in July were mostly for contracts signed in May and June. Mortgage rates, according to the Freddie Mac PMMS, averaged around 6.4% in May and 6.7% in June. August sales will be mostly for contracts signed in June and July, mortgage rates averaged 6.9% in July, so seasonally adjusted closed sales will likely be less in August compared to July.

The recent surge in mortgage rates over 7% will impact closed sales in September, and it now seems likely that in a few months existing home sales will fall below the previous cycle low of 4.00 million in January 2023.

NAR: Existing-Home Sales Decreased to 4.07 million SAAR in July

by Calculated Risk on 8/22/2023 10:00:00 AM

From the NAR: Existing-Home Sales Slipped 2.2% in July

Existing-home sales receded in July, according to the National Association of Realtors®. Among the four major U.S. regions, sales grew in the West but faded in the Northeast, Midwest and South. All four regions registered year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.2% from June to a seasonally adjusted annual rate of 4.07 million in July. Year-over-year, sales slumped 16.6% (down from 4.88 million in July 2022).

...

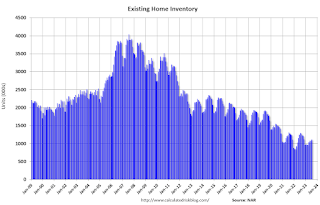

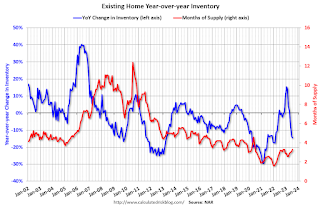

Total housing inventory registered at the end of July was 1.11 million units, up 3.7% from June but down 14.6% from one year ago (1.3 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 3.1 months in June and 3.2 months in July 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in July (4.07 million SAAR) were down 2.2% from the previous month and were 16.6% below the July 2022 sales rate.

According to the NAR, inventory increased to 1.11 million in July up from 1.08 million in June.

According to the NAR, inventory increased to 1.11 million in July up from 1.08 million in June.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.6% year-over-year (blue) in July compared to July 2022.

Inventory was down 14.6% year-over-year (blue) in July compared to July 2022. Months of supply (red) increased to 3.3 months in July from 3.1 months in June.

This was below the consensus forecast. I'll have more later.

Monday, August 21, 2023

Tuesday: Existing Home Sales, Richmond Fed Mfg

by Calculated Risk on 8/21/2023 08:17:00 PM

"Higher for longer," they said. And they weren't kidding. ... There have been some complicating factors over the past 2 weeks, but rising rate momentum is still mostly about the economy. As such, it's the economy that will need to demonstrate a shift before we see meaningful relief. Until then, the path of least resistance is the path we've been seeing. Today was just another day on that path. [30 year fixed 7.48%]Tuesday:

emphasis added

• At 10:00 AM ET, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, down from 4.16 million last month.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.39% in July"

by Calculated Risk on 8/21/2023 04:14:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July

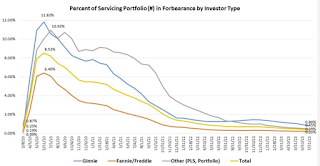

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023. According to MBA’s estimate, 195,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.9 million borrowers since March 2020.

In July 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.20%. Ginnie Mae loans in forbearance decreased 13 basis points to 0.80%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 7 basis points to 0.45%.

“The prevalence of forbearance plans has dramatically dropped since 2020, and the reasons that borrowers are in forbearance are changing,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “About two-thirds of borrowers are still in forbearance because of the effects of COVID-19, but a growing share of borrowers are in forbearance for other reasons that cause temporary hardship such as financial distress or natural disasters. With the COVID-19 national emergency lifted, Fannie Mae and Freddie Mac recently announced the retirement of certain COVID-19 flexibilities relating to forbearance plans and workouts.[1]”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing and declined to 0.39% in July from 0.44% in June.

At the end of July, there were about 195,000 homeowners in forbearance plans.

4th Look at Local Housing Markets in July

by Calculated Risk on 8/21/2023 02:40:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in July

A brief excerpt:

Note: The National Association of Realtors (NAR) is scheduled to release July existing home sales tomorrow, Tuesday, August 22nd, at 10:00 AM ET. The consensus is for 4.15 million SAAR, down from 4.16 million last month. Housing economist Tom Lawler expects the NAR to report sales of 4.06 million SAAR for July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

In July, sales in these markets were down 15.0%. In June, these same markets were down 16.8% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in June for these markets. Note that there were the same number of selling days each year in July 2022 and July 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates - and sales in July on a seasonally adjusted annual rate (SAAR) basis will likely be close to 4.06 million.

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

DOT: Vehicle Miles Driven Increased 2.8% year-over-year in June

by Calculated Risk on 8/21/2023 11:12:00 AM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

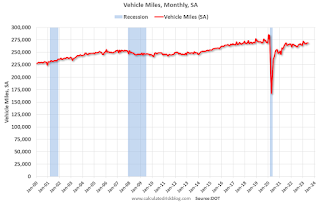

Travel on all roads and streets changed by +3.1% (+8.4 billion vehicle miles) for June 2023 as compared with June 2022. Travel for the month is estimated to be 283.0 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for June 2023 is 268.9 billion miles, a 2.8% (7.4 billion vehicle miles) change over June 2022. It also represents a -0.2% change (-0.4 billion vehicle miles) compared with May 2023.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. Miles driven are now slightly below pre-pandemic levels.