by Calculated Risk on 8/24/2023 03:45:00 PM

Thursday, August 24, 2023

Realtor.com Reports Weekly Active Inventory Down 7% YoY; New Listings Down 6% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Aug 19, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 7.2%.

This past week marked the 9th consecutive decline in the number of homes actively for sale compared to the prior year, however the gap narrowed slightly compared to the previous week’s -8.6% figure. The existing home sales pace has been roughly consistent at a low level in recent months, suggesting affordability driven by high rates and high prices keep making sellers and buyers hold their moving plans.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 5.7% from one year ago.

For 59 weeks, there have been fewer newly listed homes compared to the same time one year ago. However, this gap has been shrinking as we start to compare against low new listings in the latter months of 2022. This week’s data shows a 2.4 percentage point improvement over last week. While it’s likely that we might see more new listings this fall than the previous year, inventory will continue to remain constrained as listings are still more than 20% below typical pre-pandemic levels seen this time of year.

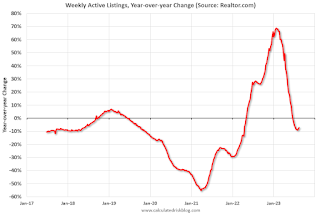

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 7.2% year-over-year - this was the ninth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Final Look at Local Housing Markets in July

by Calculated Risk on 8/24/2023 12:58:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in July

A brief excerpt:

Each month I track closed sales, new listings and active inventory in a sample of local markets around the country (over 40 local housing markets) in the US to get an early sense of changes in the housing market. In addition, we can look for regional differences.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m frequently adding more markets). This is the final look at local markets in July.

The big story for July existing home sales was the large year-over-year (YoY) decline in sales. Also new listings were down sharply YoY and active listings are now down YoY.

...

In July, sales in these markets were down 16.9%. In June, these same markets were down 16.9% YoY Not Seasonally Adjusted (NSA).

...

My early expectation is we will see a somewhat lower level of sales in August on a seasonally adjusted annual rate basis (SAAR) than in July.

...

More local data coming in September for activity in August!

LA Port Inbound Traffic Down Sharply YoY in July

by Calculated Risk on 8/24/2023 11:17:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

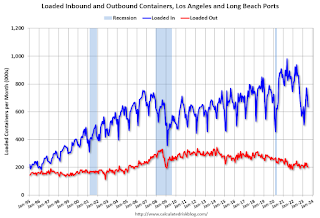

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

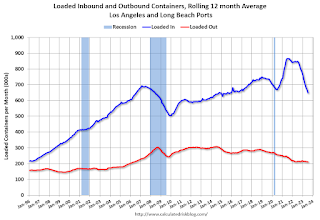

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 2.8% in July compared to the rolling 12 months ending in June. Outbound traffic decreased 0.5% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Weekly Initial Unemployment Claims Decrease to 230,000

by Calculated Risk on 8/24/2023 08:30:00 AM

The DOL reported:

In the week ending August 19, the advance figure for seasonally adjusted initial claims was 230,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 239,000 to 240,000. The 4-week moving average was 236,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 234,250 to 234,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,750.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, August 23, 2023

Thursday: Unemployment Claims, Durable Goods

by Calculated Risk on 8/23/2023 08:05:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 239 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for July. This is a composite index of other data.

• Also at 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

August Vehicle Sales Forecast: 15.3 million SAAR, Up Sharply YoY

by Calculated Risk on 8/23/2023 05:01:00 PM

From WardsAuto: August U.S. Light-Vehicle Sales Tracking to a 19% Increase; SAAR Weakens from July (pay content). Brief excerpt:

Keeping sales from growing faster are still-elevated average vehicle prices and inventory stuck at historic lows with the mix slanted toward higher cost models and trims levels. Fleet volume in August also is not expected to rebound from a seasonal decline in July and is partly behind the expected 6.3% increase in inventory from July.

emphasis added

Click on graph for larger image.

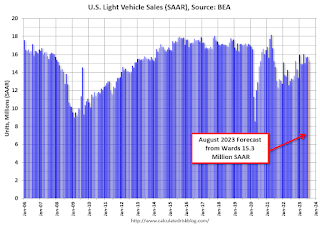

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for July (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.3 million SAAR, would be down 3% from last month, and up 16% from a year ago.

AIA: Architecture Billings "Stable" in July; Multi-family Billings Decline for 12th Consecutive Month

by Calculated Risk on 8/23/2023 02:53:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Sees Stable Business Conditions in July

The American Institute of Architects (AIA)/Deltek Architecture Billings Index (ABI) results for July signals mostly stable business conditions. The ABI score was 50.0, indicating that billings at architecture firms remained flat for the month.

“This is the third straight month that billings at architecture firms have stabilized,” said AIA Chief Economist Kermit Baker, PhD. “New project work has been even stronger over this period. This suggests that design work may finally begin to increase over the coming months, although somewhat modestly.”

Firms with a commercial/industrial specialization reported their strongest billings growth in more than a year, while firms with a multifamily residential specialization continued to report declining billings. While this marks the ninth consecutive month of growth for firms located in the Midwest region, firms in other regions reported modest declines in billings.

...

• Regional averages: Midwest (51.6); West (49.6); Northeast (49.3); South (48.9)

• ector index breakdown: commercial/industrial (52.7); institutional (51.2); mixed practice (firms that do not have at least half of their billings in any one other category) (46.3); multifamily residential (45.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.0 in July, down from 50.1 in June. Anything above 50 indicates an increase in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment later in 2023 and into 2024.

New Home Sales increase to 714,000 Annual Rate in July; Median New Home Price is Down 12% from the Peak

by Calculated Risk on 8/23/2023 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales increase to 714,000 Annual Rate in July

Brief excerpt:

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 714 thousand. The previous three months were revised down, combined.You can subscribe at https://calculatedrisk.substack.com/.

...

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in July 2023 were up 31.5% from July 2022. Year-to-date sales are up 0.4% compared to the same period in 2022.

As expected, new home sales were up solidly year-over-year in July, and it is fairly certain there will be more sales in 2023 than in 2022 - although 7%+ mortgage rates will likely slow sales.

Employment: Preliminary annual benchmark revision shows downward adjustment of 306,000 jobs

by Calculated Risk on 8/23/2023 10:09:00 AM

The BLS released the preliminary annual benchmark revision showing 306,000 fewer payroll jobs as of March 2023. The final revision will be published when the January 2024 employment report is released in February 2024. The number is then "wedged back" to the previous revision (March 2022). Usually, the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

n accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2024 with the publication of the January 2024 Employment Situation news release.Construction was revised up by 30,000 jobs, and manufacturing revised down by 43,000 jobs.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus one-tenth of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2023 total nonfarm employment of −306,000 (−0.2 percent).

emphasis added

This preliminary estimate showed 358,000 fewer private sector jobs, and 52,000 more government jobs (as of March 2023) than originally estimated.

New Home Sales increase to 714,000 Annual Rate in July

by Calculated Risk on 8/23/2023 10:00:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 714 thousand.

The previous three months were revised down, combined.

Sales of new single‐family houses in July 2023 were at a seasonally adjusted annual rate of 714,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.4 percent above the revised June rate of 684,000 and is 31.5 percent above the July 2022 estimate of 543,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are at pre-pandemic levels.

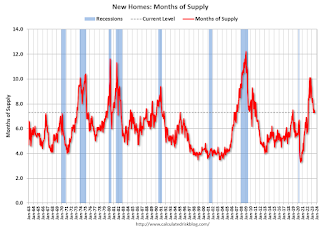

The second graph shows New Home Months of Supply.

The months of supply decreased in July to 7.3 months from 7.5 months in June.

The months of supply decreased in July to 7.3 months from 7.5 months in June. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of July was 437,000. This represents a supply of 7.3 months at the current sales rate."Sales were above expectations of 701 thousand SAAR, however, sales for the three previous months were revised down, combined. I'll have more later today.