by Calculated Risk on 8/28/2023 08:01:00 PM

Monday, August 28, 2023

Tuesday: Case-Shiller House Prices, Job Openings

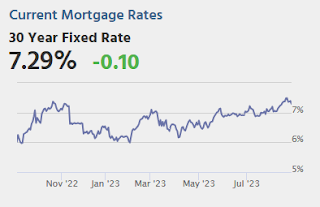

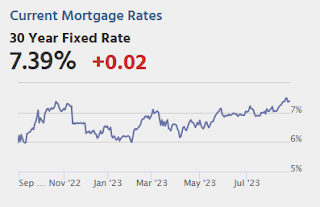

Mortgage rates hit fresh multi-decade highs last week with many lenders hitting the mid-7% range earlier in the week for top tier conventional 30yr fixed scenarios. There was some immediate relief on Wednesday, but things have been broadly sideways since then. ...Tuesday:

There are several economic reports that have a strong track record of causing volatility for rates--at least one on each of the remaining days this week. [30 year fixed 7.29%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for June. The consensus is for a 1.1% year-over-year decrease in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS.

Mortgage Serious Delinquency Rate vs Unemployment Rate

by Calculated Risk on 8/28/2023 02:37:00 PM

Here is a graph of the Fannie Mae mortgage serious delinquency rate and the unemployment rate since 1998 (ht @CharlieAllievo).

For the last two recessions, the delinquency rate and the unemployment rate moved in the same direction.

However, there were significant differences between the two periods. During the housing bust, many homeowners had little or no equity - or even negative equity - when prices started falling. If they lost their jobs, they were unable to pay their mortgage.

Following the 2001 recession, the serious delinquency rate didn't increase significantly even though the unemployment rate increased.

Following the 2001 recession, the serious delinquency rate didn't increase significantly even though the unemployment rate increased.Fannie Mae Single-Family Mortgage Serious Delinquency Rate Lowest since 2002

by Calculated Risk on 8/28/2023 10:42:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie Mae Single-Family Mortgage Serious Delinquency Rate Lowest since 2002

Brief excerpt:

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.54% in July from 0.55% in June. The serious delinquency rate is down year-over-year from 0.76% in July 2022. This is below the pre-pandemic low of 0.65% and the lowest rate since 2002.You can subscribe at https://calculatedrisk.substack.com/.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure". Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

...

Since lending standards have been solid and most homeowners have substantial equity there will not be a huge wave of single-family foreclosures this cycle. This means that we will not see cascading price declines like following the housing bubble.

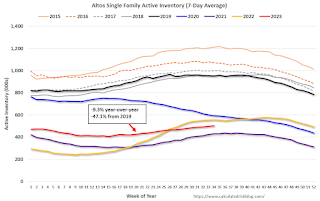

Housing August 28th Weekly Update: Inventory increased 1.3% Week-over-week; Down 9.3% Year-over-year

by Calculated Risk on 8/28/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, August 27, 2023

Sunday Night Futures

by Calculated Risk on 8/27/2023 07:40:00 PM

Weekend:

• Schedule for Week of August 27, 2023

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 6 and DOW futures are up 48 (fair value).

Oil prices were down over the last week with WTI futures at $79.83 per barrel and Brent at $84.48 per barrel. A year ago, WTI was at $94, and Brent was at $101 - so WTI oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.78 per gallon. A year ago, prices were at $3.78 per gallon, so gasoline prices are unchanged year-over-year.

An Early Look at the September FOMC Projections

by Calculated Risk on 8/27/2023 09:52:00 AM

The next FOMC meeting will be held on September 19th and 20th. Projections will be released at this meeting. For review, here are the June projections.

Since the last projections were released in June, the economy has performed better than the FOMC expected, and inflation was slightly below expectations.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.5% in July and the consensus estimate is that the unemployment rate was unchanged in August (to be released Friday, September 1st). To reach the mid-point of the FOMC projections for Q4 2023, the economy would have to lose a significant number of jobs over the last several months of 2023. The FOMC's unemployment rate projection for Q4 will likely be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of June 2023, PCE inflation increased 3.0 percent year-over-year (YoY), down from 3.8 percent YoY in May, and down from the recent peak of 7.0 percent in June 2022. However, a year ago, July 2022 PCE inflation was slightly negative for the month, so YoY PCE inflation will likely increase in July (to be released this coming Thursday, Aug 31st).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 4.1 percent YoY in June, down from 4.6 percent in May, and down from the recent peak of 5.4 percent in February 2022. However, a year ago, July 2022 core PCE inflation was low, so YoY PCE inflation will likely increase in July.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

Saturday, August 26, 2023

Real Estate Newsletter Articles this Week: New Home Sales increase to 714,000 Annual Rate in July

by Calculated Risk on 8/26/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.07 million SAAR in July

• New Home Sales increase to 714,000 Annual Rate in July

• Forecast: Multifamily Starts will Decline Sharply

• Final Look at Local Housing Markets in July

• 4th Look at Local Housing Markets in July

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of August 27, 2023

by Calculated Risk on 8/26/2023 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the second estimate of Q2 GDP, Personal Income and Outlays for July, the August ISM manufacturing index, August auto sales, and Case-Shiller house prices for June.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August. This is the last of the regional Fed manufacturing surveys for August.

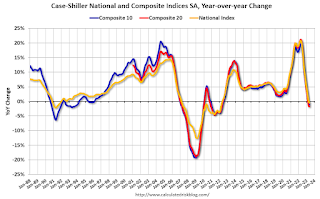

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 1.1% year-over-year decrease in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for June. This was originally a GSE only repeat sales, however there is also an expanded index.

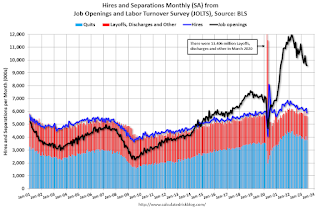

10:00 AM Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in June to 9.58 million from 9.62 million in May.

The number of job openings (black) were down 13% year-over-year and Quits were down 9% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government).

8:30 AM: Gross Domestic Product, 2nd quarter 2023 (second estimate). The consensus is that real GDP increased 2.4% annualized in Q2, unchanged from the advance estimate of 2.4% in Q2.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.8% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 230 thousand last week.

8:30 AM: Personal Income and Outlays, July 2023. The consensus is for a 0.3% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.3% YoY, and core PCE prices up 4.2% YoY.

9:45 AM: Chicago Purchasing Managers Index for August.

8:30 AM: Employment Report for August. The consensus is for 187,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

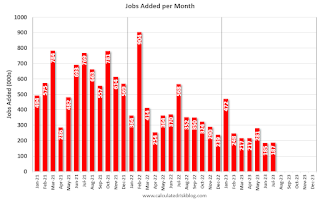

8:30 AM: Employment Report for August. The consensus is for 187,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.There were 187,000 jobs added in July, and the unemployment rate was at 3.5%.

This graph shows the jobs added per month since January 2021.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 46.6, up from 46.4 in July.

10:00 AM: Construction Spending for July. The consensus is for a 0.5% increase in construction spending.

All Day: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.4 million SAAR in August, down from 15.7 million in July (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for August. The consensus is for light vehicle sales to be 15.4 million SAAR in August, down from 15.7 million in July (Seasonally Adjusted Annual Rate).Friday, August 25, 2023

Aug 25th COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 8/25/2023 08:09:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

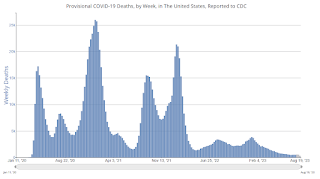

| Hospitalized2🚩 | 9,401 | 8,100 | ≤3,0001 | |

| Deaths per Week2🚩 | 551 | 497 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Forecast: Multifamily Starts will Decline Sharply

by Calculated Risk on 8/25/2023 01:14:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Forecast: Multifamily Starts will Decline Sharply

A brief excerpt:

In 2021 there was a sharp increase in rents. This was due to a surge in household formation during the pandemic. Over time, housing economist Tom Lawler and I unraveled the household formation mystery in a series of articles (links at the bottom of this post).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This analysis led to the conclusion that household formation would slow sharply, and that asking rents would likely turn negative year-over-year (both have happened). The next likely consequence is that multifamily starts will decline significantly.

Here are several data points supporting this forecast.

...

Freddie: Multifamily Delinquencies Have Tripled Year-over-year

Freddie Mac reports that multifamily delinquencies increased to 0.23% in July, up from 0.07% in July 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family delinquency rate increased following the pandemic and then recovered as rents soared. The rate has increased recently as asking rents softened, vacancy rates increased, lending has tightened, and interest rates have increased sharply.