by Calculated Risk on 8/31/2023 08:51:00 PM

Thursday, August 31, 2023

Friday: Employment Report, ISM Mfg, Construction Spending, Vehicle Sales

Thursday:

• At 8:30 AM ET, Employment Report for August. The consensus is for 187,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 46.6, up from 46.4 in July.

• At 10:00 AM, Construction Spending for July. The consensus is for a 0.5% increase in construction spending.

• All Day, Light vehicle sales for August. The consensus is for light vehicle sales to be 15.4 million SAAR in August, down from 15.7 million in July (Seasonally Adjusted Annual Rate).

Goldman August Payrolls Preview

by Calculated Risk on 8/31/2023 06:01:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

"We estimate nonfarm payrolls rose by 149k in August (mom sa), below consensus of +170k. ... our forecast embeds a 26k one-time drag from the combination of Hollywood worker strikes (-18k) and Yellow trucking layoffs (-8k) ... We estimate that the unemployment rate was unchanged at 3.5%—in line with consensus—reflecting a modest rise in household employment and unchanged labor force participation (at 62.6%)."

emphasis added

Asking Rents Down 1.2% Year-over-year

by Calculated Risk on 8/31/2023 03:32:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.2% Year-over-year

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The surge in household formation has been confirmed (mostly due to work-from-home), and this also led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now flat year-over-year).

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through July 2023, except CoreLogic is through June and Apartment List is through August 2023.

...

The CoreLogic measure is up 3.3% YoY in June, down from 3.4% in May, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 3.6% YoY in July, down from 4.1% YoY in June, and down from a peak of 16.2% YoY in March 2022.

The ApartmentList measure is down 1.2% YoY as of August, down from -0.8% in June, and down from a peak of 18.1% YoY November 2021.

...

With slow household formation, more supply coming on the market and a rising vacancy rate, rents will be under pressure all year. See: Forecast: Multifamily Starts will Decline Sharply

Realtor.com Reports Weekly Active Inventory Down 6% YoY; New Listings Down 8% YoY

by Calculated Risk on 8/31/2023 12:32:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Hannah Jones: Weekly Housing Trends View — Data Week Ending Aug 26, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 5.9%. This past week marked the 10th consecutive decline in the number of homes actively for sale compared to the prior year, however the gap narrowed for the fourth week in a row.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 8.8% from one year ago. For 60 weeks, there have been fewer newly listed homes compared to the same time one year ago. This gap has been shrinking, but reversed trend this week. This week’s data shows a 3.1 percentage point widening compared to last week.

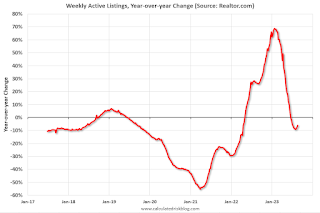

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 7.2% year-over-year - this was the tenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

PCE Measure of Shelter Slows to 7.8% YoY in July

by Calculated Risk on 8/31/2023 09:06:00 AM

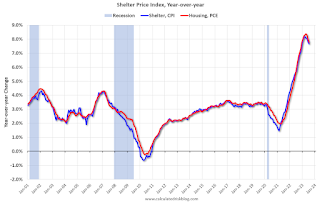

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through July 2023.

Since asking rents are slightly negative year-over-year, these measures will slow sharply in coming months.

Personal Income increased 0.2% in July; Spending increased 0.8%

by Calculated Risk on 8/31/2023 08:40:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billion (0.8 percent).The July PCE price index increased 3.3 percent year-over-year (YoY), up from 3.0 percent YoY in June, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI decreased 0.2 percent in July and real PCE increased 0.6 percent; goods increased 0.9 percent and services increased 0.4 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through July 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly below expectations, and PCE was slightly above expectations.

Weekly Initial Unemployment Claims Decrease to 228,000

by Calculated Risk on 8/31/2023 08:30:00 AM

The DOL reported:

In the week ending August 26, the advance figure for seasonally adjusted initial claims was 228,000, a decrease of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 230,000 to 232,000. The 4-week moving average was 237,500, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 500 from 236,750 to 237,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,500.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

Wednesday, August 30, 2023

Thursday: Unemployment Claims, Personal Income and Outlays, Chicago PMI

by Calculated Risk on 8/30/2023 09:05:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 230 thousand last week.

• At 8:30 AM, Personal Income and Outlays, July 2023. The consensus is for a 0.3% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.3% YoY, and core PCE prices up 4.2% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

Las Vegas July 2023: Visitor Traffic Up 1.0% YoY; Convention Traffic Down 16.8% YoY

by Calculated Risk on 8/30/2023 05:01:00 PM

From the Las Vegas Visitor Authority: July 2023 Las Vegas Visitor Statistics

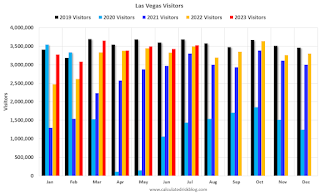

With the highest July Occupancy since before the pandemic, Las Vegas visitation surpassed 3.5M visitors, approximately 1% ahead of last July.

Overall hotel occupancy reached 85.2% for the month (+1.8 pts YoY) as Weekend occupancy reaching 92.6% (+1.5 pts YoY), and Midweek occupancy reached 82.2%, surpassing last July by 3.1 pts.

With YoY growth stabilizing after the dramatic post‐pandemic surges last year, ADR reached $163, +1.7% YoY while RevPAR reached $139, +3.9% YoY.

Click on graph for larger image.

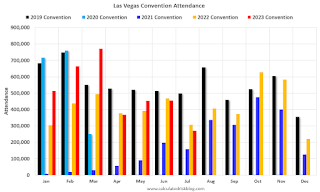

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was up 1.0% compared to last July.

Note: There was almost no convention traffic from April 2020 through May 2021.

Inflation Adjusted House Prices 3.9% Below Peak; Price-to-rent index is 7.6% below recent peak

by Calculated Risk on 8/30/2023 12:22:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.9% Below Peak; Price-to-rent index is 7.6% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the June Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 65% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 9% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% below the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $359,000 today adjusted for inflation (79.5% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.