by Calculated Risk on 9/12/2023 08:12:00 AM

Tuesday, September 12, 2023

CoreLogic: US Annual Home Price Growth Rate Increased in July

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Annual US Home Price Growth Rebounds in July, CoreLogic Reports

• U.S. home price gains moved up to 2.5% year over year in July, marking the 138th consecutive month of annual growth.This index was up 1.6% YoY in June.

• Eleven states saw home price declines on an annual basis in July, ranging from -5.7% in Idaho to -0.3% in California.

• The median sales price for a U.S. single-family home was $375,000 in July, led by California ($700,000), the District of Columbia ($670,000) and Massachusetts ($590,000).

...

U.S. home price gains rebounded year over year in July, increasing to 2.5% and following two months of 1.6% annual gains. The annual reacceleration reflects six consecutive monthly gains, which drove prices about 5% higher compared to the February bottom. The 11 states that saw home price declines were all in the West, but since many of those markets continue to struggle with inventory shortages, that trend may be short-lived, and recent buyer competition will cause prices to heat up again. CoreLogic projects that all states that saw year-over-year losses in July will begin posting gains by October of this year.

“Annual home price growth regained momentum in July, which mostly reflects strong appreciation from earlier this year,” said Selma Hepp, chief economist for CoreLogic. “That said, high mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

“Nevertheless, the projection of prolonged higher mortgage rates has dampened price forecasts over the next year, particularly in less-affordable markets,” Hepp continued. “But as there is still an extreme inventory shortage in the Western U.S., home prices in some of those markets should see relatively more upward pressure.”

emphasis added

Monday, September 11, 2023

Tuesday: Corelogic House Price index

by Calculated Risk on 9/11/2023 08:14:00 PM

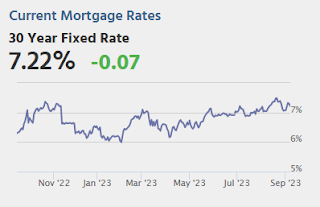

At times over the past 2 years, the Consumer Price Index (CPI) has been the most important economic report on any given month and has had a bigger impact on bonds than the mighty jobs report. ...Tuesday:

If this week's numbers are far enough from forecasts, there's no reason to doubt CPI's market moving power--especially with the uptick in energy costs and the Fed on deck next week. [30 year fixed 7.30%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 8:00 AM, Corelogic House Price index for July

Q2 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 9/11/2023 12:33:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Q2 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. And there was a slight increase.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

However, I argued this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes.

...

Here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q1 2023 (Q2 2023 data will be released in a few weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 23.3% of loans are under 3%, 61.3% are under 4%, and 81.2% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Leading Index for Commercial Real Estate Decreased in August

by Calculated Risk on 9/11/2023 10:19:00 AM

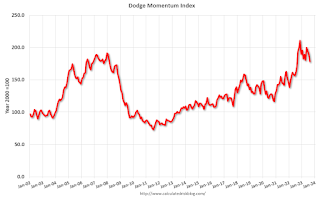

From Dodge Data Analytics: Dodge Momentum Index Drops 6.5% in August

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, declined 6.5% in August to 178.0 (2000=100) from the revised July reading of 190.3. Over the month, the commercial component of the DMI fell 1.6%, while the institutional component fell 14.8%.

“Overall activity remains above historical norms, but weaker market fundamentals continue to undermine planning growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “It’s likely that the full year of tightening lending standards and high interest rates has begun to affect institutional planning, which has otherwise been resistant to these market headwinds. Also, planning in the sector continues to revert from the strong spike in activity back in May. As we move into the final four months of 2023, both commercial and institutional planning will continue to be constrained.”

August saw a deceleration in education, healthcare and amusement planning activity, fueling the sizable decline in the institutional sector. Meanwhile, stronger hotel planning offset weaker office activity, causing a milder regression in the commercial segment over August. Year over year, the DMI remained 4% higher than in August 2022. The commercial and institutional components were up 3% and 7%, respectively.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 178.0 in August, down from 190.3 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 and in 2024.

Housing September 11th Weekly Update: Inventory increased 0.1% Week-over-week; Down 6.9% Year-over-year

by Calculated Risk on 9/11/2023 08:17:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, September 10, 2023

Sunday Night Futures

by Calculated Risk on 9/10/2023 06:54:00 PM

Weekend:

• Schedule for Week of September 10, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $87.09 per barrel and Brent at $90.39 per barrel. A year ago, WTI was at $87, and Brent was at $92 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.79 per gallon. A year ago, prices were at $3.68 per gallon, so gasoline prices are up $0.11 year-over-year.

Hotels: Occupancy Rate Increased 0.2% Year-over-year

by Calculated Risk on 9/10/2023 08:21:00 AM

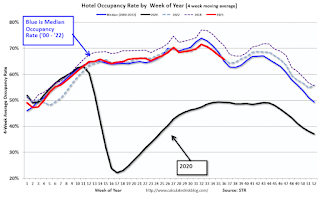

Following seasonal patterns, U.S. hotel performance showed mixed results from the previous week but positive comparisons year over year, according to CoStar’s latest data through 2 September. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

27 August through 2 September 2023 (percentage change from comparable week in 2022):

• Occupancy: 62.7% (+0.2%)

• Average daily rate (ADR): US$150.52 (+1.8%)

• Revenue per available room (RevPAR): US$94.38 (+2.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, September 09, 2023

Real Estate Newsletter Articles this Week: The "Home ATM" Stays Mostly Closed in Q2

by Calculated Risk on 9/09/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Single Family Rent Trends at AMH and Invitation Homes

• 1st Look at Local Housing Markets in August

• The "Home ATM" Stays Mostly Closed in Q2

• Black Knight Mortgage Monitor: Purchase Rate Locks "are now running 39% below pre-pandemic levels"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 10, 2023

by Calculated Risk on 9/09/2023 08:11:00 AM

The key economic reports this week are August Consumer Price Index (CPI) and Retail Sales.

For manufacturing, August Industrial Production, and the September New York Fed survey, will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for August.

8:00 AM: Corelogic House Price index for July

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.6% year-over-year and core CPI to be up 4.3% YoY.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, down from 216 thousand last week.

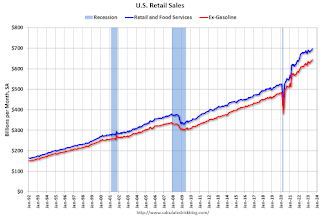

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.1% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.4% decrease in PPI, and a 0.2% increase in core PPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of -10.7, up from -19.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 79.3%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).

Friday, September 08, 2023

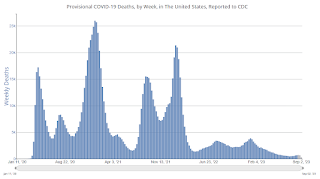

Sept 8th COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 9/08/2023 08:19:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 12,852 | 11,196 | ≤3,0001 | |

| Deaths per Week2🚩 | 722 | 672 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.