by Calculated Risk on 9/18/2023 02:01:00 PM

Monday, September 18, 2023

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.3% in August

Note: I didn't update this last week.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in August. The 16% trimmed-mean Consumer Price Index also increased 0.3% in August. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

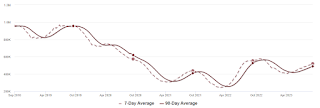

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor Fuel" increased at a 237% annualized rate in August!

NAHB: Builder Confidence Decreased in September

by Calculated Risk on 9/18/2023 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, down from 50 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: High Mortgage Rates Continue to Weaken Builder Confidence

Persistently high mortgage rates above 7% continue to erode builder confidence, as sentiment levels have dropped below the key break-even measure of 50 for the first time in five months.

Builder confidence in the market for newly built single-family homes in September fell five points to 45, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This follows a six-point drop in August.

“The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “And on the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots and distribution transformers, which is further adding to housing affordability woes. Insurance cost and availability is also a growing concern for the housing sector.”

“High mortgage rates are clearly taking a toll on builder confidence and consumer demand, as a growing number of buyers are electing to defer a home purchase until long-term rates move lower,” said NAHB Chief Economist Robert Dietz. “Putting into place policies that will allow builders to increase the housing supply is the best remedy to ease the nation’s housing affordability crisis and curb shelter inflation. Shelter inflation posted a 7.3% year-over-year gain in August, compared to an overall 3.7% consumer inflation reading.”

As mortgage rates stayed above 7% over the last month, more builders are reducing home prices again to bolster sales. In September, 32% of builders reported cutting home prices, compared to 25% in August. That’s the largest share of builders cutting prices since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 59% of builders provided sales incentives of all forms in September, more than any month since April 2023.

While more pricing-out is now occurring, the lack of resale inventory at the start of 2023 has shifted the new construction buyer mix. A special question in the September HMI survey revealed that 42% of new single-family home buyers were first-time buyers on a year-to-date basis in 2023. This is significantly higher than the 27% reading from a more normalized market in 2018.

...

All three major HMI indices posted declines in September. The HMI index gauging current sales conditions fell six points to 51, the component charting sales expectations in the next six months also declined six points to 49 and the gauge measuring traffic of prospective buyers dropped five points to 30.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 54, the Midwest dropped three points to 42, the South fell four points to 54 the West posted a three-point decline to 47.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

Housing September 18th Weekly Update: Inventory increased 1.9% Week-over-week; Down 6.1% Year-over-year

by Calculated Risk on 9/18/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, September 17, 2023

Sunday Night Futures

by Calculated Risk on 9/17/2023 06:31:00 PM

Weekend:

• Schedule for Week of September 17, 2023

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 50, unchanged from 50 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $90.77 per barrel and Brent at $93.93 per barrel. A year ago, WTI was at $86, and Brent was at $89 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.82 per gallon. A year ago, prices were at $3.65 per gallon, so gasoline prices are up $0.17 year-over-year.

FOMC Preview: No Change to Policy Expected

by Calculated Risk on 9/17/2023 08:11:00 AM

Most analysts expect there will be no change to FOMC policy at this meeting, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent.

"We expect the Fed to stay on hold at the September FOMC meeting, consistent with recent Fed communications and current market pricing. Recent data should leave the Fed encouraged by ongoing disinflation but concerned about re-acceleration in inflation because of the strength in activity. ... The biggest focus of the September meeting should be the updated Summary of Economic Projections (SEP). We expect the 2023 median policy rate forecast to show one more 25bp hike, for a terminal rate of 5.5-5.75%. Perhaps the most important forecast is the 2024 median, which we think will shift up by 25bp to 4.875%, reflecting just 75bp of cuts next year."And from Goldman Sachs economists:

emphasis added

"[T]he story of the year so far is that solid growth has not derailed either the rebalancing of the labor market or progress in lowering inflation, as one might have feared. In fact, measures of labor market tightness have now returned to roughly their pre-pandemic levels, on average. This means that the desired rebalancing of supply and demand is now largely complete and that further sustained below-potential growth is likely no longer necessary.

At their September meeting, Fed officials are likely to make fairly straightforward revisions to their economic projections that reflect these recent developments. For 2023, we expect a substantial upward revision to GDP growth (+1.1pp to +2.1%) and moderate downward revisions to the unemployment rate (-0.2pp to 3.9%) and core inflation (-0.4pp to 3.5%)."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

| March 2023 | 0.0 to 0.8 | 1.0 to 1.5 | 1.7 to 2.1 | |

The unemployment rate was at 3.8% in August. To reach the mid-point of the FOMC projections for Q4 2023, the economy would likely have to lose a significant number of jobs in Q4. The FOMC's unemployment rate projection for Q4 will likely be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

| March 2023 | 4.0 to 4.7 | 4.3 to 4.9 | 4.3 to 4.8 | |

As of July 2023, PCE inflation increased 3.3 percent year-over-year (YoY), up from 3.0 percent YoY in June, and down from the recent peak of 7.0 percent in June 2022. Projections for PCE inflation will likely be revised down.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

| March 2023 | 3.0 to 3.8 | 2.2 to 2.8 | 2.0 to 2.2 | |

PCE core inflation increased 4.2 percent YoY, up from 4.1 percent in April, and down from the recent peak of 5.4 percent in February 2022. This includes PCE measure of shelter that was up 7.8% YoY in July (even though asking rents are soft). Core PCE inflation likely declined to around 3.8% in August, and the FOMC will revise down their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

| March 2023 | 3.5 to 3.9 | 2.3 to 2.8 | 2.0 to 2.2 | |

Saturday, September 16, 2023

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 9/16/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Q2 Update: Delinquencies, Foreclosures and REO

• Part 1: Current State of the Housing Market; Overview for mid-September

• Part 2: Current State of the Housing Market; Overview for mid-September

• 3rd Look at Local Housing Markets in August

• 2nd Look at Local Housing Markets in August

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 17, 2023

by Calculated Risk on 9/16/2023 08:11:00 AM

The key reports this week are August Housing Starts and Existing Home sales.

The FOMC meets this week and no change to policy is expected.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 50, unchanged from 50 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.440 million SAAR, down from 1.452 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for August 2023

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 220 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 0.0, up from -12.0.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.07 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.07 million in July.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 4.07 million SAAR.

No major economic releases scheduled.

Friday, September 15, 2023

Sept 15th COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 9/15/2023 07:58:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 14,489 | 12,984 | ≤3,0001 | |

| Deaths per Week2🚩 | 860 | 844 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

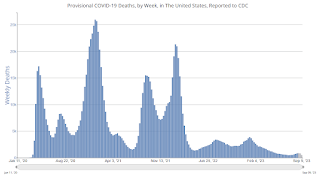

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

3rd Look at Local Housing Markets in August

by Calculated Risk on 9/15/2023 03:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in August

A brief excerpt:

Note: The National Association of Realtors (NAR) is scheduled to release August existing home sales next week on Thursday, September 21st, at 10:00 AM ET. The consensus is the NAR will report sales of 4.10 million SAAR, up from 4.07 million in July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the third look at local markets in August. I’m tracking a sample of about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in August were mostly for contracts signed in June and July. Since 30-year fixed mortgage rates were in the 6.7% range in June, and 6.8% in July, compared to the mid-5% range the previous year, closed sales were down year-over-year in August.

...

Here is a summary of active listings for these housing markets in August.

Inventory for these markets is down 4.7% YoY, a slightly smaller YoY decline than in July.

...

More local markets to come!

Q3 GDP Tracking: Around 3%

by Calculated Risk on 9/15/2023 11:15:00 AM

From BofA:

Overall, the data flow since our last report pushed our 3Q US GDP tracking down two-tenths to 2.9% q/q saar and 2Q is down two-tenths as well to 2.3%. [Sept 15th estimate]From Goldman:

emphasis added

We boosted our Q3 GDP tracking estimate by one tenth to +3.2% (qoq ar) and our domestic final sales growth forecast by the same amount to +2.9%. [Sept 14th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.9 percent on September 14, down from 5.6 percent on September 8. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the US Department of the Treasury's Bureau of the Fiscal Service, the nowcasts of third-quarter real personal consumption expenditures growth, third-quarter real gross private domestic investment growth, and third-quarter real government spending growth decreased from 4.0 percent, 11.7 percent, and 2.3 percent, respectively, to 3.5 percent, 10.6 percent, and 1.9 percent. [Sept 14th estimate]