by Calculated Risk on 9/19/2023 07:47:00 PM

Tuesday, September 19, 2023

Wednesday: FOMC Statement

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

LA Port Inbound Traffic Down YoY in August

by Calculated Risk on 9/19/2023 01:32:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

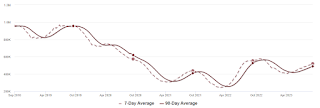

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.4% in August compared to the rolling 12 months ending in July. Outbound traffic decreased 0.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. August Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 9/19/2023 09:23:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: August Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Total starts were down 14.8% in August compared to August 2022. And starts year-to-date are down 12.5% compared to last year.

Starts have been down year-over-year for 14 of the last 16 months (May and July 2023 were the exceptions), and I expect total starts to be down this year - although the year-over-year comparisons will be easier the rest of the year.

Housing Starts Decreased to 1.283 million Annual Rate in August

by Calculated Risk on 9/19/2023 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,283,000. This is 11.3 percent below the revised July estimate of 1,447,000 and is 14.8 percent below the August 2022 rate of 1,505,000. Single‐family housing starts in August were at a rate of 941,000; this is 4.3 percent below the revised July figure of 983,000. The August rate for units in buildings with five units or more was 334,000.

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,543,000. This is 6.9 percent above the revised July rate of 1,443,000, but is 2.7 percent below the August 2022 rate of 1,586,000. Single‐family authorizations in August were at a rate of 949,000; this is 2.0 percent above the revised July figure of 930,000. Authorizations of units in buildings with five units or more were at a rate of 535,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased in August compared to July. Multi-family starts were down 41.6% year-over-year in August.

Single-family starts (red) decreased in August and were up 2.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in August were well below expectations, however, starts in June and July were revised up, combined.

I'll have more later …

Monday, September 18, 2023

Tuesday: Housing Starts

by Calculated Risk on 9/18/2023 08:10:00 PM

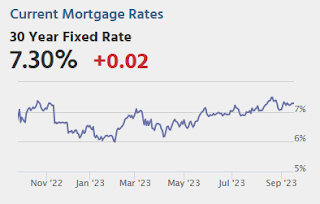

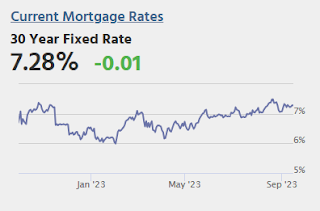

The average lender was only 0.02% higher than Friday this morning, and the improvement brought them 0.01% lower than Friday. These moves are so small that many borrowers would not see any detectable different in mortgage quotes between today and Friday.Tuesday:

Volatility stands a better chance of increasing on Wednesday afternoon when we get the next rate announcement from the Fed. Even if the Fed doesn't hike rates (and they probably won't), other information released in conjunction with that decision can have a big impact. [30 year fixed 7.28%]

emphasis added

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.440 million SAAR, down from 1.452 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for August 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.33% in August"

by Calculated Risk on 9/18/2023 04:07:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.33% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.92 million borrowers since March 2020.

In August, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.19%. Ginnie Mae loans in forbearance decreased 15 basis points to 0.65%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 6 basis points to 0.39%.

“The forbearance rate is just 8 basis points shy of where it was at the beginning of March 2020, which indicates that most homeowners have recovered from the pandemic,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “While there was a monthly decline in the performance of post-forbearance workouts in August, overall mortgage servicing portfolios remain resilient. Compared to other credit types with weaker performance, the percentage of home mortgages that are performing is holding steady at a non-seasonally adjusted 96 percent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing and declined to 0.33% in August from 0.39% in July.

At the end of July, there were about 165,000 homeowners in forbearance plans.

Lawler: Early Read on Existing Home Sales in August and Some New Household/Housing Stock Data

by Calculated Risk on 9/18/2023 02:58:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in August and Some New Household/Housing Stock Data

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.07 million in August, unchanged from July’s preliminary pace and down 14.7 % from last August’s seasonally adjusted pace.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 3.8% from last August.

CR Note: The NAR is scheduled to released August Existing Home Sales on Thursday at 10:00 AM ET. The consensus is for 4.10 million SAAR, up from 4.07 million in July.

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.3% in August

by Calculated Risk on 9/18/2023 02:01:00 PM

Note: I didn't update this last week.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in August. The 16% trimmed-mean Consumer Price Index also increased 0.3% in August. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor Fuel" increased at a 237% annualized rate in August!

NAHB: Builder Confidence Decreased in September

by Calculated Risk on 9/18/2023 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, down from 50 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: High Mortgage Rates Continue to Weaken Builder Confidence

Persistently high mortgage rates above 7% continue to erode builder confidence, as sentiment levels have dropped below the key break-even measure of 50 for the first time in five months.

Builder confidence in the market for newly built single-family homes in September fell five points to 45, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This follows a six-point drop in August.

“The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “And on the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots and distribution transformers, which is further adding to housing affordability woes. Insurance cost and availability is also a growing concern for the housing sector.”

“High mortgage rates are clearly taking a toll on builder confidence and consumer demand, as a growing number of buyers are electing to defer a home purchase until long-term rates move lower,” said NAHB Chief Economist Robert Dietz. “Putting into place policies that will allow builders to increase the housing supply is the best remedy to ease the nation’s housing affordability crisis and curb shelter inflation. Shelter inflation posted a 7.3% year-over-year gain in August, compared to an overall 3.7% consumer inflation reading.”

As mortgage rates stayed above 7% over the last month, more builders are reducing home prices again to bolster sales. In September, 32% of builders reported cutting home prices, compared to 25% in August. That’s the largest share of builders cutting prices since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 59% of builders provided sales incentives of all forms in September, more than any month since April 2023.

While more pricing-out is now occurring, the lack of resale inventory at the start of 2023 has shifted the new construction buyer mix. A special question in the September HMI survey revealed that 42% of new single-family home buyers were first-time buyers on a year-to-date basis in 2023. This is significantly higher than the 27% reading from a more normalized market in 2018.

...

All three major HMI indices posted declines in September. The HMI index gauging current sales conditions fell six points to 51, the component charting sales expectations in the next six months also declined six points to 49 and the gauge measuring traffic of prospective buyers dropped five points to 30.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 54, the Midwest dropped three points to 42, the South fell four points to 54 the West posted a three-point decline to 47.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

Housing September 18th Weekly Update: Inventory increased 1.9% Week-over-week; Down 6.1% Year-over-year

by Calculated Risk on 9/18/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.