by Calculated Risk on 9/20/2023 02:17:00 PM

Wednesday, September 20, 2023

FOMC Projections and Press Conference

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. Projections of the neutral Fed Funds rate increased again!

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.8% in August. The FOMC's unemployment rate projection for Q4 was revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of July 2023, PCE inflation increased 3.3 percent year-over-year (YoY), up from 3.0 percent YoY in June, and down from the recent peak of 7.0 percent in June 2022. Projections for PCE inflation were mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 4.2 percent YoY, up from 4.1 percent in June, and down from the recent peak of 5.4 percent in February 2022. This includes PCE measure of shelter that was up 7.8% YoY in July (even though asking rents are soft). Core PCE inflation likely declined to around 3.8% in August, and the FOMC revised down their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

FOMC Statement: No Change to Rates

by Calculated Risk on 9/20/2023 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

emphasis added

AIA: Architecture Billings "Softening Business Conditions in August"; Multi-family Billings Decline for 13th Consecutive Month

by Calculated Risk on 9/20/2023 11:46:00 AM

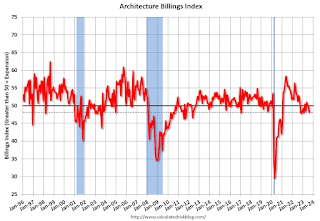

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Sees Softening Business Conditions in August

The AIA/Deltek Architecture Billings Index (ABI) eased modestly in August, with a score of 48.1, marking the eleventh consecutive month of essentially flat billings at architecture firms. Any score below 50.0 indicates decreasing business conditions. This follows a period of robust growth in 2021 and 2022. While inquiries into new projects remained relatively strong in August, the value of newly signed design contracts declined for the first time since April, indicating that fewer clients signed contracts for new projects than in the prior three months.

“Business conditions at architecture firms continue to be sluggish,” said Kermit Baker, PhD, AIA Chief Economist. “New project work coming into architecture firms as well ongoing project activity remain stalled in a relatively narrow range and exhibit very little month-to-month variation. Through this pause has taken pressure off tight staffing conditions across the profession, there is considerable uncertainty over the direction of future activity.”

Business conditions also remained soft at firms with a multifamily residential specialization and declined modestly at firms with an institutional specialization. However, firms with a commercial/industrial specialization reported billings growth for the third month in a row in August.

...

• Regional averages: Northeast (50.6); South (49.9); Midwest (48.1); West (45.8)

• Sector index breakdown: commercial/industrial (51.5); institutional (49.4); mixed practice (firms that do not have at least half of their billings in any one other category) (46.9); multifamily residential (44.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.1 in July, down from 50.0 in July. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment into 2024.

4th Look at Local Housing Markets in August; California Home Sales Down 18.9% YoY in August

by Calculated Risk on 9/20/2023 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in August

A brief excerpt:

Note: The National Association of Realtors (NAR) is scheduled to release August existing home sales tomorrow, Thursday, September 21st, at 10:00 AM ET. The consensus is the NAR will report sales of 4.10 million SAAR, up from 4.07 million in July.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Housing economist Tom Lawler expects the NAR to report sales of 4.07 million SAAR for August.

...

In August, sales in these markets were down 12.1% YoY. In July, these same markets were down 14.5% YoY Not Seasonally Adjusted (NSA).

This is a slightly smaller YoY decline NSA than in July for these markets. Note that there were the same number of selling days each year in August 2022 and August 2023.

A key factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates - and sales in August on a seasonally adjusted annual rate (SAAR) basis will likely be close to the July sales rate (4.07 million SAAR).

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 9/20/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 15, 2023. Last week’s results included an adjustment for the Labor Day holiday.

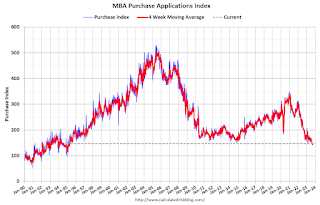

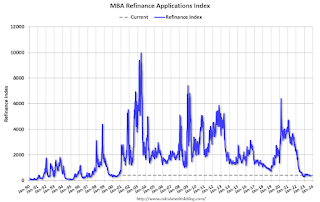

The Market Composite Index, a measure of mortgage loan application volume, increased 5.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 16 percent compared with the previous week. The Refinance Index increased 13 percent from the previous week and was 29 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 26 percent lower than the same week one year ago.

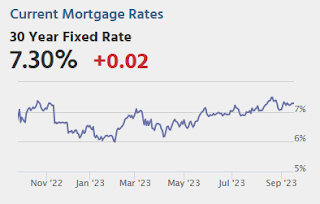

“Mortgage applications increased last week, despite the 30-year fixed rate edging back up to 7.31 percent – its highest level in four weeks,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications increased for conventional and FHA loans over the week but remained 26 percent lower than the same week a year ago, as homebuyers continue to face higher rates and limited for-sale inventory, which have made purchase conditions more challenging. Refinance applications also increased last week but are still almost 30 percent lower than the same week last year.”

Added Kan, “The average loan size on a purchase application was $416,800, the highest level in six weeks. Home prices in many markets have been supported by low inventory and resilient housing demand for available homes.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.31 percent from 7.27 percent, with points remaining unchanged from 0.72 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Tuesday, September 19, 2023

Wednesday: FOMC Statement

by Calculated Risk on 9/19/2023 07:47:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

LA Port Inbound Traffic Down YoY in August

by Calculated Risk on 9/19/2023 01:32:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.4% in August compared to the rolling 12 months ending in July. Outbound traffic decreased 0.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. August Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 9/19/2023 09:23:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: August Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Total starts were down 14.8% in August compared to August 2022. And starts year-to-date are down 12.5% compared to last year.

Starts have been down year-over-year for 14 of the last 16 months (May and July 2023 were the exceptions), and I expect total starts to be down this year - although the year-over-year comparisons will be easier the rest of the year.

Housing Starts Decreased to 1.283 million Annual Rate in August

by Calculated Risk on 9/19/2023 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,283,000. This is 11.3 percent below the revised July estimate of 1,447,000 and is 14.8 percent below the August 2022 rate of 1,505,000. Single‐family housing starts in August were at a rate of 941,000; this is 4.3 percent below the revised July figure of 983,000. The August rate for units in buildings with five units or more was 334,000.

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,543,000. This is 6.9 percent above the revised July rate of 1,443,000, but is 2.7 percent below the August 2022 rate of 1,586,000. Single‐family authorizations in August were at a rate of 949,000; this is 2.0 percent above the revised July figure of 930,000. Authorizations of units in buildings with five units or more were at a rate of 535,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased in August compared to July. Multi-family starts were down 41.6% year-over-year in August.

Single-family starts (red) decreased in August and were up 2.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in August were well below expectations, however, starts in June and July were revised up, combined.

I'll have more later …

Monday, September 18, 2023

Tuesday: Housing Starts

by Calculated Risk on 9/18/2023 08:10:00 PM

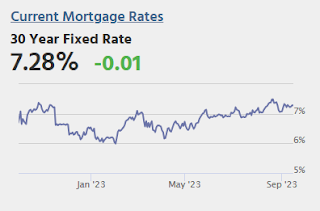

The average lender was only 0.02% higher than Friday this morning, and the improvement brought them 0.01% lower than Friday. These moves are so small that many borrowers would not see any detectable different in mortgage quotes between today and Friday.Tuesday:

Volatility stands a better chance of increasing on Wednesday afternoon when we get the next rate announcement from the Fed. Even if the Fed doesn't hike rates (and they probably won't), other information released in conjunction with that decision can have a big impact. [30 year fixed 7.28%]

emphasis added

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.440 million SAAR, down from 1.452 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for August 2023