by Calculated Risk on 9/22/2023 08:28:00 AM

Friday, September 22, 2023

Q3 GDP Tracking: Around 3%

From BofA:

Overall, the data flow since our last report left our 3Q and 2Q US GDP tracking unchanged at 2.9% q/q saar and 2.3% q/q saar, respectively. [Sept 22nd estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +3.2% (qoq ar). [Sept 21st estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.9 percent on September 19, unchanged from September 14 after rounding. After recent releases from the US Census Bureau and the US Bureau of Labor Statistics, the nowcast of third-quarter real residential investment growth decreased from 6.8 percent to 6.3 percent, while the nowcast of the contribution of inventory investment to third-quarter real GDP growth decreased from 1.20 percentage points to 1.05 percentage points. [Sept 19th estimate]

Thursday, September 21, 2023

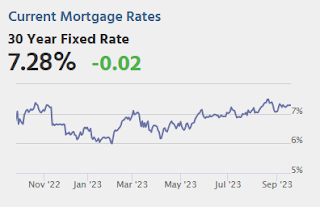

"Mortgage Rates Jump up to 23-Year Highs"

by Calculated Risk on 9/21/2023 08:15:00 PM

Between the data and the overnight momentum in overseas markets, bonds are at their weakest levels in years. Mortgage-backed securities (the bonds that dictate mortgage rates) didn't swoon quite as much as Treasuries, but as of today, it was just enough to push the average mortgage lender almost perfectly back in line with the highest 30yr fixed rate of the past 23 years. [30 year fixed 7.47%]Friday:

emphasis added

• No major economic releases scheduled.

Hotels: Occupancy Rate Decreased 2.2% Year-over-year

by Calculated Risk on 9/21/2023 05:23:00 PM

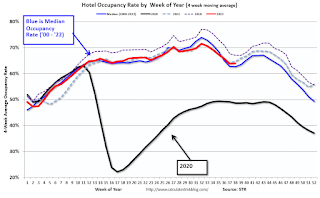

U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 16 September. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

10-16 September 2023 (percentage change from comparable week in 2022):

• Occupancy: 67.7% (-2.2%)

• Average daily rate (ADR): US$161.15 (+2.3%)

• Revenue per available room (RevPAR): US$109.07 (+0.1%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly Active Inventory Down 4.4% YoY; New Listings Down 6.0% YoY

by Calculated Risk on 9/21/2023 02:00:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Sep 16, 2023

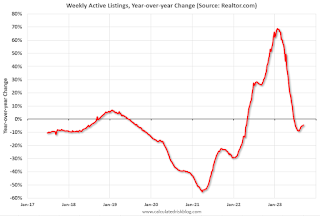

• Active inventory declined, with for-sale homes lagging behind year ago levels by 4.4%.

During the past week, we observed the 13th successive drop in the number of homes available for sale when compared to the previous year. This decline showed a slight improvement compared to the previous week’s -5.1% figure.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 6.0% from one year ago.

Over the past 63 weeks, we’ve consistently seen a decline in the number of newly listed homes compared to the same period one year ago. However, this gap in new listings has been gradually narrowing over the past few weeks. This shift comes as the market recovers from more significant declines experienced last year, which were triggered by the steady increase in mortgage rates affecting the real estate landscape.

In the most recent week, the decrease in newly listed homes was 6.0% compared to the previous year, showing improvement from the 7.1% decline in the week prior.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 4.4% year-over-year - this was the thirteenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

NAR: Existing-Home Sales Decreased to 4.04 million SAAR in August; Median Prices Increased 3.9% YoY in August

by Calculated Risk on 9/21/2023 10:49:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.04 million SAAR in August; Median Prices Increased 3.9% YoY in August

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

The fourth graph shows existing home sales by month for 2022 and 2023.

Sales declined 15.3% year-over-year compared to August 2022. This was the twenty-fourth consecutive month with sales down year-over-year. Since sales were declining all year in 2022, the year-over-year declines are getting smaller - even as sales declined over the last 6 months.

NAR: Existing-Home Sales Decreased to 4.04 million SAAR in August

by Calculated Risk on 9/21/2023 10:00:00 AM

From the NAR: Existing-Home Sales Decreased 0.7% in August

Existing-home sales moved lower in August, according to the National Association of REALTORS®. Among the four major U.S. regions, sales improved in the Midwest, were unchanged in the Northeast, and slipped in the South and West. All four regions recorded year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 0.7% from July to a seasonally adjusted annual rate of 4.04 million in August. Year-over-year, sales fell 15.3% (down from 4.77 million in August 2022).

...

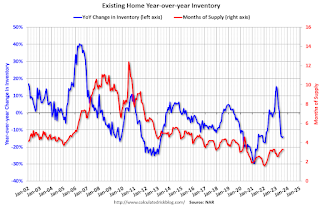

Total housing inventory registered at the end of August was 1.1 million units, down 0.9% from July and 14.1% from one year ago (1.28 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, identical to July and up from 3.2 months in August 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in August (4.04 million SAAR) were down 0.7% from the previous month and were 15.3% below the August 2022 sales rate.

According to the NAR, inventory decreased to 1.10 million in August down from 1.11 million in June.

According to the NAR, inventory decreased to 1.10 million in August down from 1.11 million in June.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.1% year-over-year (blue) in August compared to August 2022.

Inventory was down 14.1% year-over-year (blue) in August compared to August 2022. Months of supply (red) was unchanged at 3.3 months in August from 3.3 months in July.

This was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 201,000

by Calculated Risk on 9/21/2023 08:30:00 AM

The DOL reported:

In the week ending September 16, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 20,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 220,000 to 221,000. The 4-week moving average was 217,000, a decrease of 7,750 from the previous week's revised average. The previous week's average was revised up by 250 from 224,500 to 224,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 217,000.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, September 20, 2023

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 9/20/2023 08:36:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 220 thousand last week.

• At 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 0.0, up from -12.0.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, up from 4.07 million in July.

FOMC Projections and Press Conference

by Calculated Risk on 9/20/2023 02:17:00 PM

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. Projections of the neutral Fed Funds rate increased again!

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.8% in August. The FOMC's unemployment rate projection for Q4 was revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of July 2023, PCE inflation increased 3.3 percent year-over-year (YoY), up from 3.0 percent YoY in June, and down from the recent peak of 7.0 percent in June 2022. Projections for PCE inflation were mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 4.2 percent YoY, up from 4.1 percent in June, and down from the recent peak of 5.4 percent in February 2022. This includes PCE measure of shelter that was up 7.8% YoY in July (even though asking rents are soft). Core PCE inflation likely declined to around 3.8% in August, and the FOMC revised down their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

FOMC Statement: No Change to Rates

by Calculated Risk on 9/20/2023 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

emphasis added