by Calculated Risk on 9/25/2023 07:45:00 PM

Monday, September 25, 2023

Tuesday: Case-Shiller House Prices, New Home Sales

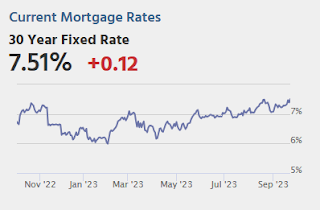

For the average lender, a top tier 30yr fixed rate is now over 7.5% for the first time in at least 22 years. The average borrower (not "top tier") is seeing rates that are even higher. This assumes an adjustment for discount points. Many loans are being quoted with points currently, and in those cases, the note rate would be a bit lower. [30 year fixed 7.51%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. The consensus is for a 0.5% year-over-year increase in the National index for July.

• Also at 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for 700 thousand SAAR, down from 714 thousand in July.

• Also at 10:00 AM, the Richmond Fed manufacturing survey for September.

Final Look at Local Housing Markets in August

by Calculated Risk on 9/25/2023 01:56:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in August

A brief excerpt:

Each month I track closed sales, new listings and active inventory in a sample of local markets around the country (over 40 local housing markets) in the US to get an early sense of changes in the housing market. In addition, we can look for regional differences.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m adding more markets). This is the final look at local markets in August.

The big story for August existing home sales was the near cycle low sales volume, and the large year-over-year (YoY) decline in sales. Also new listings were down YoY, but much less than in previous months.

This table shows the YoY change in new listings since the start of 2023. The smaller decline is due to a combination of new listings collapsing in the 2nd half of 2022, and new listings holding up more seasonally than normal (but still historically very low).

...

More local data coming in October for activity in September!

Update on Four High Frequency Indicators

by Calculated Risk on 9/25/2023 12:19:00 PM

I stopped the weekly updates of high frequency indicators at the end of 2022.

The TSA is providing daily travel numbers.

This data is as of September 24th.

Click on graph for larger image.

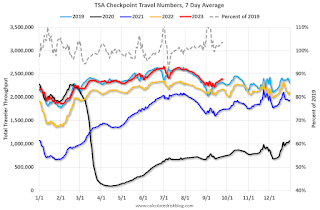

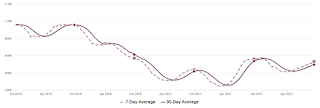

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Orange) and 2023 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is above the level for the same week in 2019 (103.4% of 2019). (Dashed line)

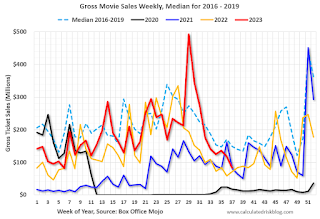

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales (dollars) have mostly been running below the pre-pandemic levels.

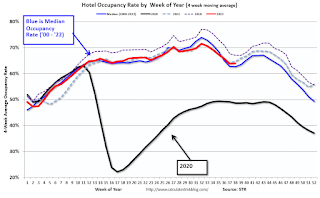

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

This data is through September 16th. The occupancy rate was down 2.2% compared to the same week in 2022.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

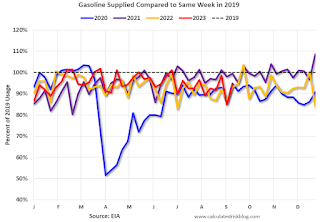

Blue is for 2020. Purple is for 2021, and Orange is for 2022, and Red is for 2023.

Gasoline supplied in 2023 is running about 5% below 2019 levels.

Housing September 25th Weekly Update: Inventory increased 1.8% Week-over-week; Down 5.2% Year-over-year

by Calculated Risk on 9/25/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, September 24, 2023

Sunday Night Futures

by Calculated Risk on 9/24/2023 06:12:00 PM

Weekend:

• Schedule for Week of September 24, 2023

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 5 and DOW futures are up 40 (fair value).

Oil prices were down slightly over the last week with WTI futures at $90.03 per barrel and Brent at $93.27 per barrel. A year ago, WTI was at $79, and Brent was at $84 - so WTI oil prices are up 14% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.81 per gallon. A year ago, prices were at $3.83 per gallon, so gasoline prices are mostly unchanged year-over-year.

The Top Ten Job Streaks: Current Streak is in 8th Place

by Calculated Risk on 9/24/2023 09:51:00 AM

For fun:

| Headline Jobs, Top 10 Streaks | |

|---|---|

| Year Ended | Streak, Months |

| 2019 | 100 |

| 1990 | 48 |

| 2007 | 46 |

| 1979 | 45 |

| 1943 | 33 |

| 1986 | 33 |

| 2000 | 33 |

| 20231 | 32 |

| 1967 | 29 |

| 1995 | 25 |

| 1Currrent Streak | |

Saturday, September 23, 2023

Real Estate Newsletter Articles this Week: Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 9/23/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• August Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

• NAR: Existing-Home Sales Decreased to 4.04 million SAAR in August

• Lawler: Early Read on Existing Home Sales in August and Some New Household/Housing Stock Data

• 4th Look at Local Housing Markets in August

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of September 24, 2023

by Calculated Risk on 9/23/2023 08:11:00 AM

The key reports this week are August New Home sales, the third estimate of Q2 GDP, Personal Income and Outlays for August, and Case-Shiller house prices for July.

For manufacturing, the Richmond, Dallas and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM: S&P/Case-Shiller House Price Index for July.

9:00 AM: S&P/Case-Shiller House Price Index for July.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 0.5% year-over-year increase in the National index for July.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 700 thousand SAAR, down from 714 thousand in July.

10:00 AM: the Richmond Fed manufacturing survey for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.6% decrease in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, up from 201 thousand last week.

8:30 AM: Gross Domestic Product, 2nd Quarter 2023 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 2.2% annualized in Q2, up from the second estimate of 2.1%.

10:00 AM: Pending Home Sales Index for August. The consensus is 1.0% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

4:00 PM: Conversation with Fed Chair Powell: A Teacher Town Hall Meeting "Federal Reserve Board Chair Jerome H. Powell will host a town hall with educators in Washington, D.C. and nationwide via webcast ... The Chair will respond to questions from the in-person audience and virtual participants from across the country."

8:30 AM: Personal Income and Outlays, August 2023. The consensus is for a 0.5% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.5% YoY, and core PCE prices up 3.9% YoY.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 47.6, down from 48.7 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 67.7.

Friday, September 22, 2023

Sept 22nd COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 9/22/2023 07:17:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 16,050 | 14,681 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,005 | 959 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

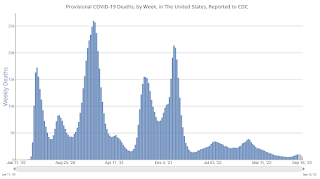

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Black Knight: Mortgage Delinquency Rate Decreased Slightly in August

by Calculated Risk on 9/22/2023 01:43:00 PM

From Black Knight: Black Knight’s First Look: Mortgage Performance Remains Strong, but Slowing Improvement Suggests Delinquencies May Be Nearing Cycle Lows

• At 3.17%, the U.S. delinquency rate improved by 4 basis points in August and is nearly a full percentage point below its 2015-2019 same-month averageAccording to Black Knight's First Look report, the percent of loans delinquent decreased 1.2% in August compared to July and decreased 0.8% year-over-year.

• However, steady slowing in the annual rate of improvement -- from -40% in early 2022 to -0.8% as of August – suggests delinquency rates may be nearing cycle lows

• Serious delinquencies (90+ days past due) continued to improve, falling 20K from July to 448K – still the lowest level since June 2006 – and down 151K (-25%) year over year

• Early-stage delinquencies, on the other hand, continued to trend upward, with both 30- and 60-day late populations inching up by 2K, marking the third consecutive monthly increase

• The number of loans in active foreclosure declined to 215K – the lowest level since March 2022 following the end of moratoria on such actions – and is down 68K (-24%) from pre-pandemic February 2020

• August’s 31.9K (+21.3% month over month) foreclosure starts – equating to 6.8% of serious delinquencies – were still 21% below August 2019 pre-pandemic levels

• While 6.9K foreclosure sales marked a 13% increase from July, volumes remain at roughly half pre-pandemic levels

• Prepayment activity (SMM) inched up to 0.53% under pressure from seasonal home buying patterns, while interest rates north of 7% continue to hold prepayment speeds at historically low levels

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.17% in August, down from 3.21% the previous month.

The percent of loans in the foreclosure process decreased in August to 0.41%, from 0.42% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| August 2023 | July 2023 | |||

| Delinquent | 3.17% | 3.21% | ||

| In Foreclosure | 0.41% | 0.42% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,684,000 | 1,700,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 215,000 | 220,000 | ||

| Total Properties | 1,899,000 | 1,919,000 | ||