by Calculated Risk on 9/27/2023 08:23:00 PM

Wednesday, September 27, 2023

Thursday: Q2 GDP, Unemployment Claims, Pending Home Sales, Fed Chair Powell

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, up from 201 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 2nd Quarter 2023 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 2.2% annualized in Q2, up from the second estimate of 2.1%. "BEA will release initial results from the 2023 comprehensive update of the National Economic Accounts, which include the National Income and Product Accounts as well as the Industry Economic Accounts, on September 28, 2023."

• At 10:00 AM, Pending Home Sales Index for August. The consensus is 1.0% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

• At 4:00 PM, Conversation with Fed Chair Powell: A Teacher Town Hall Meeting "Federal Reserve Board Chair Jerome H. Powell will host a town hall with educators in Washington, D.C. and nationwide via webcast ... The Chair will respond to questions from the in-person audience and virtual participants from across the country."

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/27/2023 04:13:00 PM

Two key points:

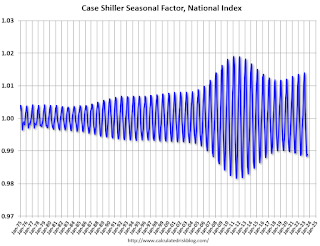

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

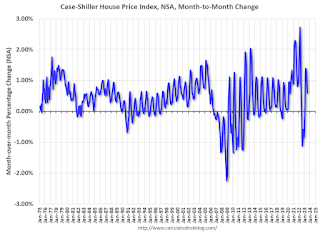

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through July 2023). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the more recent price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

A Few Comments on the Likely Government Shutdown

by Calculated Risk on 9/27/2023 01:29:00 PM

First, shutdowns are expensive, and many government employees continue to work (like the military), but don't get paid. This time President Biden and Speaker McCarthy agreed on a plan, but the Speaker has been unable to deliver. So, the path forward isn't clear.

Second, there will be an impact on GDP from Goldman Sachs:

A government shutdown this year has looked likely for several months, and we now think the odds have risen to 90%. ... We continue to think a shutdown would last 2-3 weeks.And from Nick Timiraos at the WSJ: Shutdown Would Blindfold Fed in Piloting Course on Rates. We will all be flying mostly blind without reports on employment, inflation, housing starts and more. However, there will be some private data to fill the gap.

We have estimated a shutdown would subtract 0.2pp from Q4 GDP growth for each week it lasts ... We expect all data releases from federal agencies to be postponed until after the government reopens, except for releases from the Federal Reserve, which does not rely on congressional funding.

For housing, depending on the length of the shutdown, the impact would be on existing home closings in October. If the shutdown lasts for the entire month, I'd expect about a 10% decline in seasonally adjusted sales in October. If the shutdown only lasts a couple of weeks, there would probably be little impact. Some issues could be Tax transcripts, Flood Certs, and SS# Authorization.

Inflation Adjusted House Prices 3.4% Below Peak; Price-to-rent index is 7.4% below recent peak

by Calculated Risk on 9/27/2023 09:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.4% Below Peak; Price-to-rent index is 7.4% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the June Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 66% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 9% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $360,000 today adjusted for inflation (80% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 9/27/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

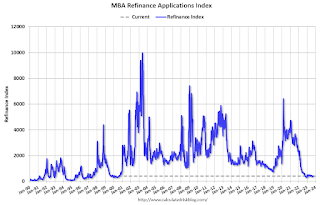

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 22, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 2 percent compared with the previous week. The Refinance Index decreased 1 percent from the previous week and was 21 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 27 percent lower than the same week one year ago.

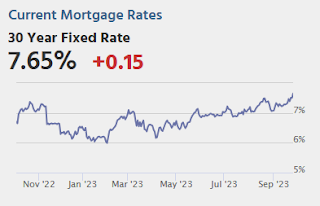

“Mortgage rates moved to their highest levels in over 20 years as Treasury yields increased late last week. The 30-year fixed mortgage rate increased to 7.41 percent, the highest rate since December 2000, and the 30-year fixed jumbo mortgage rate increased to 7.34 percent, the highest rate in the history of the jumbo rate series dating back to 2011,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Based on the FOMC’s most recent projections, rates are expected to be higher for longer, which drove the increase in Treasury yields. Overall applications declined, as both prospective homebuyers and homeowners continue to feel the impact of these elevated rates. The purchase market, which is still facing limited for-sale inventory and eroded purchasing power, saw applications down over the week and 27 percent behind last year’s pace. Refinance activity was down over 20 percent from last year and accounted for approximately one third of applications, as many homeowners have little incentive to refinance.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.41 percent, the highest level since December 2000, from 7.31 percent, with points decreasing to 0.71 from 0.72 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.

Tuesday, September 26, 2023

Wednesday: Durable Goods

by Calculated Risk on 9/26/2023 07:37:00 PM

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.6% decrease in durable goods orders.

New Home Sales decrease to 675,000 Annual Rate in August; Median New Home Price is Down 13% from the Peak

by Calculated Risk on 9/26/2023 11:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales decrease to 675,000 Annual Rate in August

Brief excerpt:

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 675 thousand. The previous three months were revised up, combined.You can subscribe at https://calculatedrisk.substack.com/.

...

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in August 2023 were up 5.8% from August 2022. Year-to-date sales are up 1.8% compared to the same period in 2022.

As expected, new home sales were up year-over-year in August, and it is fairly certain there will be more sales in 2023 than in 2022 - although 7%+ mortgage rates will likely slow sales.

New Home Sales decrease to 675,000 Annual Rate in August

by Calculated Risk on 9/26/2023 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 675 thousand.

The previous three months were revised up, combined.

Sales of new single‐family houses in August 2023 were at a seasonally adjusted annual rate of 675,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.7 percent below the revised July rate of 739,000, but is 5.8 percent above the August 2022 estimate of 638,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are close to pre-pandemic levels.

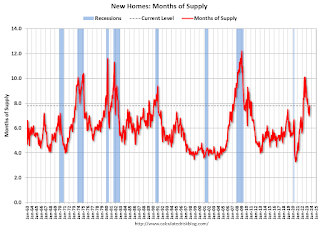

The second graph shows New Home Months of Supply.

The months of supply increased in August to 7.8 months from 7.0 months in July.

The months of supply increased in August to 7.8 months from 7.0 months in July. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of August was 436,000. This represents a supply of 7.8 months at the current sales rate."Sales were below expectations of 700 thousand SAAR, however, sales for the three previous months were revised up, combined. I'll have more later today.

Comments on July Case-Shiller and FHFA House Prices

by Calculated Risk on 9/26/2023 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 1.0% year-over-year in July; New all-time High

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices). July closing prices include some contracts signed in March, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.65%. This was the sixth consecutive MoM increase following seven straight MoM decreases.

On a seasonally adjusted basis, prices increased in all of the 20 Case-Shiller cities on a month-to-month basis. Seasonally adjusted, San Francisco has fallen 9.7% from the recent peak, Seattle is down 8.8% from the peak, Las Vegas is down 8.3%, and Phoenix is down 7.6%.

Case-Shiller: National House Price Index Up 1.0% year-over-year in July; New all-time High

by Calculated Risk on 9/26/2023 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported 1.0% annual change in July, up from a 0% change in the previous month. The 10- City Composite showed an increase of 0.9%, which improves from a -0.5% loss in the previous month. The 20-City Composite posted a year-over-year increase of 0.1%, improving from a loss of -1.2% in the previous month.

...

Before seasonal adjustment, the U.S. National Index, 10-City and 20-City Composites, all posted a 0.6% month-over-month increase in July.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.6%, while the 10-City posted a 0.8% increase and 20-City Composite a 0.9% increase.

“U.S. home prices continued to rally in July 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “Our National Composite rose by 0.6% in July, and now stands 1.0% above its year-ago level. Our 10- and 20-City Composites each also rose in July 2023, and likewise stand slightly above their July 2022 levels.

“We have previously noted that home prices peaked in June 2022 and fell through January of 2023, declining by 5.0% in those seven months. The increase in prices that began in January has now erased the earlier decline, so that July represents a new all-time high for the National Composite. Moreover, this recovery in home prices is broadly based. As was the case last month, 10 of the 20 cities in our sample have reached all-time high levels. In July, prices rose in all 20 cities after seasonal adjustment (and in 19 of them before adjustment).

“That said, regional differences continue to be striking. On a year-over-year basis, the Revenge of the Rust Belt continues. The three best-performing metropolitan areas in July were Chicago (+4.4%), Cleveland (+4.0%), and New York (+3.8%), repeating the ranking we saw in May and June. The bottom of the leader board reshuffled somewhat, with Las Vegas (-7.2%) and Phoenix (-6.6%) this month’s worst performers.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8 in July (SA) and is at a new all-time high.

The Composite 20 index is up 0.9% (SA) in July and is also at a new all-time high.

The National index is up 0.6% (SA) in July and is also at a new all-time high.

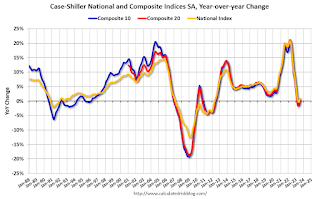

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.9% year-over-year. The Composite 20 SA is up 0.1% year-over-year.

The National index SA is up 1.0% year-over-year.

Annual price changes were close to expectations. I'll have more later.