by Calculated Risk on 10/01/2023 07:06:00 PM

Sunday, October 01, 2023

Monday: ISM Manufacturing, Construction Spending

Weekend:

• Schedule for Week of October 1, 2023

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for September. The consensus is for a reading of 47.8, up from 47.6 in August.

• Also at 10:00 AM Construction Spending for August. The consensus is for a 0.5% increase.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 16 and DOW futures are up 110 (fair value).

Oil prices were mixed over the last week with WTI futures at $90.79 per barrel and Brent at $92.20 per barrel. A year ago, WTI was at $80, and Brent was at $89 - so WTI oil prices are up about 14% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.79 per gallon. A year ago, prices were at $3.77 per gallon, so gasoline prices are up $0.02 year-over-year.

Freddie Mac House Price Index Increased in August to New High; Up 4.0% Year-over-year

by Calculated Risk on 10/01/2023 10:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in August to New High; Up 4.0% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 4.0% in August, from up 3.0% YoY in July. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% in May 2023. ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

In August, 11 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Utah (-3.8%), Arizona (-3.4%), Hawaii (-3.4%), Idaho (-3.2%), and Nevada (-2.8%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

...

I’ll have an update on the House Price Battle Royale: Low Inventory vs Affordability soon.

Saturday, September 30, 2023

Real Estate Newsletter Articles this Week: House Price Index Up 1.0% year-over-year in July; New all-time High

by Calculated Risk on 9/30/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales decrease to 675,000 Annual Rate in August

• Case-Shiller: National House Price Index Up 1.0% year-over-year in July; New all-time High

• Inflation Adjusted House Prices 3.4% Below Peak

• Asking Rents Down 1.2% Year-over-year

• Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in August

• Final Look at Local Housing Markets in August

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 1, 2023

by Calculated Risk on 9/30/2023 08:11:00 AM

The key report scheduled for this week is the September employment report on Friday.

Other key indicators include the September ISM Manufacturing and Services indices, September auto sales and the August trade deficit.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a reading of 47.8, up from 47.6 in August.

10:00 AM: Construction Spending for August. The consensus is for a 0.5% increase.

8:00 AM ET: Corelogic House Price index for August.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 8.83 million from 9.17 million in June.

The number of job openings (yellow) were down 22% year-over-year. Quits were down 12% year-over-year.

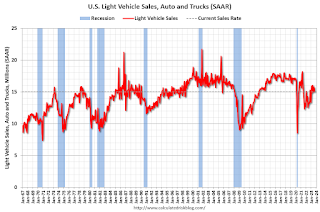

All day: Light vehicle sales for September.

All day: Light vehicle sales for September.The consensus is for sales of 15.4 million SAAR, up from 15.0 million SAAR in August (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

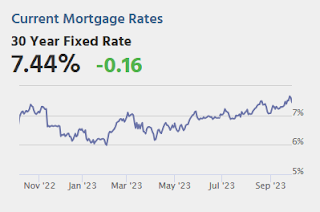

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 150,000 jobs added, down from 177,000 in August.

10:00 AM: the ISM Services Index for September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, up from 204 thousand last week.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $65.1 billion in August, from $65.0 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $65.1 billion in August, from $65.0 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

8:30 AM: Employment Report for September. The consensus is for 150,000 jobs added, and for the unemployment rate to decrease to 3.7%.

8:30 AM: Employment Report for September. The consensus is for 150,000 jobs added, and for the unemployment rate to decrease to 3.7%.There were 187,000 jobs added in August, and the unemployment rate was at 3.8%.

This graph shows the jobs added per month since January 2021.

Friday, September 29, 2023

Sept 29th COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 9/29/2023 07:20:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 16,196 | 16,139 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,132 | 1,088 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q3 GDP Tracking: Around 3%

by Calculated Risk on 9/29/2023 03:44:00 PM

From BofA:

Overall, the data flow since our last weekly lowered our 3Q US GDP tracking estimate by a tenth to 2.8%. [Sept 29th estimate]From Goldman:

emphasis added

The foreign trade details of this morning’s report were stronger than our previous assumptions, and we boosted our Q3 GDP tracking estimate by 0.3pp to +3.5% (qoq ar). We left our domestic final sales growth forecast unchanged on a rounded basis at +2.6%. [Sept 29th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.9 percent on September 29, unchanged from September 27 after rounding. After recent releases from the US Bureau of Economic Analysis and US Census Bureau, increases in the model’s nowcasts of the contributions of personal consumption expenditures and net exports to GDP growth were offset by a downward revision in the nowcast of real gross private domestic investment growth. [Sept 29th estimate]

Hotels: Occupancy Rate Decreased 1.6% Year-over-year

by Calculated Risk on 9/29/2023 02:52:00 PM

U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 23 September.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

17-23 September 2023 (percentage change from comparable week in 2022):

• Occupancy: 68.5% (-1.6%)

• Average daily rate (ADR): US$164.97 (+2.9%)

• Revenue per available room (RevPAR): US$112.96 (+1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in August

by Calculated Risk on 9/29/2023 10:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in August

Brief excerpt:

I’ve argued that there would not be a huge wave of single-family foreclosures this cycle since lending standards have been solid and most homeowners have substantial equity. That means we will not see cascading price declines like following the housing bubble. Delinquencies are a trailing indicator but are something to watch.You can subscribe at https://calculatedrisk.substack.com/.

However, there is some concern about some multi-family properties.

...

Freddie Mac reports that multi-family delinquencies increased to 0.25% in August, up from 0.12% in August 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Delinquency rates were still high in 2012 following the housing bust and financial crisis.

The multi-family delinquency rate increased following the pandemic and has increased recently as rent growth has stalled, vacancy rates have increased, lending has tightened, and interest rates have increased sharply. This will be something to watch as rents soften.

PCE Measure of Shelter Slows to 7.4% YoY in August

by Calculated Risk on 9/29/2023 09:12:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through July 2023.

Since asking rents are slightly negative year-over-year, these measures will continue to slow sharply over coming months.

Personal Income increased 0.4% in August; Spending increased 0.4%

by Calculated Risk on 9/29/2023 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $87.6 billion (0.4 percent at a monthly rate) in August, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $46.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $83.6 billion (0.4 percent).The August PCE price index increased 3.5 percent year-over-year (YoY), up from 3.4 percent YoY in July, and down from the recent peak of 7.1 percent in June 2022.

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI decreased 0.2 percent in August and real PCE increased 0.1 percent; goods decreased 0.2 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through August 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly below expectations, and PCE was at expectations.

Using the two-month method to estimate Q3 real PCE growth, real PCE was increasing at a 4.0% annual rate in Q3 2023. (Using the mid-month method, real PCE was increasing at 3.9%). This suggests strong PCE growth in Q3.