by Calculated Risk on 10/06/2023 08:30:00 AM

Friday, October 06, 2023

September Employment Report: 336 thousand Jobs, 3.8% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 336,000 in September, and the unemployment rate was unchanged at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in leisure and hospitality; government; health care; professional, scientific, and technical services; and social assistance.

...

The change in total nonfarm payroll employment for July was revised up by 79,000, from +157,000 to +236,000, and the change for August was revised up by 40,000, from +187,000 to +227,000. With these revisions, employment in July and August combined is 119,000 higher than previously reported.

emphasis added

Click on graph for larger image.

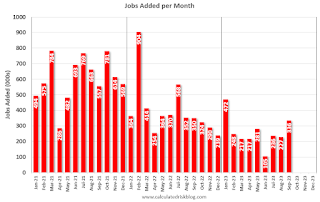

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for July and August were revised up 119 thousand, combined.

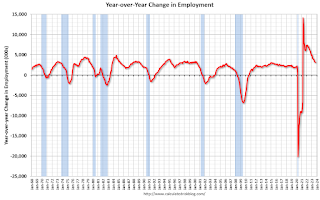

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 3.19 million jobs. Employment was up significantly year-over-year but has slowed to more normal levels of job growth recently.

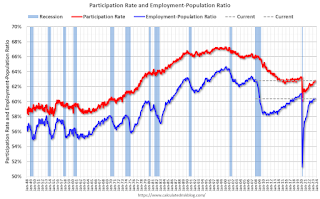

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.8% in September, from 62.8% in August. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.8% in September, from 62.8% in August. This is the percentage of the working age population in the labor force. The Employment-Population ratio was unchanged at 60.4% from 60.4% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

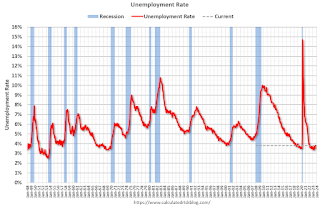

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged at 3.8% in September from 3.8% in August.

This was well above consensus expectations; and, July and August payrolls were revised up by 119,000 combined.

Thursday, October 05, 2023

Friday: Employment Report

by Calculated Risk on 10/05/2023 08:19:00 PM

Friday:

• At 8:30 AM ET, Employment Report for September. The consensus is for 150,000 jobs added, and for the unemployment rate to decrease to 3.7%.

September Employment Preview

by Calculated Risk on 10/05/2023 04:03:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 150,000 jobs added, and for the unemployment rate to decrease to 3.7%.

From BofA economists:

"We look for nonfarm payroll employment to increase by 185k ... we forecast the unemployment rate to fall two-tenths in September to 3.6% owing in part to a tenth decline in the labor force participation rate to 62.7%."From Goldman Sachs:

"We estimate nonfarm payrolls rose by 200k in September (mom sa) ... Big Data indicators indicate strong job growth on net, and we place little weight on the ADP miss because of its lop-sided composition and because of the negative correlation between that indicator and nonfarm payroll growth. ... We estimate that the unemployment rate declined one tenth to 3.7%."• ADP Report: The ADP employment report showed 89,000 private sector jobs were added in September. This suggests job gains below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in September to 51.2%, up from 48.5% last month. This would suggest about 10,000 job lost in manufacturing. The ADP report indicated 12,000 manufacturing jobs lost in September.

The ISM® services employment index decreased to 53.4%, down from 54.7%. This would suggest about 165,000 jobs added in the service sector. Combined this suggests job gains of 155,000 in September, close to consensus expectations.

• Unemployment Claims: The weekly claims report showed a sharp decrease in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 240,000 in August to 202,000 in September. This suggests fewer layoffs in September than in August.

Moody's: "Apartment Market Softens, Office Evolution Continues, and Retail On Shaky Ground"

by Calculated Risk on 10/05/2023 01:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: "Apartment Market Softens, Office Evolution Continues, and Retail On Shaky Ground"

A brief excerpt:

From Moody’s:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/The national office vacancy rate climbed to 19.2% in Q3 2023, rising from Q2’s 18.9% and rapidly approaching the historic peak of 19.3% set in 1991. The office landscape has struggled in 2023, though market performance is more mixed with property-specific nuances. With rising vacancies, the national office market experienced another quarter of relatively stagnant rent growth. ...Moody’s Analytics reported that the office vacancy rate was at 19.2% in Q3 2023, up from 18.9% in Q2 2023, and up from 18.5% in Q3 2022. This is just below the record high of 19.3% during the S&L crisis.

Realtor.com Reports Weekly Active Inventory Down 2.6% YoY; New Listings Down 1.2% YoY

by Calculated Risk on 10/05/2023 12:30:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Hannah Jones: Weekly Housing Trends View — Data Week Ending Sep 30, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 2.6%.

During the past week, we observed the 15th successive weekly drop in the number of homes available for sale relative to the previous year. However, this decline showed another improvement compared to the previous week’s -3.7% figure.

• New listings–a measure of sellers putting homes up for sale–were down by just 1.2% from one year ago.

Over the past 65 weeks, we’ve consistently seen a decline in the number of newly listed homes compared to the same period one year ago. However, the difference narrowed to the smallest gap in the 65 week stretch.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 1.2% year-over-year - this was the fifteenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Trade Deficit decreased to $58.3 Billion in August

by Calculated Risk on 10/05/2023 08:45:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $58.3 billion in August, down $6.4 billion from $64.7 billion in July, revised.

August exports were $256.0 billion, $4.1 billion more than July exports. August imports were $314.3 billion, $2.3 billion less than July imports.

emphasis added

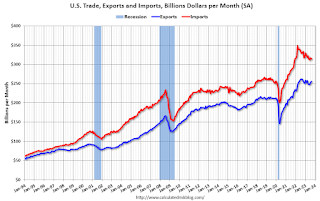

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in August.

Exports are down 2% year-over-year; imports are down 4% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - and both have been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have picked up.

The trade deficit with China decreased to $26.0 billion from $37.5 billion a year ago.

Weekly Initial Unemployment Claims Increase to 207,000

by Calculated Risk on 10/05/2023 08:30:00 AM

The DOL reported:

In the week ending September 30, the advance figure for seasonally adjusted initial claims was 207,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 204,000 to 205,000. The 4-week moving average was 208,750, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 211,000 to 211,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 208,750.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

Wednesday, October 04, 2023

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 10/04/2023 08:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, up from 204 thousand last week.

• Also at 8:30 AM, Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $65.1 billion in August, from $65.0 billion in July.

Las Vegas August 2023: Visitor Traffic Up 4.0% YoY; Convention Traffic Up Sharply YoY

by Calculated Risk on 10/04/2023 07:11:00 PM

From the Las Vegas Visitor Authority: August 2023 Las Vegas Visitor Statistics

August was a solid month with more than 3.3M visitors as weekend occupancy was largely on par with last year while midweek saw notable gains supported in part by a strengthening convention segment that included recurring shows such as ASD Market Week as well the Summer 2023 Las Vegas Market show at World Market Center which fell in August this year vs. July in 2022.

Overall hotel occupancy reached 80.3% for the month (+3.5 pts YoY) as Weekend occupancy came in at 89.7% (‐0.4 pts YoY), and Midweek occupancy reached 77.0%, surpassing last August by 4.8 pts.

ADR growth continued in August, approaching $159, +7.0% YoY while RevPAR exceeded $127, +11.9% YoY

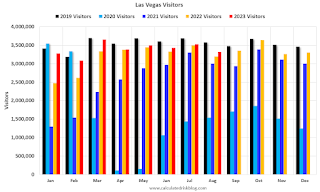

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was up 4.0% compared to last August.

Note: There was almost no convention traffic from April 2020 through May 2021.

Lawler: The Second Half “Bear Steepener”: Higher for Longer, a Higher R*, and A Rising Term Premium

by Calculated Risk on 10/04/2023 03:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: The Second Half “Bear Steepener”: Higher for Longer, a Higher R*, and A Rising Term Premium

A brief excerpt:

NOTE: This is technical and related to these earlier notes (and mortgage rates):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

August 18th: Lawler: Is The “Natural” Rate of Interest Back to Pre-Financial Crisis Levels?

August 15th: The "New Normal" Mortgage Rate Range

From housing economist Tom Lawler:

Below is a chart showing the Treasury yield curve from 1 to 30 years yesterday compared to the end of each of the previous four months.

...

As the graph and table show, the one-year Treasury yield hasn’t moved much since middle of the year, while the 10- and 30-year Treasury yields have increased by over 100 basis points. While the yield curve is still very inverted by historical standards, it is a far cry from the “uber-inversion” of earlier in the year.