by Calculated Risk on 10/11/2023 07:00:00 AM

Wednesday, October 11, 2023

MBA: Mortgage Applications Increased in Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 6, 2023.

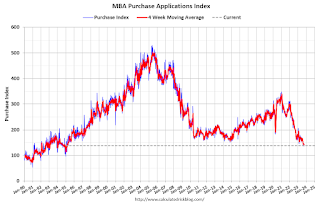

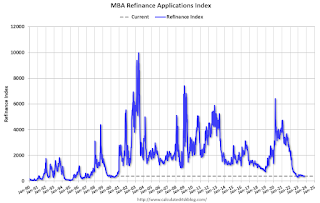

The Market Composite Index, a measure of mortgage loan application volume, increased 0.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index increased 0.3 percent from the previous week and was 9 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 19 percent lower than the same week one year ago.

“While most mortgage rates increased last week, rates on ARMs declined, leading to an increase in ARM volume and an increase in overall applications. The level of ARM applications increased by 15 percent over the week, bringing the ARM share up to 9.2 percent of all applications, the highest share since November 2022. The yield curve has become less inverted in recent weeks and ARM pricing has certainly improved,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The 30-year fixed mortgage rate is at 7.67 percent – the highest level since 2000 and 40 basis points higher than a month ago. Application activity remains depressed and close to multi-decade lows, with purchase applications still almost 20 percent behind last year’s pace. Refinance applications also continue to be limited, and the average loan size has fallen to its lowest level since 2017.”

...

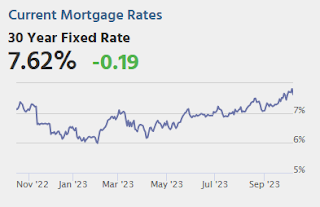

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.67 percent from 7.53 percent, with points decreasing to 0.75 from 0.80 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

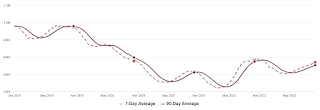

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 19% year-over-year unadjusted.

Tuesday, October 10, 2023

Wednesday: PPI, FOMC Minutes

by Calculated Risk on 10/10/2023 07:31:00 PM

The average mortgage lender is quoting a top tier 30yr fixed mortgage rate that is nearly a quarter of a percent lower than the same scenario last Friday. Granted, big moves like this are more common after hitting multi-decade highs, bit today's example has other motivations.Wednesday:

Specifically, the outbreak of the Israel-Gaza conflict prompted some excess demand for safer haven assets like US Treasuries and mortgage-backed securities. Perhaps more importantly the conflict creates geopolitical uncertainty that is seen as one more reason for the Fed to "wait and see" when it comes time to decide whether to hike rates one more time in 2023 or not. [30 year fixed 7.62%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 2:00 PM, FOMC Minutes, Minutes Meeting of September 19-20, 2023

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Diffusion Indexes

by Calculated Risk on 10/10/2023 12:45:00 PM

A few more employment graphs ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.1% in September, and highest for those without a high school degree at 5.5% in September.

All four groups were generally trending down prior to the pandemic. And all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

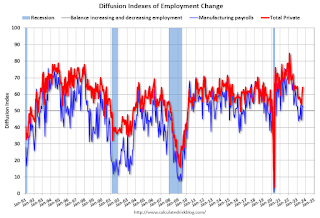

The BLS diffusion index for total private employment was at 64.2 in September, up from 62.2 in August. A solid reading.

The BLS diffusion index for total private employment was at 64.2 in September, up from 62.2 in August. A solid reading.For manufacturing, the diffusion index was at 52.8, unchanged from 52.8 in August.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was widespread in September.

Part 2: Current State of the Housing Market; Overview for mid-October

by Calculated Risk on 10/10/2023 09:21:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-October

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-October I reviewed home inventory and sales.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Most measures of house prices have shown an increase in prices over the last several months, and a key question I discussed in July is Will house prices decline further later this year? I will revisit this question soon.

Other measures of house prices suggest prices will be up further YoY over the next few months in the Case-Shiller index. The NAR reported median prices were up 3.9% YoY in August, up from 1.7% YoY in July. ICE / Black Knight reported prices were up 3.8% YoY in August, up from 2.4% YoY in July to new all-time highs, and Freddie Mac reported house prices were up 4.0% YoY in August, up from 2.9% YoY in July - and also to new all-time highs.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will increase further in the report for August.

Monday, October 09, 2023

Moody's: Mall Vacancy Rate Unchanged in Q3

by Calculated Risk on 10/09/2023 03:49:00 PM

Note: I covered apartments and offices in the newsletter: Moody's: "Apartment Market Softens, Office Evolution Continues, and Retail On Shaky Ground"

From Moody’s Analytics economists Thomas Lasalvia, Lu Chen and Nick Luettke: Apartment Market Softens, Office Evolution Continues, and Retail On Shaky Ground

Over the past decade, traditional retail forms have been challenged by e-commerce’s boom, whose share as a percentage of total retail sales has been constantly hovering above 15% since early 2023. During the sector’s ongoing revolution, retail clusters have been shifting towards service-centric and experience-oriented uses. As non-performing assets get replaced by modernized retail forms or even mixed-use communities, the retail sector ignited a long-awaited hope at the rise of pent-up consumer demand.

...

[N]eighborhood and community shopping centers held steady for another quarter. But over 85,000 sqft of net move-ins fell well under the verified new retail completions, totaling 390,000 sqft over the last three months. August and September leasing activities showed some cracks but it may still be too early to call it systematic. National vacancy stayed flat at 10.3% since early 2023. Asking/effective rents were up slightly by 0.2%/0.3% as compared to last quarter but remained in the $21/$18-per-sqft range, a level relatively unchanged since 2018.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Part 1: Current State of the Housing Market; Overview for mid-October

by Calculated Risk on 10/09/2023 12:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-October

A brief excerpt:

The NAR reported sales were at a “seasonally adjusted annual rate of 4.04 million in August. Year-over-year, sales fell 15.3% (down from 4.77 million in August 2022).” This was in line with the local markets I tracked for August.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The current cycle low for existing home sales was 4.00 million SAAR in January 2023. The early local market reports suggest a new cycle low for closed sales in September!

Usually, house prices bottom after sales bottom, so a new cycle low for sales suggests likely further weakness for house prices in coming months. I’ll have more on this pattern.

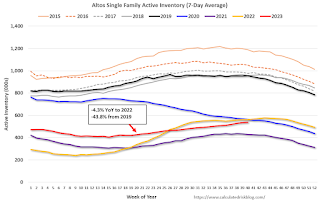

Housing October 9th Weekly Update: Inventory increased 0.4% Week-over-week; Down 4.3% Year-over-year

by Calculated Risk on 10/09/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, October 08, 2023

Sunday Night Futures

by Calculated Risk on 10/08/2023 06:16:00 PM

Weekend:

• Schedule for Week of October 8, 2023

Monday:

Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open.

• At 1:30 PM: Speech, Fed Vice Chair Philip Jefferson, U.S. Economic Outlook and Monetary Policy Transmission, At the 65th National Association for Business Economics (NABE) Annual Meeting, Dallas, Texas

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 29 and DOW futures are down 199 (fair value).

Oil prices were down over the last week (Prior to the attack on Israel) with WTI futures at $84.58 per barrel and Brent at $92.20 per barrel. A year ago, WTI was at $93, and Brent was at $99 - so WTI oil prices were down about 0% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.67 per gallon. A year ago, prices were at $3.94 per gallon, so gasoline prices are down $0.27 year-over-year.

Hotels: Occupancy Rate Increased 0.8% Year-over-year

by Calculated Risk on 10/08/2023 08:11:00 AM

As expected, U.S. hotel performance was lower than the previous week, but year-over-year comparisons were improved, according to CoStar’s latest data through 30 September.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

24-30 September 2023 (percentage change from comparable week in 2022):

• Occupancy: 66.7% (+0.8%)

• Average daily rate (ADR): US$157.89 (+4.6%)

• Revenue per available room (RevPAR): US$105.31 (+5.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, October 07, 2023

Real Estate Newsletter Articles this Week: Outstanding Mortgage Rates, LTV and Credit Scores

by Calculated Risk on 10/07/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

• Freddie Mac House Price Index Increased in August to New High; Up 4.0% Year-over-year

• Lawler: The Second Half “Bear Steepener”: Higher for Longer, a Higher R*, and A Rising Term Premium

• 1st Look at Local Housing Markets in September

• Moody's: "Apartment Market Softens, Office Evolution Continues, and Retail On Shaky Ground"

• ICE (Black Knight) Mortgage Monitor: "Home Prices Set Yet Another Record in August"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/