by Calculated Risk on 10/17/2023 07:51:00 PM

Tuesday, October 17, 2023

Wednesday: Housing Starts, Beige Book

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September. The consensus is for 1.405 million SAAR, up from 1.283 million SAAR.

• During the day, The AIA/Deltek's Architecture Billings Index for September (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/17/2023 01:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in September

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.00 million in September, down 1.0% from August’s preliminary pace and down 14.5% from last September’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting this September’s lower business day count relative to last September’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 3.4% from last September.

CR Note: The National Association of Realtors (NAR) is scheduled to release September existing home sales on Thursday, October 19th, at 10:00 AM ET. The consensus is for 3.94 million SAAR, down from 4.04 million in August.

NAHB: Builder Confidence Decreased in October

by Calculated Risk on 10/17/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 40, down from 44 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

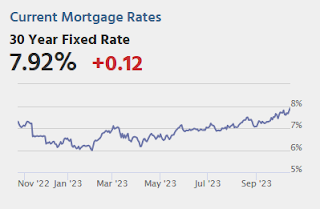

From the NAHB: Mortgage Rates Well Above 7% Continue to Hammer Builder Confidence

Stubbornly high mortgage rates that have climbed to a 23-year high and have remained above 7% for the past two months continue to take a heavy toll on builder confidence, as sentiment levels have dropped to the lowest point since January 2023.

Builder confidence in the market for newly built single-family homes in October fell four points to 40 from a downwardly revised September reading, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the third consecutive monthly drop in builder confidence.

“Builders have reported lower levels of buyer traffic, as some buyers, particularly younger ones, are priced out of the market because of higher interest rates,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Higher rates are also increasing the cost and availability of builder development and construction loans, which harms supply and contributes to lower housing affordability.”

Since late September, mortgage rates are up nearly 40 basis points to 7.57%, according to Freddie Mac. Interest rates have increased on the Federal Reserve’s apparent higher-for-longer monetary policy stance, better than expected macro growth during the third quarter and longer-term concerns over government budget deficits.

“The housing affordability crisis can only be solved by adding additional attainable, affordable supply,” said NAHB Chief Economist Robert Dietz. “Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.”

As a result of the extended high interest environment, many builders continue to reduce home prices to boost sales. In October, 32% of builders reported cutting home prices, unchanged from the previous month but still the highest rate since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 62% of builders provided sales incentives of all forms in October, up from 59% in September and tied with the previous high for this cycle set in December 2022.

...

All three major HMI indices posted declines in October. The HMI index gauging current sales conditions fell four points to 46, the component charting sales expectations in the next six months dropped five points to 44 and the gauge measuring traffic of prospective buyers dipped four points to 26.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell four points to 50, the Midwest dropped three points to 39, the South fell five points to 49 and the West posted a six-point decline to 41.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast.

Industrial Production Increased 0.3% in September

by Calculated Risk on 10/17/2023 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

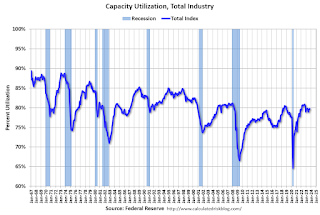

Industrial production increased 0.3 percent in September and advanced at an annual rate of 2.5 percent in the third quarter. Manufacturing output rose 0.4 percent in September, the index for mining moved up 0.4 percent, and the index for utilities decreased 0.3 percent. At 103.6 percent of its 2017 average, total industrial production in September was 0.1 percent above its year-earlier level. Capacity utilization moved up 0.2 percentage point to 79.7 percent in September, a rate that is equal to its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 79.7% is at the average from 1972 to 2022. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 103.6. This is above the pre-pandemic level.

Industrial production was above consensus expectations, however the previous month was revised down.

Retail Sales Increased 0.7% in September

by Calculated Risk on 10/17/2023 08:30:00 AM

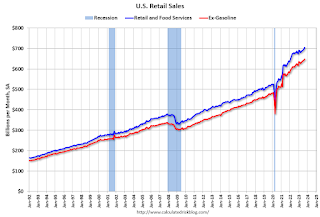

On a monthly basis, retail sales were up 0.7% from August to September (seasonally adjusted), and sales were up 3.8 percent from September 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.9 billion, up 0.7 percent from the previous month, and up 3.8 percent above September 2022. ... The July 2023 to August 2023 percent change was revised from up 0.6 percent to up 0.8 percent (±0.1 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.3% on a YoY basis.

The increase in sales in September was well above expectations, and sales in July and August were revised up.

The increase in sales in September was well above expectations, and sales in July and August were revised up.

Monday, October 16, 2023

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 10/16/2023 07:10:00 PM

Last week was mostly good for mortgage rates, even if the goodness was made possible in large part by the badness of the previous week. By Friday, rates were 0.15% lower than the previous Friday, on average.Tuesday:

As the new week begins, virtually all of that progress has been erased. In other words, the average lender is now very close to the same rates seen on Friday, October 6th. [30 year fixed 7.80%]

emphasis added

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.2% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 79.6%.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 44, down from 45 in September. Any number below 50 indicates that more builders view sales conditions as poor than good.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.31% in September"

by Calculated Risk on 10/16/2023 04:07:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.31% in September

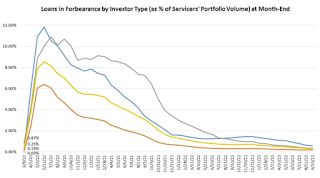

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.33% of servicers’ portfolio volume in the prior month to 0.31% as of September 30, 2023. According to MBA’s estimate, 155,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8 million borrowers since March 2020.

In September 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.18%. Ginnie Mae loans in forbearance decreased 8 basis points to 0.57%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 4 basis points to 0.35%.

“The number of loans in forbearance dropped in September, but the overall performance of servicing portfolios and loan workouts declined slightly,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “MBA’s baseline forecast has a recession in the first half of 2024. Several factors – including unemployment increases, rising property taxes and insurance, the resumption of student debt payments, and possible natural disasters – may affect loan performance in future months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing and declined to 0.31% in September from 0.33% in August.

At the end of August, there were about 155,000 homeowners in forbearance plans.

Preliminary 2024 Housing Forecasts

by Calculated Risk on 10/16/2023 10:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Preliminary 2024 Housing Forecasts

A brief excerpt:

Towards the end of each year, I collect some housing forecasts for the following year - and also provide my own outlook. Several more forecast will be available in early December.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

A few key points from these early forecasts:

1) Forecasters expect house prices in increase next year.

2) Everyone expects multi-family starts to be down sharply in 2024.

3) 30-year fixed rate mortgages rates are expected to be above 6% next year (MBA is at 6.1%, NAHB is at 6.4%, and Fannie is at 6.9%)

I’ll have several more forecasts (and updated forecasts) by December.

Housing October 16th Weekly Update: Inventory increased 1.8% Week-over-week; Down 3.5% Year-over-year

by Calculated Risk on 10/16/2023 08:19:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, October 15, 2023

Sunday Night Futures

by Calculated Risk on 10/15/2023 07:00:00 PM

Weekend:

• Schedule for Week of October 15, 2023

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of -1.5, down from 1.9.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 4 and DOW futures are up 27 (fair value).

Oil prices were up over the last week with WTI futures at $87.69 per barrel and Brent at $90.89 per barrel. A year ago, WTI was at $86, and Brent was at $92 - so WTI oil prices were up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.56 per gallon. A year ago, prices were at $3.87 per gallon, so gasoline prices are down $0.31 year-over-year.