by Calculated Risk on 10/24/2023 07:36:00 PM

Tuesday, October 24, 2023

Wednesday: New Home Sales

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 679 thousand SAAR, up from 675 thousand in August.

• At 4:35 PM, Speech, Fed Chair Jerome Powell, Introductory Remarks, At the 2023 Moynihan Lecture in Social Science and Public Policy, Washington, D.C.

Goldman: 2024 Housing Outlook

by Calculated Risk on 10/24/2023 12:23:00 PM

A few excerpts from a research note by Goldman Sachs economist Ronnie Walker: Higher for Longer and the 2024 Housing Outlook

Sustained higher mortgage rates will have their most pronounced impact in 2024 on housing turnover. ... As a result, we expect the fewest annual existing home sales since the early 1990s at 3.8mn.

While vacancy rates remain at historic lows, we expect housing starts to decline by 4% to 1.34mn in 2024, reflecting sharply fewer multifamily starts.

We expect only modest home price growth of +1.3% in 2024, as supply remains tight but high rates weigh on affordability.

Total Housing Completions Will Likely Increase Slightly in 2023; The Mix will Change

by Calculated Risk on 10/24/2023 08:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Total Housing Completions Will Likely Increase Slightly in 2023; The Mix will Change

Brief excerpt:

Although housing starts have slowed, completions will likely increase slightly in 2023.You can subscribe at https://calculatedrisk.substack.com/.

This graph shows total housing completions and placements since 1968 with an estimate for 2023 based on completions through September. Note that the net additional to the housing stock is less because of demolitions and destruction of older housing units.

My current estimate is total completions (single family, multi-family, manufactured homes) will increase in 2023 to around 1.535 million, up from 1.503 million in 2022. However, the mix will change significantly from 2022 with fewer single-family completions and fewer manufactured homes, and more multi-family completions.

Monday, October 23, 2023

Tuesday: Richmond Fed Mfg

by Calculated Risk on 10/23/2023 08:16:00 PM

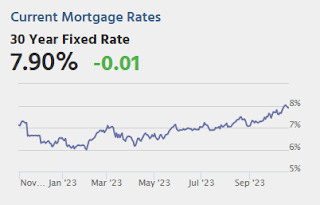

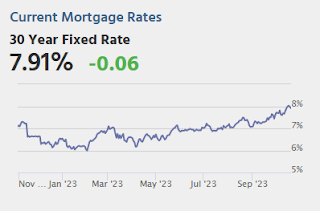

In terms of MND's index, we started at 8.01 this morning versus 7.97 on Friday afternoon. The intraday gains ultimately paved the way for a drop to 7.91.Tuesday:

As always, keep in mind that this is an index value that represents an a effective top tier rate for the most ideal 30yr fixed scenario. It means that plenty of loans are being done at rates in the 8%+ range and many continue to be quoted in the mid-to-high 7s. Loans in the 7% range tend to have discount points or buydowns. [30 year fixed 7.91%]

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for October.

LA Port Traffic Increases in September

by Calculated Risk on 10/23/2023 04:01:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.5% in September compared to the rolling 12 months ending in July. Outbound traffic increased 1.2% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Final Look at Local Housing Markets in September

by Calculated Risk on 10/23/2023 11:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in September

A brief excerpt:

Each month I track closed sales, new listings and active inventory in a sample of local markets around the country (over 40 local housing markets) in the US to get an early sense of changes in the housing market. In addition, we can look for regional differences.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m adding more markets). This is the final look at local markets in September.

The big story for September was that existing home sales hit a new cycle low. Also new listings were down YoY, but less than over the Summer.

This table shows the YoY change in new listings since the start of 2023. The smaller decline is due to a combination of new listings collapsing in the 2nd half of 2022, and new listings holding up more than normal seasonally (but still historically very low).

...

More local data coming in November for activity in October!

Black Knight: Mortgage Delinquency Rate Increased in September

by Calculated Risk on 10/23/2023 09:42:00 AM

From ICE / Black Knight: ICE First Look at Monthly Mortgage Performance: Delinquencies Rose in September While Foreclosure Activity Remained Muted

• The national delinquency rate rose to 3.29% in September, up 12 basis points (BPS) from August and +13BPS year over year, marking only the second – and largest – annual increase in the past 2.5 yearsAccording to Black Knight's First Look report, the percent of loans delinquent increased 3.7% in September compared to August and increased 4.3% year-over-year.

• Despite the rise, the delinquency rate is still 71BPS below the level of pre-pandemic September 2019

• Loans 30 days past due rose by 48.8K (+5.1%) – marking the fourth consecutive monthly rise – while the 60-day delinquent population extended its own streak of increases (+8.7K; +3.0%) to six months

• At the national level, serious delinquencies (90+ days past due) rose by 7K to 455K, but remain 6.7% below September 2019 levels

• While overall delinquencies have risen, the number of loans in active foreclosure fell to 214K in September, its lowest point since March 2022 and some 25% below 2019 pre-pandemic levels

• Foreclosure starts also declined, falling by -20.4% in the month to 25.4K, with completed sales down 8% from the month prior

• Prepay activity (measured as single-month mortality) dropped to 0.45% under continued pressure from seasonal homebuying patterns confounded by interest rates north of 7%, and is down -26% year over year

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.29% in August, up from 3.17% the previous month.

The percent of loans in the foreclosure process decreased in September to 0.40%, from 0.41% the previous month.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| September 2023 | August 2023 | |||

| Delinquent | 3.29% | 3.17% | ||

| In Foreclosure | 0.40% | 0.41% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,749,000 | 1,684,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 214,000 | 215,000 | ||

| Total Properties | 1,963,000 | 1,899,000 | ||

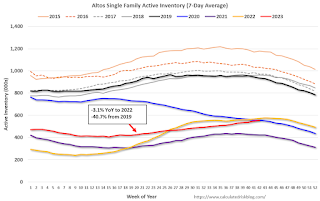

Housing October 23rd Weekly Update: Inventory increased 1.4% Week-over-week; Down 3.1% Year-over-year

by Calculated Risk on 10/23/2023 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, October 22, 2023

Sunday Night Futures

by Calculated Risk on 10/22/2023 06:14:00 PM

Weekend:

• Schedule for Week of October 22, 2023

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $88.08 per barrel and Brent at $92.16 per barrel. A year ago, WTI was at $85, and Brent was at $92 - so WTI oil prices were up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.51 per gallon. A year ago, prices were at $3.78 per gallon, so gasoline prices are down $0.27 year-over-year.

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 10/22/2023 08:21:00 AM

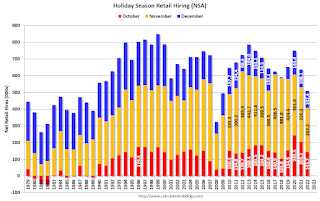

Every year I track seasonal retail hiring for hints about holiday retail sales. At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

Here is a graph of retail hiring for previous years based on the BLS employment report:

This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired 509 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 144 thousand seasonal workers last October.

Note that in the early '90s, retailers started hiring seasonal workers earlier - and the trend towards hiring earlier has continued.

The following scatter graph is for the years 2005 through 2022 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

NOTE: The dot in the upper right - with real Retail sales up over 10% YoY is for 2020 - when retail sales soared due to the pandemic spending on goods (service spending was soft).