by Calculated Risk on 10/26/2023 05:33:00 PM

Thursday, October 26, 2023

Realtor.com Reports Weekly Active Inventory Down 2.0% YoY; New Listings Down 1.0% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Jiayi Xu: Weekly Housing Trends View — Data Week Ending Oct 21, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 2.0%. For 18 straight weeks, the number of homes available for sale has registered below that of the previous year. ... The number of for-sale homes registered 45.1% below typical pre-pandemic levels in September.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 1.0% from one year ago. Since mid-2022, new listings have registered lower than prior year levels, as the mortgage-rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Although the year over year declines are smaller now than the double-digit pace seen earlier in 2023, declines from the pre-pandemic period are still substantial.

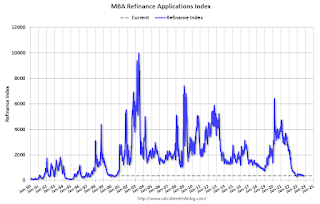

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 2.0% year-over-year - this was the eighteenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

CoreLogic: "US Serious Mortgage Delinquency Rate Drops to All-Time Low in August"

by Calculated Risk on 10/26/2023 02:19:00 PM

From CoreLogic: US Serious Mortgage Delinquency Rate Drops to All-Time Low in August

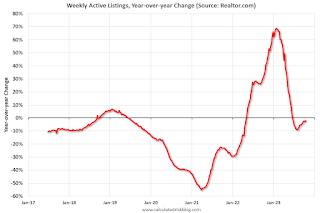

• The share of U.S. borrowers who were in serious mortgage delinquency (90 days or more late on payments) dropped to 0.9% in August, the lowest recorded since January 1999.

• The overall national mortgage delinquency rate (30 days or more late) was at 2.6% in August, also a historic low.

• The U.S. foreclosure rate held steady at 0.3% in August, unchanged since early 2022.

• Only Idaho and Utah saw slight annual upticks in overall mortgage delinquency growth in August, both up by 0.1 percentage point.

• Fifty-one metro areas posted year-over-year mortgage delinquency rate increases in August.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In August 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:• Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in August 2022.

• Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in August 2022.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 0.9%, down from 1.2% in August 2022 and a high of 4.3% in August 2020.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from August 2022.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, unchanged from August 2022.

NAR: Pending Home Sales Increase 1.1% in September; Down 11% Year-over-year

by Calculated Risk on 10/26/2023 10:00:00 AM

From the NAR: Pending Home Sales Grew 1.1% in September

Pending home sales augmented 1.1% in September, according to the National Association of REALTORS®. The Northeast, Midwest and South posted monthly gains in transactions while the West experienced a loss. All four U.S. regions had year-over-year declines in transactions.This was above expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

"Despite the slight gain, pending contracts remain at historically low levels due to the highest mortgage rates in 20 years," said Lawrence Yun, NAR chief economist. "Furthermore, inventory remains tight, which hinders sales but keeps home prices elevated."

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – rose 1.1% to 72.6 in September. Year over year, pending transactions declined 11%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI increased 0.8% from last month to 63.1, a loss of 12.7% from September 2022. The Midwest index expanded 4.1% to 74.3 in September, down 9.2% from one year ago.

The South PHSI rose 0.7% to 87.1 in September, retreating 10.7% from the prior year. The West index declined 1.8% in September to 55.3, dropping 12.9% from September 2022.

emphasis added

BEA: Real GDP increased at 4.9% Annualized Rate in Q3

by Calculated Risk on 10/26/2023 08:37:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2023 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 4.9 percent in the third quarter of 2023, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.PCE increased at a 4.0% annual rate, and residential investment increased at a 3.9% rate. The advance Q3 GDP report, with 4.9% annualized increase, was above expectations.

The increase in real GDP reflected increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, and residential fixed investment that were partly offset by a decrease in nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors were housing and utilities, health care, financial services and insurance, and food services and accommodations. Within goods, the leading contributors to the increase were other nondurable goods (led by prescription drugs) as well as recreational goods and vehicles. The increase in private inventory investment reflected increases in manufacturing and retail trade. Within nonresidential fixed investment, a decrease in equipment was partly offset by increases in intellectual property products and structures.

Compared to the second quarter, the acceleration in real GDP in the third quarter reflected accelerations in consumer spending, private inventory investment, and federal government spending and upturns in exports and residential fixed investment. These movements were partly offset by a downturn in nonresidential fixed investment and a deceleration in state and local government spending. Imports turned up.

emphasis added

Weekly Initial Unemployment Claims Increase to 210,000

by Calculated Risk on 10/26/2023 08:30:00 AM

The DOL reported:

In the week ending October 21, the advance figure for seasonally adjusted initial claims was 210,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 198,000 to 200,000. The 4-week moving average was 207,500, an increase of 1,250 from the previous week's revised average. The previous week's average was revised up by 500 from 205,750 to 206,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 207,500.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, October 25, 2023

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 10/25/2023 07:45:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, up from 198 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 3rd quarter 2022 (advance estimate). The consensus is that real GDP increased 4.1% annualized in Q3, up from 2.1% in Q2.

• Also at 8:30 AM, Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for October.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 1.0% increase in the index.

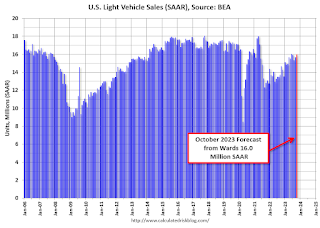

October Vehicle Sales Forecast: 16.0 million SAAR, Up 9% YoY

by Calculated Risk on 10/25/2023 02:41:00 PM

From WardsAuto: October U.S. Light-Vehicle Sales Looking Good Despite Strike-Related Inventory Losses (pay content). Brief excerpt:

Sales are showing surprising strength in October despite the inventory hits taken at Ford, GM and Stellantis from strike-related plant shutdowns. Still, industry inventory at the end of the month will be lower by an estimated 5% because of the shutdowns, and November deliveries will be negatively impacted, too, as the rest of the industry will not be in a strong position to make up the to-date losses at the Detroit 3.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 16.0 million SAAR, would be up 2% from last month, and up 9% from a year ago.

New Home Sales increase to 759,000 Annual Rate in September; Median New Home Price is Down 16% from the Peak

by Calculated Risk on 10/25/2023 10:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales increase to 759,000 Annual Rate in September

Brief excerpt:

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 759 thousand. The previous three months were revised down slightly, combined.You can subscribe at https://calculatedrisk.substack.com/.

...

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in September 2023 were up 33.9% from September 2022. Year-to-date sales are up 4.5% compared to the same period in 2022.

As expected, new home sales were up year-over-year in September, and it is fairly certain there will be more sales in 2023 than in 2022 - although mortgage rates close to 8% will likely slow sales.

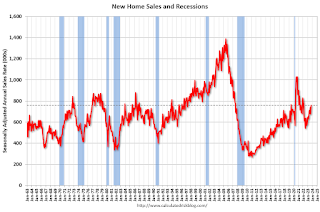

New Home Sales increase to 759,000 Annual Rate in September

by Calculated Risk on 10/25/2023 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 759 thousand.

The previous three months were revised down slightly, combined.

Sales of new single‐family houses in September 2023 were at a seasonally adjusted annual rate of 759,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.3 percent above the revised August rate of 676,000 and is 33.9 percent above the September 2022 estimate of 567,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are above pre-pandemic levels.

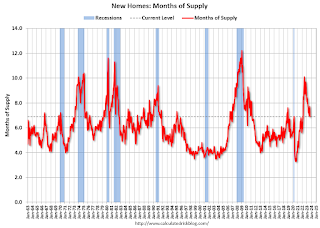

The second graph shows New Home Months of Supply.

The months of supply decreased in September to 6.9 months from 7.7 months in August.

The months of supply decreased in September to 6.9 months from 7.7 months in August. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of September was 435,000. This represents a supply of 6.9 months at the current sales rate."Sales were well above expectations of 679 thousand SAAR, and sales for the three previous months were only revised down slightly, combined. I'll have more later today.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 10/25/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

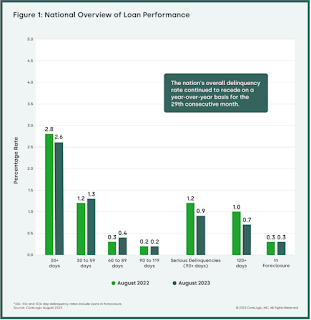

Mortgage applications decreased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 20, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 8 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 22 percent lower than the same week one year ago.

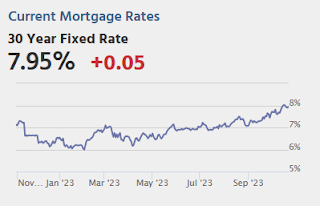

“Ten-year Treasury yields climbed higher last week, as global investors remained concerned about the prospect for higher-for-longer rates and burgeoning fiscal deficits. Mortgage rates followed Treasuries higher, with the 30-year fixed mortgage rate jumping 20 basis points to 7.9 percent – the highest since 2000. Rates have now risen seven consecutive weeks at a cumulative amount of 69 basis points,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Mortgage activity continued to stall, with applications dipping to the slowest weekly pace since 1995. These higher mortgage rates are keeping prospective homebuyers out of the market and continue to suppress refinance activity. The ARM share of applications inched up to 9.5 percent, its highest since November 2022.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.90 percent from 7.70 percent, with points increasing to 0.77 from 0.71 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 22% year-over-year unadjusted.