by Calculated Risk on 10/31/2023 10:18:00 AM

Tuesday, October 31, 2023

Comments on August Case-Shiller and FHFA House Prices

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 2.6% year-over-year in August; New all-time High

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices). August closing prices include some contracts signed in April, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.9%. This was the seventh consecutive MoM increase following seven straight MoM decreases.

On a seasonally adjusted basis, prices increased in 19 of the 20 Case-Shiller cities on a month-to-month basis (Cleveland saw prices decline MoM). Seasonally adjusted, San Francisco has fallen 9.5% from the recent peak, Seattle is down 7.3% from the peak, Las Vegas is down 6.5%, and Phoenix is down 6.1%.

Case-Shiller: National House Price Index Up 2.6% year-over-year in August; New all-time High

by Calculated Risk on 10/31/2023 09:30:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in August

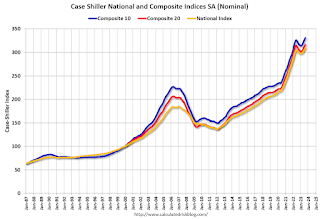

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.0% in August (SA) and is at a new all-time high.

The Composite 20 index is up 1.0% (SA) in August and is also at a new all-time high.

The National index is up 0.9% (SA) in August and is also at a new all-time high.

The Composite 10 SA is up 3.0% year-over-year. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 2.6% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, October 30, 2023

Tuesday: Case-Shiller House Prices, Chicago PMI, Housing Vacancies and Homeownership

by Calculated Risk on 10/30/2023 07:51:00 PM

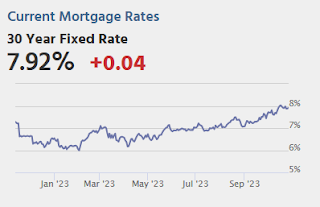

Mortgage rates barely budged today. The average lender was just a hair higher compared to Friday's top tier conventional 30yr fixed rate offerings.Tuesday:

...

The biggest risk (or opportunity) involves a cohesive message across multiple economic reports and events. In other words, if the economic data on Tue-Fri sends the same message as the Fed announcement on Wednesday, and if a handful of other relevant events argue the same case, rates could move significantly higher or lower by Friday afternoon. [30 year fixed 7.92%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 0.1% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 44.8, up from 44.1 in September.

• At 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

Goldman: 2024 Inflation Outlook

by Calculated Risk on 10/30/2023 01:34:00 PM

A few excerpts from a note by Goldman Sachs economists Spencer Hill and Manuel Abecasis: 2024 Inflation Outlook: Approaching the Target

"We are lowering our December 2024 core CPI forecast by two tenths to 2.7% year-on-year, and we continue to expect a significant decline in core PCE inflation from 3.7% currently to 2.4% in December 2024. We expect the backdrop of falling but above-target inflation to validate the Fed’s decision to hold the fed funds rate at its current level until 2024Q4."Currently the FOMC is projecting core PCE inflation to decline to 2.5% to 2.8% year-over-year (YoY) in Q4 2024. The Goldman Sachs projection is 2.4% by December 2024. Two of the key reasons that YoY inflation will likely continue to decline is wage growth has slowed (and appears likely to continue to slow), and shelter inflation will decline sharply in 2024.

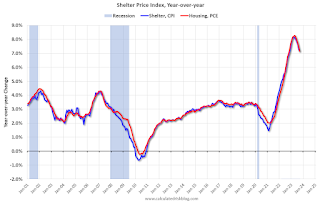

And here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report through September 2023.

CPI Shelter was up 7.1% year-over-year in September, down from 7.2% in August, and down from the cycle peak of 8.2% in March 2023.

CPI Shelter was up 7.1% year-over-year in September, down from 7.2% in August, and down from the cycle peak of 8.2% in March 2023.Since asking rents are slightly negative year-over-year, these measures will continue to slow over coming months.

Note that core CPI ex-shelter was up 1.9% YoY in September, down from 2.3% in August. And over the last 4 months, core CPI ex-shelter has increased at a 0.8% annual rate.

Housing October 30th Weekly Update: Inventory increased 1.5% Week-over-week; Down 2.7% Year-over-year

by Calculated Risk on 10/30/2023 08:17:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, October 29, 2023

Sunday Night Futures

by Calculated Risk on 10/29/2023 07:30:00 PM

Weekend:

• Schedule for Week of October 29, 2023

• FOMC Preview: No Change to Policy Expected

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 10 and DOW futures are up 30 (fair value).

Oil prices were down over the last week with WTI futures at $84.46 per barrel and Brent at $89.39 per barrel. A year ago, WTI was at $88, and Brent was at $95 - so WTI oil prices were down 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.44 per gallon. A year ago, prices were at $3.72 per gallon, so gasoline prices are down $0.28 year-over-year.

Hotels: Occupancy Rate Decreased 0.8% Year-over-year

by Calculated Risk on 10/29/2023 12:17:00 PM

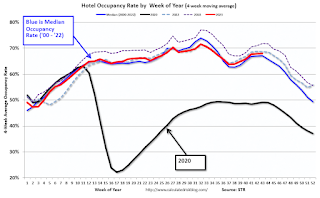

U.S. hotel performance increased from the previous week and showed improved year-over-year comparisons, according to CoStar’s latest data through 21 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

15-21 October 2023 (percentage change from comparable week in 2022):

• Occupancy: 69.0% (-0.8%)

• Average daily rate (ADR): US$165.32 (+3.8%)

• Revenue per available room (RevPAR): US$114.04 (+2.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

FOMC Preview: No Change to Policy Expected

by Calculated Risk on 10/29/2023 08:21:00 AM

Most analysts expect there will be no change to FOMC policy at this meeting, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent.

"We still do not expect a hike in November, as the Fed is clearly worried about the extent of financial tightening. But today’s robust spending and inflation data keep a December hike on the table, as they are a reminder that the war on inflation has not yet been won."And from Goldman Sachs economists:

emphasis added

"Fed officials appear to have signaled that they will not be hiking at their November meeting next week, and we interpret their recent comments to imply that most would prefer not to hike again, consistent with our forecast. ... the story of the year so far has been that economic reacceleration has not prevented further labor market rebalancing and progress in the inflation fight. We expect this to continue in coming months, with core PCE on track to undershoot the FOMC’s year-end projections."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.8% in September. The FOMC's unemployment rate projection for Q4 is probably close.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of September 2023, PCE inflation increased 3.4 percent year-over-year (YoY), unchanged from 3.4 percent YoY in August, and down from the recent peak of 7.1 percent in June 2022. It appears YoY PCE inflation will be close to the FOMC projection for Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 3.7 percent YoY, down from 3.8 percent in August, and down from the recent peak of 5.6 percent in February 2022. This remains a concern for the FOMC, however this includes shelter that was up 7.2% YoY in September (even though asking rents are mostly unchanged YoY). Also, core PCE inflation was fairly high in Q4 2022, and it seems likely YoY core PCE inflation will be at or below the low end of the FOMC Q4 projection.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

Saturday, October 28, 2023

Real Estate Newsletter Articles this Week: New Home Sales increase to 759,000 Annual Rate in September

by Calculated Risk on 10/28/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales increase to 759,000 Annual Rate in September

• Total Housing Completions Will Likely Increase Slightly in 2023; The Mix will Change

• Final Look at Local Housing Markets in September

• Fannie and Freddie: Single-Family Mortgage Delinquency Rate Mostly Unchanged in September

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 29, 2023

by Calculated Risk on 10/28/2023 08:11:00 AM

Boo!

The key report this week is the October employment report on Friday.

Other key indicators include the Case-Shiller house prices for August, October ISM manufacturing and services indexes, and October vehicle sales.

The FOMC meets this week and no change to policy is expected.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 0.1% year-over-year.

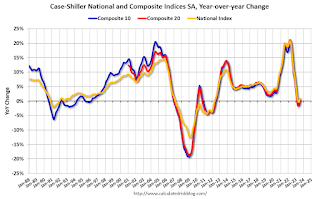

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 0.1% year-over-year.This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 44.8, up from 44.1 in September.

10:00 AM: The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 135,000 jobs added, up from 89,000 in September.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 9.61 million from 8.92 million in July.

The number of job openings (black) were down 6% year-over-year. Quits were down 14% year-over-year.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.0, unchanged from 49.0.

10:00 AM: Construction Spending for September. The consensus is for 0.4% increase in spending.

2:00 PM: FOMC Meeting Announcement. No change to FOMC policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

All day: Light vehicle sales for October.

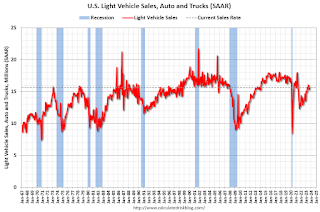

All day: Light vehicle sales for October.The consensus is for sales of 15.1 million SAAR, down from 15.7 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand last week.

8:30 AM: Employment Report for October. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

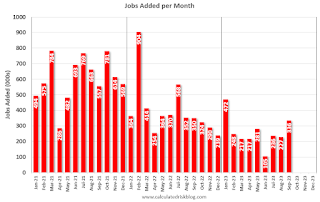

8:30 AM: Employment Report for October. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.There were 336,000 jobs added in September, and the unemployment rate was at 3.8%.

This graph shows the jobs added per month since January 2021.

10:00 AM: the ISM Services Index for October. The consensus is for a decrease to 53.0 from 53.6.