by Calculated Risk on 11/02/2023 08:30:00 AM

Thursday, November 02, 2023

Weekly Initial Unemployment Claims Increase to 217,000

The DOL reported:

In the week ending October 28, the advance figure for seasonally adjusted initial claims was 217,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 210,000 to 212,000. The 4-week moving average was 210,000, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 207,500 to 208,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 210,000.

The previous week was revised up.

Weekly claims were sligthly higher than the consensus forecast.

Wednesday, November 01, 2023

Thursday: Unemployment Claims

by Calculated Risk on 11/01/2023 08:56:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 210 thousand last week.

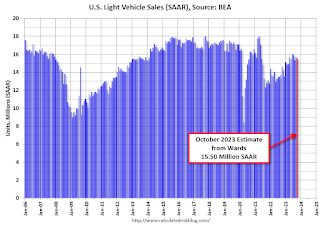

Vehicles Sales decrease to 15.5 million SAAR in October; Up 6% YoY

by Calculated Risk on 11/01/2023 05:11:00 PM

Wards Auto released their estimate of light vehicle sales for October: October U.S. Light-Vehicle Sales Miss Expectations but Still Record 6% Increase (pay site).

October’s results were below expectations, apparently due to weakness at the end of the month. Most automakers finished below mid-month projections for each, thus the industry’s overall weaker results can’t be blamed on underestimating the impacts to Ford, GM and Stellantis from the strike-related plant shutdowns. The results also show that other automakers did not benefit from losses at the Detroit 3. Still, most manufacturers recorded year-over-year gains and the industry posted its 14th straight increase.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for September (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in October were below Ward's forecast, but above the consensus forecast.

FOMC Statement: No Change to Rates

by Calculated Risk on 11/01/2023 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity expanded at a strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

emphasis added

Inflation Adjusted House Prices 3.1% Below Peak; Price-to-rent index is 7.0% below recent peak

by Calculated Risk on 11/01/2023 12:19:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.1% Below Peak; Price-to-rent index is 7.0% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the August Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 68% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 9% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be $362,000 today adjusted for inflation (81% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

Construction Spending Increased 0.4% in September

by Calculated Risk on 11/01/2023 10:23:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during September 2023 was estimated at a seasonally adjusted annual rate of $1,996.5 billion, 0.4 percent above the revised August estimate of $1,988.3 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,555.9 billion, 0.4 percent above the revised August estimate of $1,549.6 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $440.6 billion, 0.4 percent above the revised August estimate of $438.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 10.1% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is also at a new peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 2.2%. Non-residential spending is up 21.3% year-over-year. Public spending is up 15.5% year-over-year.

ISM® Manufacturing index Decreased to 46.7% in October

by Calculated Risk on 11/01/2023 10:12:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.7% in October, down from 49.0% in September. The employment index was at 46.8%, down from 51.2% the previous month, and the new orders index was at 45.5%, down from 49.2%.

From ISM: Manufacturing PMI® at 46.7%

October 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in October for the 12th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in October. This was below the consensus forecast. Note that the price index was at 45.1% (falling prices).

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 46.7 percent in October, 2.3 percentage points lower than the 49 percent recorded in September. The overall economy dropped back into contraction after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 45.5 percent, 3.7 percentage points lower than the figure of 49.2 percent recorded in September. The Production Index reading of 50.4 percent is a 2.1-percentage point decrease compared to September’s figure of 52.5 percent. The Prices Index registered 45.1 percent, up 1.3 percentage points compared to the reading of 43.8 percent in September. The Backlog of Orders Index registered 42.2 percent, 0.2 percentage point lower than the September reading of 42.4 percent. The Employment Index registered 46.8 percent, down 4.4 percentage points from the 51.2 percent reported in September.

emphasis added

BLS: Job Openings "Little Changed" at 9.6 million in September

by Calculated Risk on 11/01/2023 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings changed little at 9.6 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 5.9 million and 5.5 million, respectively. Within separations, quits (3.7 million) and layoffs and discharges (1.5 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September; the employment report this Friday will be for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in September to 9.55 million from 9.50 million in August.

The number of job openings (black) were down 12% year-over-year.

Quits were down 10% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

ADP: Private Employment Increased 113,000 in October

by Calculated Risk on 11/01/2023 08:15:00 AM

Private sector employment increased by 113,000 jobs in October and annual pay was up 5.7 percent year-over-year, according to the October ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.This was below the consensus forecast of 135,000. The BLS report will be released Friday, and the consensus is for 168 thousand non-farm payroll jobs added in October.

...

“No single industry dominated hiring this month, and big post-pandemic pay increases seem to be behind us,” said Nela Richardson, chief economist, ADP. “In all, October's numbers paint a well-rounded jobs picture. And while the labor market has slowed, it's still enough to support strong consumer spending.”

emphasis added

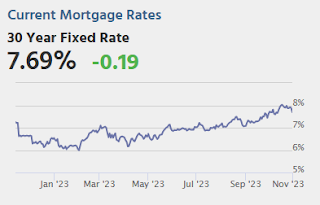

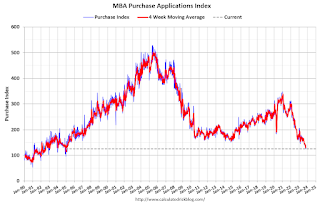

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 11/01/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 27, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 12 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 22 percent lower than the same week one year ago.

“Mortgage applications declined for the third straight week as mortgage rates remained elevated, with all rates around 30 basis points higher than they were a month ago. The 30-year fixed rate dipped slightly to 7.86 percent but remained close to 23-year highs and has been above the 7-percent level since early August 2023,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The impact of higher rates continued to be felt across both purchase and refinance markets. Purchase applications decreased to their lowest level since 1995 and refinance applications to the lowest level since January 2023. Applications for government loans saw much larger weekly declines than conventional, with government purchase applications down 3 percent and refinances down 9 percent."

Added Kan, "As higher rates continue to impact affordability and purchasing power, ARM loans increased almost 10 percent last week and continued to gain share, growing to 10.7 percent of all applications.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 7.86 percent from 7.90 percent, with points decreasing to 0.73 from 0.77 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 22% year-over-year unadjusted.