by Calculated Risk on 11/03/2023 07:53:00 PM

Friday, November 03, 2023

Nov 3rd COVID Update: Deaths and Hospitalizations Decreased

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 12,953 | 13,264 | ≤3,0001 | |

| Deaths per Week2 | 1,143 | 1,262 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

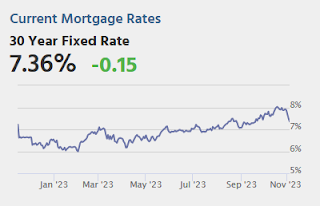

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

AAR: October Rail Combined Carloads and Intermodal Highest Since June 2021

by Calculated Risk on 11/03/2023 04:54:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

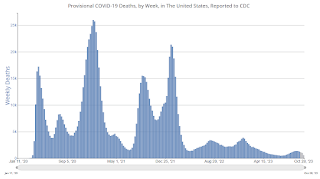

Combined originated carloads and intermodal units on U.S. railroads averaged 499,331 per week in October 2023, the most for any month since June 2021 — a span of 28 months. Part of the increase relates to intermodal seasonality and concerns over Panama Canal capacity, but part also reflects an economy that remains resilient.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

Total originated carloads on U.S. railroads (not including the U.S. operations of Canadian and Mexican railroads) were down 0.3% (2,921 carloads) in October 2023 from October 2022, their fourth decline in the past five months. Total carloads averaged 230,398 per week in October 2023. That’s down fractionally from 230,429 in September 2023 but otherwise is the highest in a year.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):It’s too soon to say intermodal is back, but October’s numbers are encouraging. U.S. railroads averaged 268,933 intermodal originations per week in October 2023, up 2.2% over October 2022. That’s the second straight year-over-year gain (September was 0.7%) following 18 straight declines. It’s also the biggest weekly average for intermodal since May 2022.

Lawler: Single-Family Rent Results

by Calculated Risk on 11/03/2023 02:52:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Single-Family Rent Results

A brief excerpt:

[H]ere are the latest rent trends just reported from two of the largest publicly traded firms in the single-family rental industry: Invitation Homes, and AMH (American Homes 4 Rent). The rent trends are for “same store/same properties.”There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that while rental growth rates have clearly decelerated at both firms since 2022, the slowdown in rent growth has been nowhere near as large as that in the rent indexes shown above.

Heavy Truck Sales Decline in October, Unchanged YoY

by Calculated Risk on 11/03/2023 12:39:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

As I noted earlier this week, Vehicles Sales decrease to 15.5 million SAAR in October; Up 6% YoY

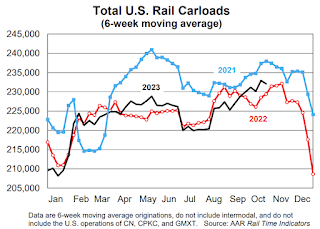

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.50 million SAAR in October, down from 15.68 million in September, and up 6% from 14.68 million in October 2022.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.50 million SAAR in October, down from 15.68 million in September, and up 6% from 14.68 million in October 2022.Comments on October Employment Report

by Calculated Risk on 11/03/2023 09:21:00 AM

The headline jobs number in the October employment report was below expectations, and employment for the previous two months was revised down by 101,000, combined. The participation rate and the employment population ratio both decreased, and the unemployment rate increased to 3.9%.

In October, the year-over-year employment change was 2.97 million jobs.

Seasonal Retail Hiring

Typically, retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. Note: I expect the long-term trend will be down with more and more internet holiday shopping.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. Note: I expect the long-term trend will be down with more and more internet holiday shopping.Retailers hired 148 thousand workers Not Seasonally Adjusted (NSA) net in October. This was about the same as last year and suggests similar real retail sales this holiday season as last year.

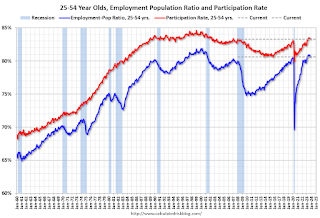

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate decreased in October to 83.3% from 83.5% in September, and the 25 to 54 employment population ratio declined to 80.6% from 80.8% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.1% YoY in October.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.3 million, changed little in October. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in October to 4.28 million from 4.07 million in September. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.2% from 7.0% in the previous month. This is down from the record high in April 22.9% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.282 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.216 million the previous month.

This is above the pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20231 | 34 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was below consensus expectations and employment for the previous two months was revised down by 101,000, combined. The participation rate and the employment population ratio both decreased, and the unemployment rate increased to 3.9%.

October Employment Report: 150 thousand Jobs, 3.9% Unemployment Rate

by Calculated Risk on 11/03/2023 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 150,000 in October, and the unemployment rate changed little at 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and social assistance. Employment declined in manufacturing due to strike activity.

...

The change in total nonfarm payroll employment for August was revised down by 62,000, from +227,000 to +165,000, and the change for September was revised down by 39,000, from +336,000 to +297,000. With these revisions, employment in August and September combined is 101,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for August and September were revised down 101 thousand, combined.

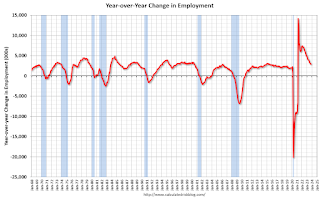

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.97 million jobs. Employment was up solidly year-over-year but has slowed to more normal levels of job growth recently.

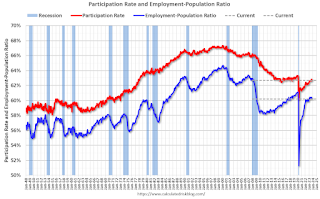

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was decreased to 62.7% in October, from 62.8% in September. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was decreased to 62.7% in October, from 62.8% in September. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.2% from 60.4% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased to 3.9% in October from 3.8% in September.

This was below consensus expectations, and August and September payrolls were revised down by 101,000 combined.

Thursday, November 02, 2023

Friday: Employment Report

by Calculated Risk on 11/02/2023 08:04:00 PM

Thursday:

• At 8:30 AM ET, Employment Report for October. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

• At 10:00 AM, the ISM Services Index for October. The consensus is for a decrease to 53.0 from 53.6.

October Employment Preview

by Calculated Risk on 11/02/2023 03:56:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for 168,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

From BofA economists:

"For the October employment report, we forecast nonfarm payroll job growth will slow from 336k in September to 230k ... Given our expectation for the participation rate to hold at 62.8% and for job growth to be strong, we expect the unemployment rate will fall to 3.7% from 3.8%."From Goldman Sachs:

"We estimate nonfarm payrolls rose by 195k in October ... tight labor markets may have incentivized a pull-forward of pre-holiday hiring, for example in the retail sector. ... We estimate that the unemployment rate declined to 3.7% ... Our forecast reflects a solid rise in household employment—striking workers are counted as employed in the household survey—and unchanged labor force participation at 62.8%."• ADP Report: The ADP employment report showed 113,000 private sector jobs were added in October. This suggests job gains below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM surveys are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in October to 46.8%, down from 51.2% the previous month. This would suggest about 35,000 jobs lost in manufacturing. The ADP report indicated 3,000 manufacturing jobs gained in October.

The ISM® services employment index will be released tomorrow.

• Unemployment Claims: The weekly claims report showed about the same number of initial unemployment claims during the reference week (includes the 12th of the month) from 202,000 in September to 200,000 in October. This suggests about the same number of layoffs in October as in September.

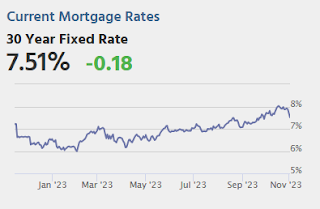

Realtor.com Reports Weekly New Listings UP 5.6% YoY; Active Inventory Down 1.0% YoY

by Calculated Risk on 11/02/2023 01:40:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Oct 28, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 1.0%.

For 19 straight weeks, the number of homes available for sale has registered below that of the previous year.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 5.6% from one year ago.

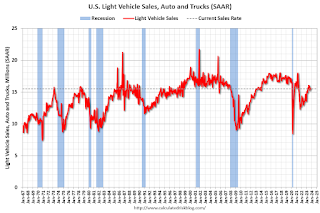

Since mid-2022, new listings have registered lower than prior year levels, as the mortgage rate lock-in effect freezes homeowners with low-rate existing mortgages in place. This past week, the trend abruptly reversed as new listings during the week outpaced the same week in the previous year by 5.6%. While growth in new listings is a needed step for the market to return to normal, this growth rate reflects a rapid decline last year compared to a more stable newly listed homes pace this year, as we are lapping a period of time last year when new listing activity was unseasonably low due to the said mortgage rate lock-in effect.

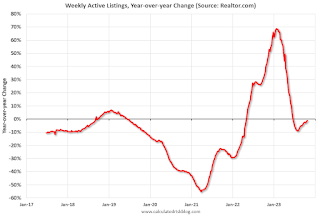

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 1.0% year-over-year - this was the 19th consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Asking Rents Down 1.2% Year-over-year

by Calculated Risk on 11/02/2023 11:03:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.2% Year-over-year

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The surge in household formation has been confirmed (mostly due to work-from-home), and this led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now negative year-over-year).

Recent data suggests household formation has slowed sharply and asking rents are declining year-over-year. With a near record number of multi-family units under construction, slow household formation, rising vacancy rates, and soft rents, most builders expect to start fewer multi-family units in 2024.

Rick Palacios Jr., Director of Research at John Burns Research and Consulting noted yesterday:

Apartment developers and investors we just surveyed expect a big drop in starts over the next 12 months....

25% expect apartment starts to fall by 50%+, and 52% expect a drop of 20%+. Very, very few expect growth ahead.

With slow household formation, more supply coming on the market and a rising rental vacancy rate, rents will be under pressure all year and multi-family starts will decline in 2024. See: Forecast: Multifamily Starts will Decline Sharply