by Calculated Risk on 11/06/2023 10:14:00 AM

Monday, November 06, 2023

ICE (Black Knight) Mortgage Monitor: "It’s fair to expect prices to weaken later in 2023"

Today, in the Calculated Risk Real Estate Newsletter: ICE (Black Knight) Mortgage Monitor: "It’s fair to expect prices to weaken later in 2023"

A brief excerpt:

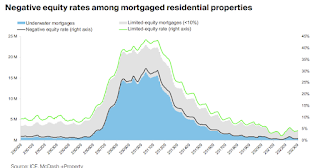

Some interesting data on negative equity and limited equity.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• As of September, 383K (0.7% of) mortgage holders were underwater on their homes – less than half the share prior to the pandemic and in the early 2000s before the Global Financial Crisis

• Likewise, the number of borrowers in limited-equity positions remains historically low, with 1.9M (4.2% of) mortgage holders having less than 10% equity in their homes

• Austin – where home prices remain more than 14% off 2022 peaks – is in the worst position of all markets, with 2.1% of mortgage holders underwater, followed by Las Vegas (1.7%) and Phoenix (1.6%)

• San Jose – despite its home-price struggles last year – and Los Angeles have the lowest negative equity rates at 0.1%

• Overall, the weighted-average combined loan-to-value ratio for all mortgaged homes in the U.S. is 45%, among the strongest we’ve seen, dating back more than 20 years, outside of Feb.-Aug. 2022 at the peak of home prices

emphasis added

Housing November 6th Weekly Update: Inventory Still Increasing, Up 0.8% Week-over-week

by Calculated Risk on 11/06/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, November 05, 2023

Monday: Senior Loan Officer Opinion Survey

by Calculated Risk on 11/05/2023 06:15:00 PM

Weekend:

• Schedule for Week of November 5, 2023

Monday:

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 5 and DOW futures are up 40 (fair value).

Oil prices were down over the last week with WTI futures at $80.51 per barrel and Brent at $84.89 per barrel. A year ago, WTI was at $93, and Brent was at $100 - so WTI oil prices were down 13% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.37 per gallon. A year ago, prices were at $3.79 per gallon, so gasoline prices are down $0.42 year-over-year.

Hotels: Occupancy Rate Increased 0.7% Year-over-year

by Calculated Risk on 11/05/2023 08:21:00 AM

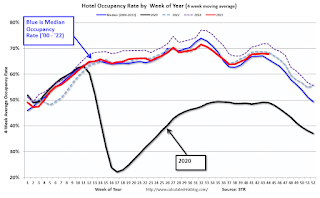

U.S. hotel performance decreased from the previous week but showed positive year-over-year comparisons, according to CoStar’s latest data through 28 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

22-28 October 2023 (percentage change from comparable week in 2022):

• Occupancy: 66.0% (+0.7%)

• Average daily rate (ADR): US$160.89 (+3.9%)

• Revenue per available room (RevPAR): US$106.16 (+4.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, November 04, 2023

Real Estate Newsletter Articles this Week: National House Price Index Up 2.6% year-over-year in August

by Calculated Risk on 11/04/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 2.6% year-over-year in August; New all-time High

• Inflation Adjusted House Prices 3.1% Below Peak

• Freddie Mac House Price Index Increased in September to New High; Up 5.2% Year-over-year

• Asking Rents Down 1.2% Year-over-year

• Lawler: Single-Family Rent Results Invitation Homes, and AMH (American Homes 4 Rent)

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of November 5, 2023

by Calculated Risk on 11/04/2023 08:11:00 AM

This will be a light week for economic data.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for October.

8:00 AM ET: Corelogic House Price index for September.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $60.3 billion in September, from $58.3 billion in August.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $60.3 billion in September, from $58.3 billion in August.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 217 thousand last week.

Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for November).

Friday, November 03, 2023

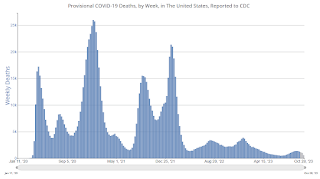

Nov 3rd COVID Update: Deaths and Hospitalizations Decreased

by Calculated Risk on 11/03/2023 07:53:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 12,953 | 13,264 | ≤3,0001 | |

| Deaths per Week2 | 1,143 | 1,262 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

AAR: October Rail Combined Carloads and Intermodal Highest Since June 2021

by Calculated Risk on 11/03/2023 04:54:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Combined originated carloads and intermodal units on U.S. railroads averaged 499,331 per week in October 2023, the most for any month since June 2021 — a span of 28 months. Part of the increase relates to intermodal seasonality and concerns over Panama Canal capacity, but part also reflects an economy that remains resilient.

emphasis added

Click on graph for larger image.

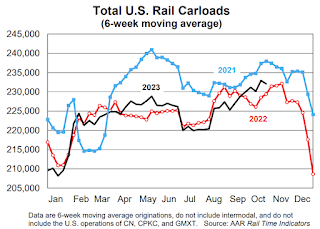

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

Total originated carloads on U.S. railroads (not including the U.S. operations of Canadian and Mexican railroads) were down 0.3% (2,921 carloads) in October 2023 from October 2022, their fourth decline in the past five months. Total carloads averaged 230,398 per week in October 2023. That’s down fractionally from 230,429 in September 2023 but otherwise is the highest in a year.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):It’s too soon to say intermodal is back, but October’s numbers are encouraging. U.S. railroads averaged 268,933 intermodal originations per week in October 2023, up 2.2% over October 2022. That’s the second straight year-over-year gain (September was 0.7%) following 18 straight declines. It’s also the biggest weekly average for intermodal since May 2022.

Lawler: Single-Family Rent Results

by Calculated Risk on 11/03/2023 02:52:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Single-Family Rent Results

A brief excerpt:

[H]ere are the latest rent trends just reported from two of the largest publicly traded firms in the single-family rental industry: Invitation Homes, and AMH (American Homes 4 Rent). The rent trends are for “same store/same properties.”There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that while rental growth rates have clearly decelerated at both firms since 2022, the slowdown in rent growth has been nowhere near as large as that in the rent indexes shown above.

Heavy Truck Sales Decline in October, Unchanged YoY

by Calculated Risk on 11/03/2023 12:39:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

As I noted earlier this week, Vehicles Sales decrease to 15.5 million SAAR in October; Up 6% YoY

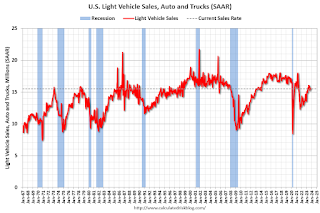

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.50 million SAAR in October, down from 15.68 million in September, and up 6% from 14.68 million in October 2022.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.50 million SAAR in October, down from 15.68 million in September, and up 6% from 14.68 million in October 2022.