by Calculated Risk on 11/07/2023 11:55:00 AM

Tuesday, November 07, 2023

1st Look at Local Housing Markets in October; Early Reporting Markets suggest some month-to-month increase in Sales in October, SAAR

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in October

A brief excerpt:

This is the first look at several early reporting local markets in October. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in October were mostly for contracts signed in August and September. Since 30-year fixed mortgage rates were in the 7.1% in August and 7.2% in September, compared to the high-5% range the previous year, closed sales were down year-over-year in October.

...

Here is a summary of active listings for these early reporting housing markets in October.

Inventory surged in some of these markets last year, but that has changed.

For example, inventory in Denver was up 116% YoY in October 2022, and is now up only 3% YoY. And inventory in Las Vegas was up 150% YoY in October 2022, and is now down 44% YoY. That is a HUGE change.

Inventory for these markets were down 12.5% YoY in September and are now down 11.1% YoY.

...

This was just several early reporting markets. Many more local markets to come!

NY Fed Q3 Report: Household Debt Increased

by Calculated Risk on 11/07/2023 11:00:00 AM

From the NY Fed: Household Debt Rises to $17.29 Trillion Led by Mortgage, Credit Card, and Student Loan Balances

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. Credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, representing a 4.7% quarterly increase. Auto loan balances rose by $13 billion, consistent with the upward trajectory seen since 2011, and now stand at $1.6 trillion. Student loan balances increased by $30 billion and now stand at $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion.

Mortgage originations modestly declined to $386 billion in Q3 2023 and are well below the robust quarterly origination volumes observed between 2020 and 2021. The volume of newly originated auto loans, which includes leases, slightly increased and now stands at $179.3 billion. Aggregate limits on credit card accounts increased by $113 billion, a 2.46% increase from the previous quarter.

Aggregate delinquency rates increased in Q3 2023, with 3% of outstanding debt in some stage of delinquency at the end of September. Delinquency transition rates increased for most debt types except student loans and home equity lines of credit. The increases in credit card delinquency were the sharpest among borrowers between the ages of 30 and 39.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased in Q3. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $228 billion in the third quarter of 2023, a 1.3% rise from 2023Q2. Balances now stand at $17.29 trillion and have increased by $3.1 trillion since the end of 2019, just before the pandemic recession.

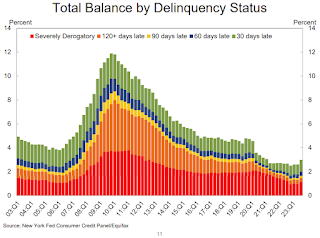

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q3. From the NY Fed:

Aggregate delinquency rates were increased in the third quarter of 2023. As of September, 3.0% of outstanding debt was in some stage of delinquency, up by 0.4 percentage points from the second quarter yet 1.7 percentage points lower than the fourth quarter of 2019.

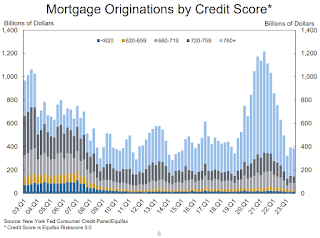

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, were at $386 billion in 2023Q3, a modest decline from the previous quarter and well below the trillion-dollar-plus quarterly origination volumes observed between 2020 and 2021 ... The median credit score for newly originated mortgages was flat at 770.There is much more in the report.

Wholesale Used Car Prices Decreased 2.3% in October; Down 4.0% Year-over-year

by Calculated Risk on 11/07/2023 10:48:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in October

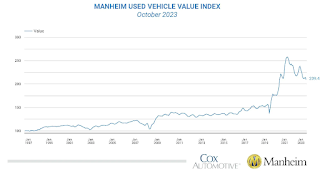

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.3% in October from September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 209.4, down 4.0% from a year ago.

“October revealed some not-so-spooky price moves, namely a reversal of the gains that were seen during the prior two months,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive. “This confirms the caution that was mentioned last month The UAW strike , avoiding one action that could have led to higher wholesale prices. October’s price decline is eerily similar to last October’s 2.2% drop, and this was not unexpected as the market remains balanced. Wholesale vehicle values typically experience some modest increases during the holiday season, and with two months remaining, we could see some upward price movements.”

The seasonal adjustment reduced the October decrease. The non-adjusted price in October declined by 3.1% compared to September, moving the unadjusted average price down 6.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit increased to $61.5 Billion in September

by Calculated Risk on 11/07/2023 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $61.5 billion in September, up $2.9 billion from $58.7 billion in August, revised.

September exports were $261.1 billion, $5.7 billion more than August exports. September imports were $322.7 billion, $8.6 billion more than August imports

emphasis added

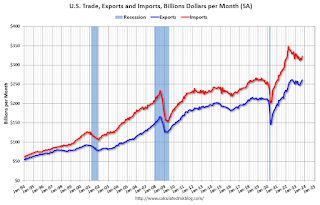

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in September.

Exports are up slightly year-over-year; imports are down 3% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - and both had been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive.

The trade deficit with China decreased to $28.3 billion from $37.4 billion a year ago.

Monday, November 06, 2023

Tuesday: Trade Deficit

by Calculated Risk on 11/06/2023 07:45:00 PM

In and of itself, today would rank among the handful of "worst days" of any given year in term of mortgage rate movement. In other words, comparing today's rates to Friday's shows a big jump relative to the average day. Specifically, most lenders are offering rates that are at least an eighth of a percent (.125%) higher versus Friday morning.Tuesday:

All that having been said, this is a prime opportunity to "put things in perspective." [30 year fixed 7.48%]

emphasis added

• At 8:00 AM ET, Corelogic House Price index for September.

• At 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $60.3 billion in September, from $58.3 billion in August.

• At 11:00 AM, NY Fed: Q3 Quarterly Report on Household Debt and Credit

Fed SLOOS Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

by Calculated Risk on 11/06/2023 02:00:00 PM

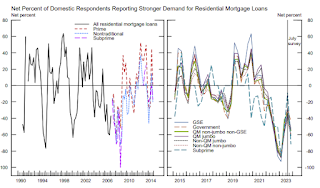

From the Federal Reserve: The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government residential mortgages, for which standards remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.

ICE (Black Knight) Mortgage Monitor: "It’s fair to expect prices to weaken later in 2023"

by Calculated Risk on 11/06/2023 10:14:00 AM

Today, in the Calculated Risk Real Estate Newsletter: ICE (Black Knight) Mortgage Monitor: "It’s fair to expect prices to weaken later in 2023"

A brief excerpt:

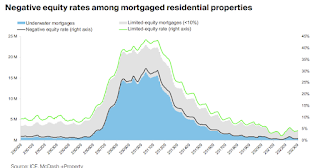

Some interesting data on negative equity and limited equity.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• As of September, 383K (0.7% of) mortgage holders were underwater on their homes – less than half the share prior to the pandemic and in the early 2000s before the Global Financial Crisis

• Likewise, the number of borrowers in limited-equity positions remains historically low, with 1.9M (4.2% of) mortgage holders having less than 10% equity in their homes

• Austin – where home prices remain more than 14% off 2022 peaks – is in the worst position of all markets, with 2.1% of mortgage holders underwater, followed by Las Vegas (1.7%) and Phoenix (1.6%)

• San Jose – despite its home-price struggles last year – and Los Angeles have the lowest negative equity rates at 0.1%

• Overall, the weighted-average combined loan-to-value ratio for all mortgaged homes in the U.S. is 45%, among the strongest we’ve seen, dating back more than 20 years, outside of Feb.-Aug. 2022 at the peak of home prices

emphasis added

Housing November 6th Weekly Update: Inventory Still Increasing, Up 0.8% Week-over-week

by Calculated Risk on 11/06/2023 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, November 05, 2023

Monday: Senior Loan Officer Opinion Survey

by Calculated Risk on 11/05/2023 06:15:00 PM

Weekend:

• Schedule for Week of November 5, 2023

Monday:

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 5 and DOW futures are up 40 (fair value).

Oil prices were down over the last week with WTI futures at $80.51 per barrel and Brent at $84.89 per barrel. A year ago, WTI was at $93, and Brent was at $100 - so WTI oil prices were down 13% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.37 per gallon. A year ago, prices were at $3.79 per gallon, so gasoline prices are down $0.42 year-over-year.

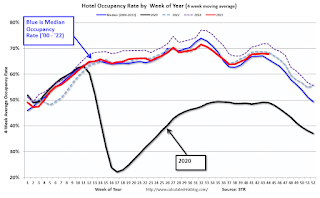

Hotels: Occupancy Rate Increased 0.7% Year-over-year

by Calculated Risk on 11/05/2023 08:21:00 AM

U.S. hotel performance decreased from the previous week but showed positive year-over-year comparisons, according to CoStar’s latest data through 28 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

22-28 October 2023 (percentage change from comparable week in 2022):

• Occupancy: 66.0% (+0.7%)

• Average daily rate (ADR): US$160.89 (+3.9%)

• Revenue per available room (RevPAR): US$106.16 (+4.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.