by Calculated Risk on 11/08/2023 09:42:00 AM

Wednesday, November 08, 2023

Housing: Inventory will Tell the Tale

Today, in the Calculated Risk Real Estate Newsletter: Inventory will Tell the Tale

A brief excerpt:

Two years ago, in November 2021, I wrote Inventory will Tell the Tale and recounted how changes in housing inventory had helped me forecast the housing market at several key points. Here is an update to that post with a few additional comments.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Starting in January 2005, I was very bearish on housing, but I wasn’t sure when the market would turn. Speculative bubbles can go on and on. However, the increase in inventory in late 2005 (see red arrow on graph below) helped me call the top for house prices in 2006.

Several years later, in early 2012, when many people were still bearish on housing, the plunge in inventory in 2011 (blue arrow on graph below) helped me call the bottom for house prices in early 2012 (see The Housing Bottom is Here).

...

With higher mortgage rates and increasing inventory, a key question right now is “Will prices decline over the winter?”. I’ll update some price projections soon.

But I believe one thing is certain: inventory will tell the tale!

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 11/08/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 3, 2023.

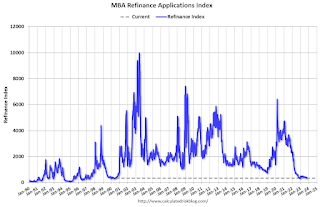

The Market Composite Index, a measure of mortgage loan application volume, increased 2.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 7 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 20 percent lower than the same week one year ago.

“The 30-year fixed mortgage rate dropped by 25 basis points to 7.61 percent, the largest single week decline since July 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Last week’s decrease in rates was driven by the U.S. Treasury’s issuance update, the Fed striking a dovish tone in the November FOMC statement, and data indicating a slower job market. Applications for both purchase and refinance loans were up over the week but remained at low levels. The purchase index is still more than 20 percent behind last year’s pace, as many homebuyers remain on the sidelines until more for-sale inventory becomes available.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 7.61 percent from 7.86 percent, with points decreasing to 0.69 from 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

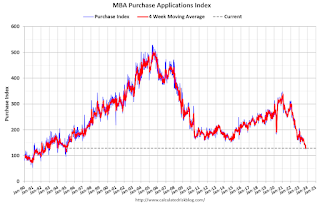

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 20% year-over-year unadjusted.

Tuesday, November 07, 2023

Wednesday: Mortgage Applications

by Calculated Risk on 11/07/2023 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Leading Index for Commercial Real Estate Increased in October, Down 8% YoY

by Calculated Risk on 11/07/2023 04:59:00 PM

From Dodge Data Analytics: Dodge Momentum Index Inches Up 1% in October

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 1% in October to 181.7 (2000=100) from the revised September reading of 180.3. Over the month, the commercial component of the DMI rose 2.0%, while the institutional component retreated 1.4%.

“Heightened momentum in warehouse planning activity supported the commercial side of the Index this month, while muted education planning activity slowed the institutional portion,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Overall levels of planning activity remain robust and will support construction spending over the next 12 to 18 months.”

Improvements in warehouse planning helped support commercial growth, but despite strong progress in September, education and healthcare activity slowed down this month. Year over year, the DMI was 8% lower than in October 2022. The commercial segment was down 14%, while the institutional segment was up 7%.

...

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 181.7 in October, up from 180.3 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown towards the end of 2023 and in 2024.

1st Look at Local Housing Markets in October; Early Reporting Markets suggest some month-to-month increase in Sales in October, SAAR

by Calculated Risk on 11/07/2023 11:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in October

A brief excerpt:

This is the first look at several early reporting local markets in October. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in October were mostly for contracts signed in August and September. Since 30-year fixed mortgage rates were in the 7.1% in August and 7.2% in September, compared to the high-5% range the previous year, closed sales were down year-over-year in October.

...

Here is a summary of active listings for these early reporting housing markets in October.

Inventory surged in some of these markets last year, but that has changed.

For example, inventory in Denver was up 116% YoY in October 2022, and is now up only 3% YoY. And inventory in Las Vegas was up 150% YoY in October 2022, and is now down 44% YoY. That is a HUGE change.

Inventory for these markets were down 12.5% YoY in September and are now down 11.1% YoY.

...

This was just several early reporting markets. Many more local markets to come!

NY Fed Q3 Report: Household Debt Increased

by Calculated Risk on 11/07/2023 11:00:00 AM

From the NY Fed: Household Debt Rises to $17.29 Trillion Led by Mortgage, Credit Card, and Student Loan Balances

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. Credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, representing a 4.7% quarterly increase. Auto loan balances rose by $13 billion, consistent with the upward trajectory seen since 2011, and now stand at $1.6 trillion. Student loan balances increased by $30 billion and now stand at $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion.

Mortgage originations modestly declined to $386 billion in Q3 2023 and are well below the robust quarterly origination volumes observed between 2020 and 2021. The volume of newly originated auto loans, which includes leases, slightly increased and now stands at $179.3 billion. Aggregate limits on credit card accounts increased by $113 billion, a 2.46% increase from the previous quarter.

Aggregate delinquency rates increased in Q3 2023, with 3% of outstanding debt in some stage of delinquency at the end of September. Delinquency transition rates increased for most debt types except student loans and home equity lines of credit. The increases in credit card delinquency were the sharpest among borrowers between the ages of 30 and 39.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased in Q3. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $228 billion in the third quarter of 2023, a 1.3% rise from 2023Q2. Balances now stand at $17.29 trillion and have increased by $3.1 trillion since the end of 2019, just before the pandemic recession.

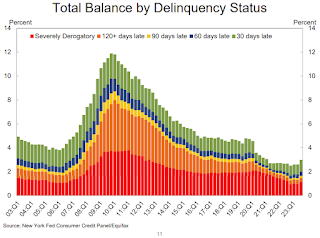

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q3. From the NY Fed:

Aggregate delinquency rates were increased in the third quarter of 2023. As of September, 3.0% of outstanding debt was in some stage of delinquency, up by 0.4 percentage points from the second quarter yet 1.7 percentage points lower than the fourth quarter of 2019.

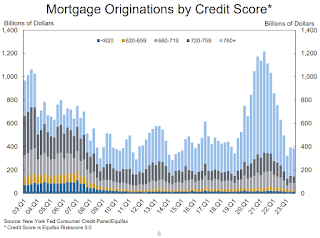

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, were at $386 billion in 2023Q3, a modest decline from the previous quarter and well below the trillion-dollar-plus quarterly origination volumes observed between 2020 and 2021 ... The median credit score for newly originated mortgages was flat at 770.There is much more in the report.

Wholesale Used Car Prices Decreased 2.3% in October; Down 4.0% Year-over-year

by Calculated Risk on 11/07/2023 10:48:00 AM

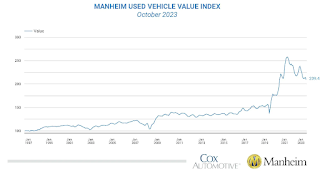

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in October

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.3% in October from September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 209.4, down 4.0% from a year ago.

“October revealed some not-so-spooky price moves, namely a reversal of the gains that were seen during the prior two months,” said Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive. “This confirms the caution that was mentioned last month The UAW strike , avoiding one action that could have led to higher wholesale prices. October’s price decline is eerily similar to last October’s 2.2% drop, and this was not unexpected as the market remains balanced. Wholesale vehicle values typically experience some modest increases during the holiday season, and with two months remaining, we could see some upward price movements.”

The seasonal adjustment reduced the October decrease. The non-adjusted price in October declined by 3.1% compared to September, moving the unadjusted average price down 6.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit increased to $61.5 Billion in September

by Calculated Risk on 11/07/2023 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

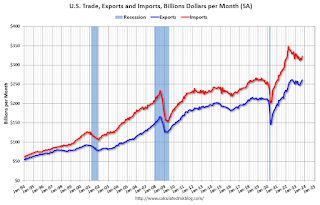

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $61.5 billion in September, up $2.9 billion from $58.7 billion in August, revised.

September exports were $261.1 billion, $5.7 billion more than August exports. September imports were $322.7 billion, $8.6 billion more than August imports

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in September.

Exports are up slightly year-over-year; imports are down 3% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - and both had been decreasing recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive.

The trade deficit with China decreased to $28.3 billion from $37.4 billion a year ago.

Monday, November 06, 2023

Tuesday: Trade Deficit

by Calculated Risk on 11/06/2023 07:45:00 PM

In and of itself, today would rank among the handful of "worst days" of any given year in term of mortgage rate movement. In other words, comparing today's rates to Friday's shows a big jump relative to the average day. Specifically, most lenders are offering rates that are at least an eighth of a percent (.125%) higher versus Friday morning.Tuesday:

All that having been said, this is a prime opportunity to "put things in perspective." [30 year fixed 7.48%]

emphasis added

• At 8:00 AM ET, Corelogic House Price index for September.

• At 8:30 AM, Trade Balance report for September from the Census Bureau. The consensus is for the deficit to be $60.3 billion in September, from $58.3 billion in August.

• At 11:00 AM, NY Fed: Q3 Quarterly Report on Household Debt and Credit

Fed SLOOS Survey: Banks reported Tighter Standards, Weaker Demand for All Loan Types

by Calculated Risk on 11/06/2023 02:00:00 PM

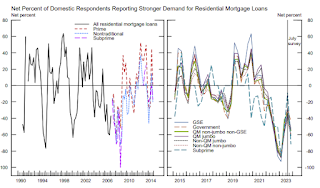

From the Federal Reserve: The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government residential mortgages, for which standards remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This shows that demand has declined.