by Calculated Risk on 11/09/2023 08:10:00 PM

Thursday, November 09, 2023

Friday: Veterans Day

Friday:

• Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open.

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (Preliminary for November).

Part 1: Current State of the Housing Market; Overview for mid-November

by Calculated Risk on 11/09/2023 03:39:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-November

A brief excerpt:

The NAR reported sales were at a “seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022).” This was in line with the local markets I tracked for September.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This was a new cycle low for existing home sales.

Usually, house prices bottom after sales bottom, so a new cycle low for sales suggests likely further weakness for house prices in coming months. I’ll have more on this pattern.

Census: U.S. Population Projected to Begin Declining in Second Half of Century

by Calculated Risk on 11/09/2023 03:07:00 PM

I'll have much more on these projections - and the implications for housing - soon (I'm sure housing economist Tom Lawler will comment!)

From Census: U.S. Population Projected to Begin Declining in Second Half of Century

The U.S. population is projected to reach a high of nearly 370 million in 2080 before edging downward to 366 million in 2100. By 2100, the total U.S. resident population is only projected to increase 9.7% from 2022, according to the latest U.S. Census Bureau population projections released today. The projections provide possible scenarios of population change for the nation through the end of the century.

...

“In an ever-changing world, understanding population dynamics is crucial for shaping policies and planning resources,” stated Sandra Johnson, a demographer at the Census Bureau.

“The U.S. has experienced notable shifts in the components of population change over the last five years,” she explained. “Some of these, like the increases in mortality caused by the COVID-19 pandemic, are expected to be short-term while others, including the declines in fertility that have persisted for decades, are likely to continue into the future. Incorporating additional years of data on births, deaths and international migration into our projections process resulted in a slower pace of population growth through 2060 than was previously projected.”

Projections illustrate possible courses of population change based on assumptions about future births, deaths and net international migration. The 2023 projections include a main series (also known as the middle series) considered the most likely outcome of four assumptions, and three alternative immigration scenarios that show how the population might change under high, low and zero immigration assumptions.

Click on graph for larger image.

Click on graph for larger image.This graph shows the projected US population for the four series.

From Census:

By 2100, the total population in the middle series is projected to reach 366 million compared to the projection for the high-immigration scenario, which puts the population at 435 million. The population for the middle series increases to a peak at 370 million in 2080 and then begins to decline, dropping to 366 million in 2100. The high-immigration scenario increases every year and is projected to reach 435 million by 2100.

The low-immigration scenario is projected to peak at around 346 million in 2043 and decline thereafter, dropping to 319 million in 2100.

Though largely illustrative, the zero-immigration scenario projects that population declines would start in 2024 in the complete absence of foreign-born immigration. The population in this scenario is projected to be 226 million in 2100, roughly 107 million lower than the 2022 estimate.

Hotels: Occupancy Rate Decreased 4.0% Year-over-year

by Calculated Risk on 11/09/2023 01:33:00 PM

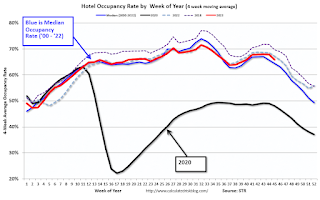

U.S. hotel performance showed an expected decline from the previous week as well as mixed year-over-year comparisons, according to CoStar’s latest data through 4 November.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

29 October through 4 November 2023 (percentage change from comparable week in 2022):

• Occupancy: 59.7% (-4.0%)

• Average daily rate (ADR): US$152.90 (+2.0%)

• Revenue per available room (RevPAR): US$91.23 (-2.1%)

The decrease in occupancy was anticipated with Halloween falling on Tuesday.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Weekly New Listings UP 0.6% YoY; Active Inventory Down Only 0.2% YoY

by Calculated Risk on 11/09/2023 09:35:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 4, 2023

• Active inventory declined slightly, with for-sale homes lagging behind year ago levels by 0.2%. For 20 straight weeks, the number of homes available for sale has registered below that of the previous year, though by just a small margin this week.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 0.6% from one year ago. Since mid-2022, new listings have registered lower than prior year levels, as the mortgage rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Over the last two weeks, however, the trend has reversed as new listings during the week outpaced the same week in the previous year by 0.6%, smaller than the previous week’s spike. This week’s stabilization comes after a spike last week, falling more in line with the shrinking gap in new listings over the last few months. With the number of homes for sale already limited, a lack of growth in new listings is likely to continue to weigh on existing home sales in the months ahead.

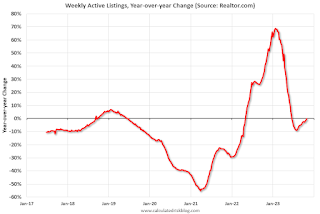

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 0.2% year-over-year - this was the 20th consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Weekly Initial Unemployment Claims Decrease to 217,000

by Calculated Risk on 11/09/2023 08:30:00 AM

The DOL reported:

In the week ending November 4, the advance figure for seasonally adjusted initial claims was 217,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 217,000 to 220,000. The 4-week moving average was 212,250, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 750 from 210,000 to 210,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,250.

The previous week was revised up.

Weekly claims were sligthly lower than the consensus forecast.

Wednesday, November 08, 2023

Thursday: Unemployment Claims

by Calculated Risk on 11/08/2023 07:40:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 217 thousand last week.

Update: Lumber Prices Down Slightly YoY

by Calculated Risk on 11/08/2023 02:25:00 PM

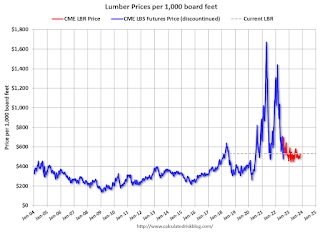

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Housing: Inventory will Tell the Tale

by Calculated Risk on 11/08/2023 09:42:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inventory will Tell the Tale

A brief excerpt:

Two years ago, in November 2021, I wrote Inventory will Tell the Tale and recounted how changes in housing inventory had helped me forecast the housing market at several key points. Here is an update to that post with a few additional comments.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Starting in January 2005, I was very bearish on housing, but I wasn’t sure when the market would turn. Speculative bubbles can go on and on. However, the increase in inventory in late 2005 (see red arrow on graph below) helped me call the top for house prices in 2006.

Several years later, in early 2012, when many people were still bearish on housing, the plunge in inventory in 2011 (blue arrow on graph below) helped me call the bottom for house prices in early 2012 (see The Housing Bottom is Here).

...

With higher mortgage rates and increasing inventory, a key question right now is “Will prices decline over the winter?”. I’ll update some price projections soon.

But I believe one thing is certain: inventory will tell the tale!

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 11/08/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

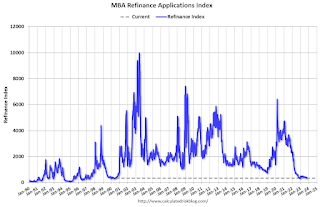

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 3, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 7 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 20 percent lower than the same week one year ago.

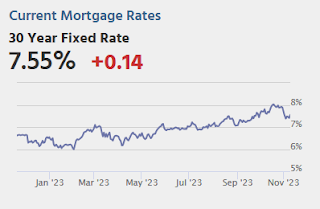

“The 30-year fixed mortgage rate dropped by 25 basis points to 7.61 percent, the largest single week decline since July 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Last week’s decrease in rates was driven by the U.S. Treasury’s issuance update, the Fed striking a dovish tone in the November FOMC statement, and data indicating a slower job market. Applications for both purchase and refinance loans were up over the week but remained at low levels. The purchase index is still more than 20 percent behind last year’s pace, as many homebuyers remain on the sidelines until more for-sale inventory becomes available.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 7.61 percent from 7.86 percent, with points decreasing to 0.69 from 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

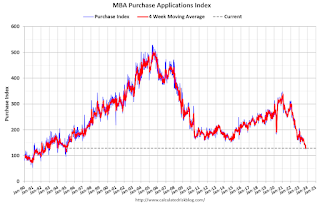

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 20% year-over-year unadjusted.