by Calculated Risk on 11/15/2023 07:00:00 AM

Wednesday, November 15, 2023

MBA: Mortgage Applications Increased in Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 10, 2023.

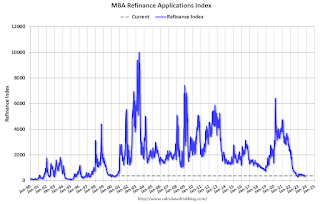

The Market Composite Index, a measure of mortgage loan application volume, increased 2.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 0.4 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 7 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 0.3 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Although Treasury rates dipped midweek, mortgage rates were little changed on average through the week. The 30-year fixed mortgage rate remained at 7.61 percent, about 30 basis points lower than three weeks ago,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications increased to the highest weekly pace in five weeks but remain at very low levels. Despite the recent downward trend, mortgage rates at current levels are still challenging for many prospective homebuyers and current homeowners.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) remained unchanged at 7.61 percent, with points decreasing to 0.67 from 0.69 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

Tuesday, November 14, 2023

Wednesday: Retail Sales, PPI, NY Fed Mfg

by Calculated Risk on 11/14/2023 07:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for October will be released. The consensus is for a 0.3% decrease in retail sales.

• Also at 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.3% increase in core PPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of -2.6, up from -4.6.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

Lawler: New Census Long-Term Population Projections Are MASSIVELY Lower Than Previous Projections

by Calculated Risk on 11/14/2023 02:34:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: New Census Long-Term Population Projections Are MASSIVELY Lower Than Previous Projections

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Last Friday Census released new long-term projections of the US resident population, this time going out to 2100. The last time Census released long-term population projections was in 2017 (going out to 2060), and the 2023 projections for the “middle” scenario are massively lower than the 2017 projections.

Here is a chart showing the “middle-case” projections for the US resident population for the 2017 release compared to the 2023 release. (Note: Census has not released updated population estimates for 2011 through 2019 that reflect Census 2020 results, but I have estimated what 2016 to 2019 would look like based on updated net international migration estimates for 2010 through 2019.)

...

I have been looking into these projections and have found some “issues” for the projections over the next few years, and I’ll be rewriting more about this topic soon. However, for those analysts who have kept using the 2017 population projections for analysis purposes even though it was obvious they were woefully out of date, these latest population projections have surely left them “dazed and confused.”

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.2% in October

by Calculated Risk on 11/14/2023 11:25:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in October. The 16% trimmed-mean Consumer Price Index increased 0.2% in October. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. "Motor fuel" decreased at a 45% annualized rate in October. Rent and Owner's equivalent rent are still high, but decreasing.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 11/14/2023 09:21:00 AM

Here are a few measures of inflation:

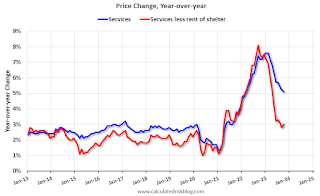

The first graph is the one Fed Chair Powell had mentioned earlier when services less rent of shelter was up 7.6% year-over-year. This has fallen sharply and is now up 3.0% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through September 2023.

Services less rent of shelter was up 3.0% YoY in October, up from 2.8% YoY in September.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were unchanged YoY in October, unchanged from 0.0% YoY in September.

Here is a graph of the year-over-year change in shelter from the CPI report (through October) and housing from the PCE report (through September 2023)

Here is a graph of the year-over-year change in shelter from the CPI report (through October) and housing from the PCE report (through September 2023)Shelter was up 6.7% year-over-year in October, down from 7.1% in September. Housing (PCE) was up 7.2% YoY in September, down from 7.4% in August.

The BLS noted this morning: "The index for shelter continued to rise in October"

Core CPI ex-shelter was up 2.0% YoY in October, up from 1.9% in September.

BLS: CPI Unchanged in October; Core CPI increased 0.2%

by Calculated Risk on 11/14/2023 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in October on a seasonally adjusted basis, after increasing 0.4 percent in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.CPI and core CPI were lower than expectated. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter continued to rise in October, offsetting a decline in the gasoline index and resulting in the seasonally adjusted index being unchanged over the month. The energy index fell 2.5 percent over the month as a 5.0-percent decline in the gasoline index more than offset increases in other energy component indexes. The food index increased 0.3 percent in October, after rising 0.2 percent in September. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.2 percent in October, after rising 0.3 percent in September. Indexes which increased in October include rent, owners' equivalent rent, motor vehicle insurance, medical care, recreation, and personal care. The indexes for lodging away from home, used cars and trucks, communication, and airline fares were among those that decreased over the month.

The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September. The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021. The energy index decreased 4.5 percent for the 12 months ending October, and the food index increased 3.3 percent over the last year.

emphasis added

Monday, November 13, 2023

Tuesday: CPI

by Calculated Risk on 11/13/2023 07:31:00 PM

Mortgage rates began the day at the highest levels in nearly 2 weeks. The underlying bond market had been losing ground steadily since last Thursday and there was some follow-through to that negative momentum early today. Weaker bonds = higher rates, all other things being equal.Tuesday:

But bonds recovered from 10am through the end of the day and the specific bonds that underlie mortgage rates did even better than their Treasury benchmarks.[30 year fixed 7.58%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.3% year-over-year and core CPI to be up 4.1% YoY.

A Few Comments on a Possible Government Shutdown

by Calculated Risk on 11/13/2023 01:26:00 PM

First, shutdowns are expensive, and many government employees continue to work (like the military), but don't get paid.

For housing, depending on the length of the shutdown, there might be an impact on existing home closings in November. If the shutdown lasts through the end of the month, I'd expect some decline in seasonally adjusted sales in November. If the shutdown only lasts a week or so, there would probably be little impact. Some issues could be Tax transcripts, Flood Certs, and SS# Authorization.

Part 2: Current State of the Housing Market; Overview for mid-November

by Calculated Risk on 11/13/2023 10:17:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-November

A brief excerpt:

Last week, in Part 1: Current State of the Housing Market; Overview for mid-November I reviewed home inventory and sales.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Most measures of house prices have shown an increase in prices over the last several months, and a key question I discussed in July is Will house prices decline further later this year? I will revisit this question soon.

Other measures of house prices suggest prices will be up further YoY in the September Case-Shiller index. The NAR reported median prices were up 2.8% YoY in September, down from 3.9% YoY in August. ICE / Black Knight reported prices were up 4.3% YoY in September, up from 3.7% YoY in August to new all-time highs, and Freddie Mac reported house prices were up 5.2% YoY in September, up from 4.3% YoY in August - and also to new all-time highs.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will increase further in the report for September.

Housing November 13th Weekly Update: Inventory Mostly Flat Week-over-week

by Calculated Risk on 11/13/2023 08:19:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.