by Calculated Risk on 11/16/2023 01:10:00 PM

Thursday, November 16, 2023

Realtor.com Reports Active Inventory UP YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 11, 2023

• Active inventory increased slightly, with for-sale homes 0.6% above year ago levels.

For 20 straight weeks, the number of homes available for sale registered below that of the previous year. However, active listings exceeded last year’s levels this week, reversing the recent trend.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 6.4% from one year ago.

Since mid-2022, new listings have registered lower than prior year levels, as the mortgage rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Over the last three weeks, however, the trend has reversed as new listings during the week outpaced the same week in the previous year by 6.4%, a jump relative to the previous week.

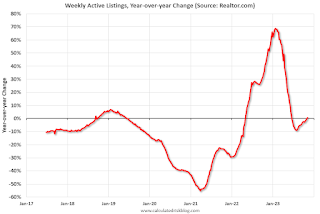

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up 0.6% year-over-year following 20 consecutive weeks with a YoY decrease in inventory.

NAHB: Builder Confidence Decreased in November

by Calculated Risk on 11/16/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 34, down from 40 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Down Again, but Better Building Conditions are in View

High mortgage rates that approached 8% earlier this month continue to hammer builder confidence, but recent economic data suggest housing conditions may improve in the coming months.

Builder confidence in the market for newly built single-family homes in November fell six points to 34 in November, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the fourth consecutive monthly drop in builder confidence, as sentiment levels have declined 22 points since July and are at their lowest level since December 2022. Also of note, nearly the entire HMI data for November was collected before the latest Consumer Price Index was released and showed that inflation is moderating.

“The rise in interest rates since the end of August has dampened builder views of market conditions, as a large number of prospective buyers were priced out of the market,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Moreover, higher short-term interest rates have increased the cost of financing for home builders and land developers, adding another headwind for housing supply in a market low on resale inventory. While the Federal Reserve is fighting inflation, state and local policymakers could also help by reducing the regulatory burdens on the cost of land development and home building, thereby allowing more attainable housing supply to the market.”

“While builder sentiment was down again in November, recent macroeconomic data point to improving conditions for home construction in the coming months,” said NAHB Chief Economist Robert Dietz. “In particular, the 10-year Treasury rate moved back to the 4.5% range for the first time since late September, which will help bring mortgage rates close to or below 7.5%. Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December.”

...

All three major HMI indices posted declines in November. The HMI index gauging current sales conditions fell six points to 40, the component charting sales expectations in the next six months dropped five points to 39 and the gauge measuring traffic of prospective buyers dipped five points to 21.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 49, the Midwest dropped three points to 36, the South fell seven points to 42 and the West posted a six-point decline to 35.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

Industrial Production Decreased 0.6% in October

by Calculated Risk on 11/16/2023 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

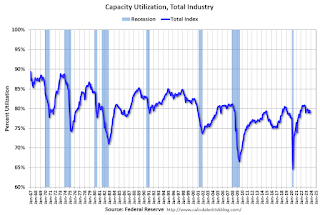

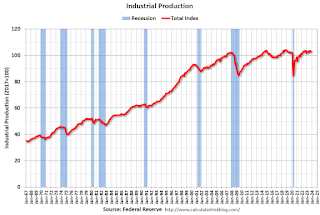

Industrial production declined 0.6 percent in October. Manufacturing output fell 0.7 percent. Much of this decline was due to a 10 percent drop in the output of motor vehicles and parts that was affected by strikes at several major manufacturers of motor vehicles—the index for manufacturing excluding motor vehicles and parts edged up 0.1 percent. The index for utilities decreased 1.6 percent, and the output of mines increased 0.4 percent. Total industrial production in October was 0.7 percent below its year-earlier level. Capacity utilization moved down 0.6 percentage point to 78.9 percent in October, a rate that is 0.8 percentage point below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.9% is 0.8% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.7 mostly due to the strikes. This is above the pre-pandemic level.

Industrial production was below consensus expectations.

Weekly Initial Unemployment Claims Increase to 231,000

by Calculated Risk on 11/16/2023 08:30:00 AM

The DOL reported:

In the week ending November 11, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 217,000 to 218,000. The 4-week moving average was 220,250, an increase of 7,750 from the previous week's revised average. The previous week's average was revised up by 250 from 212,250 to 212,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 220,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, November 15, 2023

Thursday: Industrial Production, Unemployment Claims, Homebuilder Survey

by Calculated Risk on 11/15/2023 08:02:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, up from 217 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of -11.0, down from -9.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.4%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 40, unchanged from 40. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

3rd Look at Local Housing Markets in October

by Calculated Risk on 11/15/2023 02:48:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in October

A brief excerpt:

NOTE: Starting next month, I’ll add some comparisons to 2019 (pre-pandemic)!There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the third look at several early reporting local markets in October. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in October were mostly for contracts signed in August and September. Since 30-year fixed mortgage rates were in the 7.1% in August and 7.2% in September, compared to the high-5% range the previous year, closed sales were down year-over-year in October.

...

In October, sales in these markets were down 9.5%. In September, these same markets were down 15.3% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in September for these markets. However, this is where seasonal adjustments make a difference.

There was one more working day in October 2023 compared to October 2022, the opposite of September when there was one fewer working day in 2023 compared to 2022. So, for October, the seasonally adjusted decline will be larger than the NSA decline.

...

The data so far suggests the October existing home sales report will show another significant YoY decline, perhaps close to 4 million SAAR (early guess of Seasonally Adjusted Annual Rate), and maybe slightly above the cycle low of 3.96 million SAAR last month. This will be the 26th consecutive month with a YoY decline in sales.

...

More local markets to come!

AIA: "Continuing Decline in Architecture Billings"; Multi-family Billings Decline for 15th Consecutive Month

by Calculated Risk on 11/15/2023 10:23:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Continuing Decline in Architecture Billings, AIA/Deltek Architecture Billings Index Reports

The AIA/Deltek Architecture Billings Index (ABI) reports that business conditions at architecture firms continued to soften in October. For the third consecutive month, the ABI score was under 50, indicating that a significant share of firms is seeing a decline in billings.

“This report indicates not only a decrease in billings at firms, but also a reduction in the number of clients exploring and committing to new projects, which could potentially impact future billings. The soft conditions were evident across the entire country as well as across all major nonresidential building sectors,” said Kermit Baker, PhD, AIA Chief Economist.

The score of 44.3 for October dipped slightly below the score of 44.8 in September. Billings were universally soft across the entire country in October, with firms located in the West and Northeast continuing to report the softest conditions overall for the second month in a row.

...

• Regional averages: Northeast (42.1); South (48.5); Midwest (48.9); West (40.0)

• Sector index breakdown: commercial/industrial (43.7); institutional (49.1); mixed practice (firms that do not have at least half of their billings in any one other category) (44.0); multifamily residential (40.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 44.3 in October, down from 44.8 in September. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

Retail Sales Decreased 0.1% in October

by Calculated Risk on 11/15/2023 08:30:00 AM

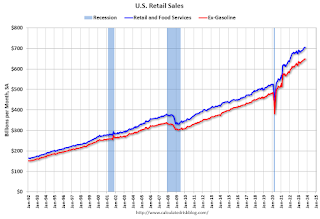

On a monthly basis, retail sales were down 0.1% from September to October (seasonally adjusted), and sales were up 2.5 percent from October 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.0 billion, down 0.1 percent from the previous month, and up 2.5 percent above October 2022. ... The August 2023 to September 2023 percent change was revised from up 0.7 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was down 0.1% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.5% on a YoY basis.

The decrease in sales in October was above expectations, and sales in August and September were revised up, combined.

The decrease in sales in October was above expectations, and sales in August and September were revised up, combined.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 11/15/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

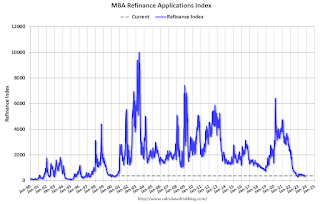

Mortgage applications increased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 10, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 0.4 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 7 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 0.3 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Although Treasury rates dipped midweek, mortgage rates were little changed on average through the week. The 30-year fixed mortgage rate remained at 7.61 percent, about 30 basis points lower than three weeks ago,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications increased to the highest weekly pace in five weeks but remain at very low levels. Despite the recent downward trend, mortgage rates at current levels are still challenging for many prospective homebuyers and current homeowners.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) remained unchanged at 7.61 percent, with points decreasing to 0.67 from 0.69 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

Tuesday, November 14, 2023

Wednesday: Retail Sales, PPI, NY Fed Mfg

by Calculated Risk on 11/14/2023 07:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for October will be released. The consensus is for a 0.3% decrease in retail sales.

• Also at 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.3% increase in core PPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of -2.6, up from -4.6.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).