by Calculated Risk on 11/20/2023 04:37:00 PM

Monday, November 20, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.29% in October"

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.29% in October

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.31% of servicers’ portfolio volume in the prior month to 0.29% as of October 31, 2023. According to MBA’s estimate, 145,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8 million borrowers since March 2020.

In October 2023, the share of Fannie Mae and Freddie Mac loans in forbearance remained flat at 0.18%. Ginnie Mae loans in forbearance decreased 5 basis points to 0.52%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 3 basis points to 0.32%.

“For the first time since MBA began tracking the reasons for forbearance in October 2022, temporary hardships such as job loss, death, and divorce represent a larger share of loans in forbearance by reason than a COVID-19 hardship,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “This upward trend will continue, as Fannie Mae and Freddie Mac sunset the use of COVID-19 as a reason for delinquency starting in November 2023,[1] and FHA’s COVID-19 forbearance period ends at the end of November 2023[2].”

Added Walsh, “Forbearance is still an option for many distressed homeowners, but in most cases, the requirements to obtain a forbearance will not be as streamlined as they were during the pandemic.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the reasons for forbearance: COVID-19, Naturnal Disaster, other Temporary Hardship.

From the MBA:

• By reason, 45.4% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 43.3% of borrowers are in forbearance because of COVID-19. Another 11.3% are in forbearance because of a natural disaster.At the end of October, there were about 145,000 homeowners in forbearance plans.

4th Look at Local Housing Markets in October

by Calculated Risk on 11/20/2023 12:56:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in October

A brief excerpt:

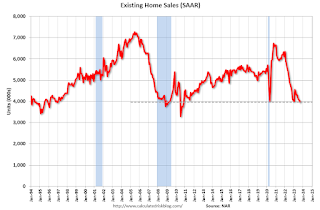

The National Association of Realtors (NAR) is scheduled to release October existing home sales on Tuesday, November 21, 2023, at 10:00 AM ET. The consensus is for 3.93 million SAAR. Housing economist Tom Lawler expects the NAR to report sales of 3.94 million SAAR. This would be a new cycle low, below the 4.00 million SAAR in January 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

NOTE: Starting next month, I’ll add some comparisons to 2019 data (pre-pandemic)!

...

In October, sales in these markets were down 9.4%. In September, these same markets were down 15.7% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in September for these markets. However, this is where seasonal adjustments make a difference.

There was one more working day in October 2023 compared to October 2022, the opposite of September when there was one fewer working day in 2023 compared to 2022. So, for October, the seasonally adjusted decline will be larger than the NSA decline. This will be the 26th consecutive month with a YoY decline in sales.

...

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

LA Port Inbound Traffic Increases in October

by Calculated Risk on 11/20/2023 10:11:00 AM

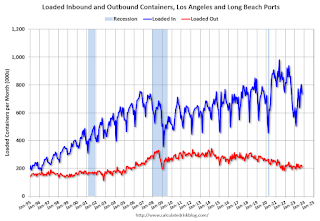

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast (recently the drought in Panama has slowed canal traffic).

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.3% in October compared to the rolling 12 months ending in September. Outbound traffic increased 0.1% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Housing November 20th Weekly Update: Inventory Up Slightly Year-over-year

by Calculated Risk on 11/20/2023 08:21:00 AM

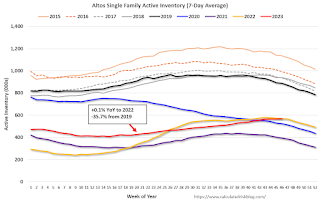

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, November 19, 2023

Sunday Night Futures

by Calculated Risk on 11/19/2023 06:51:00 PM

Weekend:

• Schedule for Week of November 19, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 5 and DOW futures are down 11 (fair value).

Oil prices were down over the last week with WTI futures at $75.89 per barrel and Brent at $80.61 per barrel. A year ago, WTI was at $80, and Brent was at $89 - so WTI oil prices were down 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.25 per gallon. A year ago, prices were at $3.65 per gallon, so gasoline prices are down $0.40 year-over-year.

Hotels: Occupancy Rate Increased 0.8% Year-over-year

by Calculated Risk on 11/19/2023 08:31:00 AM

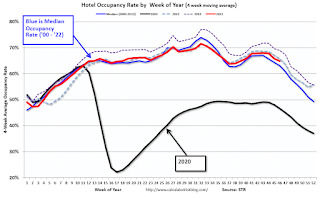

U.S. hotel performance increased from the previous week and showed positive year-over-year comparisons, according to CoStar’s latest data through 11 November.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

5-11 November 2023 (percentage change from comparable week in 2022):

• Occupancy: 64.8% (+0.8%)

• Average daily rate (ADR): US$156.01 (+4.0%)

• Revenue per available room (RevPAR): US$101.13 (+4.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, November 18, 2023

Real Estate Newsletter Articles this Week: New Census Long-Term Population Projections Are MASSIVELY Lower Than Previous Projections

by Calculated Risk on 11/18/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in October

• October Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

• 3rd Look at Local Housing Markets in October

• Lawler: New Census Long-Term Population Projections Are MASSIVELY Lower Than Previous Projections

• Part 2: Current State of the Housing Market; Overview for mid-November

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of November 19, 2023

by Calculated Risk on 11/18/2023 08:11:00 AM

The key economic report this week is Existing Home sales.

No major economic releases scheduled.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.93 million SAAR, down from 3.96 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.93 million SAAR, down from 3.96 million in September.The graph shows existing home sales from 1994 through the report last month.

2:00 PM: FOMC Minutes, Meeting of October 31-November 1

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 229 thousand initial claims, down from 231 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November).

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

Friday, November 17, 2023

Nov 17th COVID Update: Deaths and Hospitalizations Decreased

by Calculated Risk on 11/17/2023 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 12,974 | 12,647 | ≤3,0001 | |

| Deaths per Week2 | 1,130 | 1,265 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

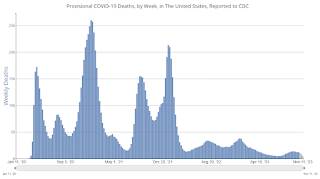

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q4 GDP Tracking: Close to 2%

by Calculated Risk on 11/17/2023 04:22:00 PM

From Goldman:

We boosted our Q4 GDP tracking estimate by 0.1pp to +1.9% (qoq ar) and our domestic final sales estimate by 0.1pp to 2.0%. [Nov 17th estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.0 percent on November 17, down from 2.2 percent on November 15. [Nov 17th estimate]