by Calculated Risk on 11/26/2023 09:31:00 AM

Sunday, November 26, 2023

2024 Conforming Loan Limits Will be Released on Tuesday

Although Case-Shiller usually receives more attention, the FHFA index will be a focus on Tuesday - since the quarterly FHFA Expanded-Data Indexes (Estimated using Enterprise, FHA, and Real Property County Recorder Data Licensed from DataQuick for sales below the annual loan limit ceiling) is used to set the Fannie and Freddie conforming loan limits (CLL), and the FHA insured limit.

For 2023, the CLL for one-unit properties was set at $726,200, and for high cost areas the ceiling loan limit for one-unit properties was $1,089,300.

Based on the monthly FHFA index, the CLL will probably increase around 6% for 2024 to around $770,000, and to $1,155,000 for high cost areas.

Saturday, November 25, 2023

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 3.79 million SAAR in October; New Cycle Low

by Calculated Risk on 11/25/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 3.79 million SAAR in October; New Cycle Low

• Lawler on Existing Home Sales, Population Projections and Household Slowdown

• 4th Look at Local Housing Markets in October

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of November 26, 2023

by Calculated Risk on 11/25/2023 08:11:00 AM

The key reports this week include the 2nd estimate of Q3 GDP and October New Home Sales.

10:00 AM: New Home Sales for October from the Census Bureau.

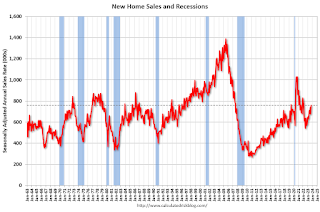

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 730 thousand SAAR, down from 759 thousand in September.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The National index was up 2.6% YoY in August and is expected to increase further in September.

9:00 AM: FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2023 Conforming loan limits will also be announced.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), 3rd Quarter 2023. The consensus is that real GDP increased 5.0% annualized in Q3, up from the advance estimate of 4.9% in Q3.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were at 209 thousand last week.

8:30 AM: Personal Income and Outlays, October 2023. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.1% YoY, and core PCE prices up 3.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for November.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 0.6% decrease in the index.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 47.7%, up from 46.7%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

11:00 AM: Discussion, Fed Chair Jerome Powell, Conversation with Spelman College President Helene Gayle, At a Fireside Chat at Spelman College, Atlanta, Ga.

All day: Light vehicle sales for November.

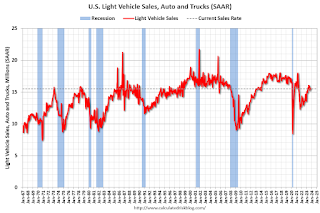

All day: Light vehicle sales for November.The consensus is for 15.5 million SAAR in November, unchanged from the BEA estimate of 15.5 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

Friday, November 24, 2023

Hotels: Occupancy Rate Decreased 0.6% Year-over-year

by Calculated Risk on 11/24/2023 03:25:00 PM

U.S. hotel performance showed mixed year-over-year comparisons, according to CoStar’s latest data through 18 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

12-18 November 2023 (percentage change from comparable week in 2022):

• Occupancy: 62.4% (-0.6%)

• Average daily rate (ADR): US$156.47 (+7.0%)

• Revenue per available room (RevPAR): US$97.61 (+6.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Realtor.com Reports Active Inventory UP 1.5% YoY; New Listings up 5.0% YoY

by Calculated Risk on 11/24/2023 12:31:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 18, 2023

• Active inventory increased slightly, with for-sale homes 1.5% above year ago levels. Active listings exceeded last year’s levels again this week, falling in line with last week’s trend.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 5.0% from one year ago. New listings registered lower than prior year levels from mid-2022 through roughly 4 weeks ago, as the mortgage rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Over the last three weeks, however, the trend has reversed and new listings during this week outpaced the same week in the previous year by 5.0%.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 2nd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Q4 GDP Tracking: Around 2%

by Calculated Risk on 11/24/2023 10:40:00 AM

From BofA:

Overall, this reduced our 4Q US GDP tracking estimate down a tenth to 1.4% q/q saar from our official forecast of 1.5% q/q saar. Also, 3Q GDP remains unchanged from our last weekly publication at 5.2% q/q saar. [Nov 22nd estimate]From Goldman:

emphasis added

The inventory details of the durable goods report were firmer than our previous assumptions, and we boosted our Q4 GDP tracking estimate by one tenth to +2.0% (qoq ar). Our Q4 domestic final sales estimate also stands at +2.0%. [Nov 22nd estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.1 percent on November 22, up from 2.0 percent on November 17. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of fourth-quarter real gross private domestic investment growth increased from -1.8 percent to -1.1 percent. [Nov 22nd estimate]

Thursday, November 23, 2023

Five Economic Reasons to be Thankful

by Calculated Risk on 11/23/2023 08:47:00 AM

Here are five economic reasons to be thankful this Thanksgiving. (Hat Tip to Neil Irwin who started doing this years ago)

1) The Unemployment Rate is Below 4%

The unemployment rate is up from 3.7% a year ago (October 2022).

2) Low unemployment claims.

This graph shows the 4-week moving average of weekly claims since 1971.

This graph shows the 4-week moving average of weekly claims since 1971.The dashed line on the graph is the current 4-week average.

3) Inflation is Decreasing

This graph shows the year-over-year change in three measures of inflation since 1970: CPI, Core CPI, and Core CPI ex-shelter.

This graph shows the year-over-year change in three measures of inflation since 1970: CPI, Core CPI, and Core CPI ex-shelter. Overall inflation is moving back to the Fed's 2% target.

4) Mortgage Delinquency Rate Near the Lowest Level since at least 1979

The percent of loans in the foreclosure process decreased year-over-year in Q3 even with the end of the foreclosure moratoriums and are historically low.

5) Household Debt burdens at Low Levels

This graph, based on data from the Federal Reserve, shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

This graph, based on data from the Federal Reserve, shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).This data suggests aggregate household cash flow is in a solid position.

Wednesday, November 22, 2023

Black Knight: Mortgage Delinquency Rate Decreased in October

by Calculated Risk on 11/22/2023 02:35:00 PM

From ICE / Black Knight: ICE First Look at Mortgage Performance: Foreclosure starts rose in October, despite serious delinquencies returning to 17-year lows

• The national delinquency rate fell 3 basis points (bps) to 3.26% in October, marking a 9 bps (-2.8%) improvement from the same time last year

• Serious delinquencies (90+ days past due) fell to 447K, once again hitting their lowest levels since 2006

• Loans 30-days late also declined, marking the first such improvement in five months

• Despite the improvement in delinquencies, foreclosure starts rose to 33K in October, hitting their highest levels in 18 months – while the number of foreclosure sales (completions) remained relatively flat

• Active foreclosure inventory inched up 3K to 217K, but remains more than 25% below prepandemic levels

• While foreclosure starts rose in October, near term risk remains muted, with serious delinquencies historically low and more than 70% of such loans protected from foreclosure by loss mitigation efforts

• Prepay activity (measured as single-month mortality) dwindled to just 0.43% under continued seasonal pressure, despite interest rates easing somewhat from the prior month

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| October 2023 | September 2023 | |||

| Delinquent | 3.26% | 3.29% | ||

| In Foreclosure | 0.41% | 0.40% | ||

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,734,000 | 1,749,000 | ||

| Number of properties in foreclosure pre-sale inventory: | 217,000 | 214,000 | ||

| Total Properties | 1,951,000 | 1,963,000 | ||

November Vehicle Sales Forecast: 15.8 million SAAR, Up 11% YoY

by Calculated Risk on 11/22/2023 01:30:00 PM

From WardsAuto: November U.S. Light-Vehicle Sales to Improve on Past Three Months (pay content). Brief excerpt:

The recent falloff in the SAAR from summer highs could mean more consumers are reaching price fatigue. It also could be that some of the stronger selling segments – especially fullsize trucks – of the past two-plus years are closer than other segments to meeting the pent-up demand built up since the inventory drain caused by the semiconductor shortage began in early 2021. Of course, there also has been a rise in distractions over that period, locally and internationally.

emphasis added

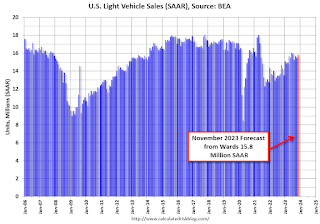

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for November (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.8 million SAAR, would be up 2% from last month, and up 11% from a year ago.

Lawler on Existing Home Sales, Population Projections and Household Slowdown

by Calculated Risk on 11/22/2023 09:34:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Lawler on Existing Home Sales, Population Projections and Household Slowdown

Excerpt:

Census’ new long-term US population projections released last Friday were massively lower than the previous long-term projection released in 2017. In a report earlier this week I highlighted the how the projected components of population change (births, deaths, and net international migration) differed in the two forecasts. Today I’m going to highlight a few “issues” with the latest projections over the next few years.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

First, the “projected” components of change from July 1, 2022, to June 30, 2023, differ significantly from likely components of change based on existing information.

For deaths, the latest projection shows deaths from July 1, 2022, to June 30, 2023, of 2,861,510, a whopping 298,232 lower than CDC provisional data for that period show (this latter number will be revised upward slightly). In looking at deaths by age, mortality rates are “too low” in the latest long-term projection for almost all age groups, but especially for young to middle-aged adults.

For net international migration (NIM), the latest projection shows NIM from July 1, 2022, to June 30, 2023, of 853,220, or a sizeable 157,703 below the estimated NIM from July 1, 2021, to June 30, 2022, in the Vintage 2022 population estimates. Yet the admittedly limited data available on immigration trends suggest the NIM INCREASED from 2022 to 2023, and my best estimate in that NIM from July 1, 2022, to June 30, 2022, was about 1,200,000 – 346,780 higher than the assumption in the latest long-term population projection.

Finally, births in the latest long-term population projection from July 1, 2022, to June 30, 2023, are 18,788 below provisional CDC data for this period.