by Calculated Risk on 11/30/2023 11:01:00 AM

Thursday, November 30, 2023

Freddie Mac House Price Index Increased in October to New High; Up 6.0% Year-over-year

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in October to New High; Up 6.0% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 6.0% in October, from up 5.1% YoY in September. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% in April 2023. ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As of October, 7 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-4.5%), Utah (-2.7%), D.C. (-2.0%), and Nevada (-1.6%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

...

I’ll have an update on the House Price Battle Royale: Low Inventory vs Affordability soon.

NAR: Pending Home Sales Decrease 1.5% in October; Down 8.5% Year-over-year; Lowest Number of Record

by Calculated Risk on 11/30/2023 10:00:00 AM

From the NAR: Pending Home Sales Fell 1.5% in October

Pending home sales dropped 1.5% in October, according to the National Association of REALTORS®. The Northeast posted a monthly gain in transactions while the Midwest, South and West all recorded losses. All four U.S. regions noted year-over-year declines in transactions.This was below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – dropped 1.5% to 71.4 in October, the lowest number since the index was originated in 2001. Year over year, pending transactions declined 8.5%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI jumped 2.7% from last month to 64.8, although representing a loss of 6.5% from October 2022. The Midwest index contracted 0.4% to 73.8 in October, down 10.3% from one year ago.

The South PHSI decreased 1.9% to 85.6 in October, declining 7.1% from the prior year. The West index fell 6.0% in October to 51.8, dipping 10.8% from October 2022.

emphasis added

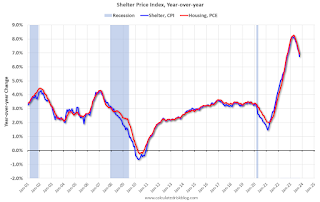

PCE Measure of Shelter Slows to 6.9% YoY in October

by Calculated Risk on 11/30/2023 09:03:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through October 2023.

Since asking rents are slightly negative year-over-year, these measures will continue to slow over coming months.

Weekly Initial Unemployment Claims Increase to 218,000

by Calculated Risk on 11/30/2023 08:43:00 AM

The DOL reported:

In the week ending November 25, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 220,000, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 220,000 to 220,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,000.

The previous week was revised up.

Weekly claims were at the consensus forecast.

Personal Income increased 0.2% in October; Spending increased 0.2%

by Calculated Risk on 11/30/2023 08:38:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $57.1 billion (0.2 percent at a monthly rate) in October, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $63.4 billion (0.3 percent) and personal consumption expenditures (PCE) increased $41.2 billion (0.2 percent).The October PCE price index increased 3.0 percent year-over-year (YoY), down from 3.4 percent YoY in September, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.3 percent in October and real PCE increased 0.2 percent; goods increased 0.1 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through October 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were at expectations.

Wednesday, November 29, 2023

Thursday: Unemployment Claims, Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 11/29/2023 08:30:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 209 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays, October 2023. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.1% YoY, and core PCE prices up 3.5% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for November.

• At 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.6% decrease in the index.

Fannie and Freddie Serious Delinquencies in October: Single Family Declined, Multi-Family Increased

by Calculated Risk on 11/29/2023 04:54:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie Serious Delinquencies in October: Single Family Declined, Multi-Family Increased

Brief excerpt:

Single-family serious delinquencies continued to decline in October, however, multi-family serious delinquencies increased.You can subscribe at https://calculatedrisk.substack.com/.

...

Freddie Mac reports that multi-family delinquencies increased to 0.26% in October, up from 0.15% in October 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and interest rates have increased sharply. This will be something to watch as rents soften, and more apartments come on the market.

Fed's Beige Book: "Economic activity slowed since the previous report"

by Calculated Risk on 11/29/2023 02:00:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before November 17, 2023."

On balance, economic activity slowed since the previous report, with four Districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity. Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers' outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Demand for labor continued to ease, as most Districts reported flat to modest increases in overall employment. The majority of Districts reported that more applicants were available, and several noted that retention improved as well.

emphasis added

Final Look at Local Housing Markets in October

by Calculated Risk on 11/29/2023 10:31:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in September

A brief excerpt:

NOTE: Starting next month, I’ll add some comparisons to 2019 data (pre-pandemic)!There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Each month I track closed sales, new listings and active inventory in a sample of local markets around the country (over 40 local housing markets) in the US to get an early sense of changes in the housing market. In addition, we can look for regional differences.

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR (and I’m adding more markets). This is the final look at local markets in September.

The big story for September was that existing home sales hit a new cycle low. Also new listings were down YoY, but less than over the Summer.

This table shows the YoY change in new listings since the start of 2023. The smaller decline is due to a combination of new listings collapsing in the 2nd half of 2022, and new listings holding up more than normal seasonally (but still historically very low).

...

More local data coming in November for activity in October!

Q3 GDP Growth Revised up to 5.2% Annual Rate

by Calculated Risk on 11/29/2023 08:30:00 AM

From the BEA: Gross Domestic Product (Second Estimate) Corporate Profits (Preliminary Estimate) Third Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 5.2 percent in the third quarter of 2023, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 4.0% to 3.4%. Residential investment was revised up from 3.9% to 6.2%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 4.9 percent. The update primarily reflected upward revisions to nonresidential fixed investment and state and local government spending that were partly offset by a downward revision to consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down (refer to "Updates to GDP").

The increase in real GDP reflected increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment. Imports increased.

emphasis added