by Calculated Risk on 12/01/2023 10:00:00 AM

Friday, December 01, 2023

ISM® Manufacturing index Unchanged at 46.7% in November

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.7% in November, unchanged from 46.7% in October. The employment index was at 45.8%, down from 46.8% the previous month, and the new orders index was at 48.3%, up from 45.5%.

From ISM: Manufacturing PMI® at 46.7% November 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in November. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 46.7 percent in November, unchanged from the 46.7 percent recorded in October. The overall economy continued in contraction for a second month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 48.3 percent, 2.8 percentage points higher than the figure of 45.5 percent recorded in October. The Production Index reading of 48.5 percent is a 1.9-percentage point decrease compared to October’s figure of 50.4 percent. The Prices Index registered 49.9 percent, up 4.8 percentage points compared to the reading of 45.1 percent in October. The Backlog of Orders Index registered 39.3 percent, 2.9 percentage points lower than the October reading of 42.2 percent. The Employment Index registered 45.8 percent, down 1 percentage point from the 46.8 percent reported in October.

emphasis added

Thursday, November 30, 2023

Friday: ISM Mfg, Construction Spending, Fed Chair Powell, Vehicle Sales

by Calculated Risk on 11/30/2023 08:34:00 PM

Friday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for 47.7%, up from 46.7%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

• At 11:00 AM, Discussion, Fed Chair Jerome Powell, Conversation with Spelman College President Helene Gayle, At a Fireside Chat at Spelman College, Atlanta, Ga.

• All day, Light vehicle sales for November. The consensus is for 15.5 million SAAR in November, unchanged from the BEA estimate of 15.5 million SAAR in October (Seasonally Adjusted Annual Rate).

Las Vegas October 2023: Visitor Traffic Down Slightly YoY; Convention Traffic Up 2%

by Calculated Risk on 11/30/2023 04:07:00 PM

From the Las Vegas Visitor Authority: October 2023 Las Vegas Visitor Statistics

Demand for sports, entertainment and conventions combined to lift room rates to record levels in October as the destination hosted more than 3.6M visitors. Complementing the signature shows and residencies of the destination were other headliner acts including P!NK, the When We Were Young music festival and Ed Sheeran, along with the Fall NASCAR race and two NFL Raider home games.

Convention attendance for the month was up 2.0% YoY, supported by various returning and rotating tradeshows as well as the TwitchCon gamers event (30k attendees) that was held in Las Vegas for the first time.

Overall hotel occupancy matched last October at 87.7% as Weekend occupancy came in at 94.2% (+0.2 pts YoY), and Midweek occupancy reached 85.4% (up 0.3 pts), and ADR and RevPAR set records at $233 and $204 respectively, beating the prior monthly record tallies from March 2023

Click on graph for larger image.

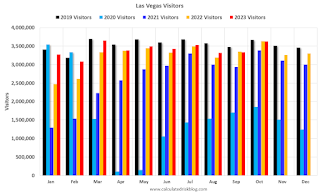

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was down 0.2% compared to last October.

Note: There was almost no convention traffic from April 2020 through May 2021.

Realtor.com Reports Active Inventory UP 1.8% YoY; New Listings up 8.9% YoY

by Calculated Risk on 11/30/2023 02:31:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 25, 2023

• Active inventory increased slightly, with for-sale homes 1.8% above year ago levels.

Active listings exceeded last year’s levels again this week, growing by a slightly higher rate than previous week (+1.8% year-over-year vs +1.5%). However, active inventory has now fallen below its peak of 758,000 listings two weeks ago, to 741,000 this past week.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 8.9% from one year ago.

New listings registered lower than prior year levels from mid-2022 through roughly 5 weeks ago, as the mortgage rate lock-in effect froze homeowners with low-rate existing mortgages in place. More recently the trend has reversed as new listings during the week outpaced the same week in the previous year by 8.9%, the largest increase since summer 2021. With the number of homes for sale already limited, a pick up in new listings is a welcome change to recent inventory woes. However, the pace of new listings is still 16.9% below typical pre-pandemic levels.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 2rd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Freddie Mac House Price Index Increased in October to New High; Up 6.0% Year-over-year

by Calculated Risk on 11/30/2023 11:01:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in October to New High; Up 6.0% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 6.0% in October, from up 5.1% YoY in September. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% in April 2023. ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As of October, 7 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-4.5%), Utah (-2.7%), D.C. (-2.0%), and Nevada (-1.6%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

...

I’ll have an update on the House Price Battle Royale: Low Inventory vs Affordability soon.

NAR: Pending Home Sales Decrease 1.5% in October; Down 8.5% Year-over-year; Lowest Number of Record

by Calculated Risk on 11/30/2023 10:00:00 AM

From the NAR: Pending Home Sales Fell 1.5% in October

Pending home sales dropped 1.5% in October, according to the National Association of REALTORS®. The Northeast posted a monthly gain in transactions while the Midwest, South and West all recorded losses. All four U.S. regions noted year-over-year declines in transactions.This was below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – dropped 1.5% to 71.4 in October, the lowest number since the index was originated in 2001. Year over year, pending transactions declined 8.5%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI jumped 2.7% from last month to 64.8, although representing a loss of 6.5% from October 2022. The Midwest index contracted 0.4% to 73.8 in October, down 10.3% from one year ago.

The South PHSI decreased 1.9% to 85.6 in October, declining 7.1% from the prior year. The West index fell 6.0% in October to 51.8, dipping 10.8% from October 2022.

emphasis added

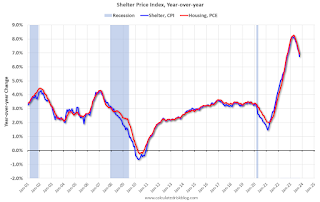

PCE Measure of Shelter Slows to 6.9% YoY in October

by Calculated Risk on 11/30/2023 09:03:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through October 2023.

Since asking rents are slightly negative year-over-year, these measures will continue to slow over coming months.

Weekly Initial Unemployment Claims Increase to 218,000

by Calculated Risk on 11/30/2023 08:43:00 AM

The DOL reported:

In the week ending November 25, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 220,000, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 220,000 to 220,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,000.

The previous week was revised up.

Weekly claims were at the consensus forecast.

Personal Income increased 0.2% in October; Spending increased 0.2%

by Calculated Risk on 11/30/2023 08:38:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $57.1 billion (0.2 percent at a monthly rate) in October, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $63.4 billion (0.3 percent) and personal consumption expenditures (PCE) increased $41.2 billion (0.2 percent).The October PCE price index increased 3.0 percent year-over-year (YoY), down from 3.4 percent YoY in September, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.3 percent in October and real PCE increased 0.2 percent; goods increased 0.1 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through October 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and PCE were at expectations.

Wednesday, November 29, 2023

Thursday: Unemployment Claims, Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 11/29/2023 08:30:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 218 thousand from 209 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays, October 2023. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.1% YoY, and core PCE prices up 3.5% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for November.

• At 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.6% decrease in the index.