by Calculated Risk on 12/02/2023 08:11:00 AM

Saturday, December 02, 2023

Schedule for Week of December 3, 2023

The key report this week is the November employment report on Friday.

No major economic releases scheduled.

8:00 AM: Corelogic House Price index for October.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 9.55 million from 9.50 million in August.

10:00 AM: the ISM Services Index for November. The consensus is for 52.5, up from 51.8.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 120,000 jobs added, up from 113,000 in October.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $63.0 billion. The U.S. trade deficit was at $61.5 billion in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand, up from 218 thousand last week.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 150,000 jobs added in October, and the unemployment rate was at 3.9%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

Friday, December 01, 2023

Dec 1st COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 12/01/2023 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 15,290 | 14,127 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,190 | 1,143 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

And here is a new graph I'm following on COVID in wastewater:

Note the recent surge in the Midwest.

Note the recent surge in the Midwest.This appears to be a leading indicator for COVID hospitalizations and deaths.

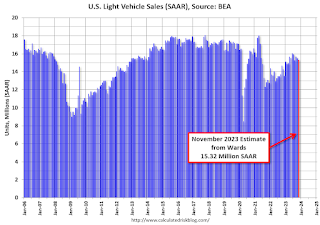

Vehicles Sales decrease to 15.32 million SAAR in November; Up 7% YoY

by Calculated Risk on 12/01/2023 05:08:00 PM

Wards Auto released their estimate of light vehicle sales for November: No Holiday Boost but U.S. Light-Vehicle Sales Continue Gains in November (pay site).

Labor-related plant shutdowns in the U.S. that covered the latter half of September and most of October negatively impacted deliveries in November. Combined sales of the vehicles impacted by shutdowns fell 15% year-over-year in November. If those vehicles had matched year-ago results, sales would have totaled a 15.9 million-unit SAAR. While CUVs accounted for over half the market for the second time ever, vehicles impacted by the strikes were largely behind weakness in pickups, SUVs and vans.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for November (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in November were below the consensus forecast due to the impact of the strikes.

Q4 GDP Tracking: Close to 1%

by Calculated Risk on 12/01/2023 04:00:00 PM

From BofA:

Overall, since our last weekly publication, our 4Q US GDP tracking estimate fell three-tenths to 1.0% q/q saar. [Dec 1st estimate]From Goldman:

emphasis added

We boosted our Q4 GDP tracking estimate by one tenth to +1.5% (qoq ar) and our Q4 domestic final sales growth forecast by the same amount to +2.1% (qoq ar). [Dec 1st estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on December 1, down from 1.8 percent on November 30. [Dec 1st estimate]

CES Strike Report: Ending Strikes will Boost November Employment

by Calculated Risk on 12/01/2023 01:51:00 PM

This shows a total of 10,500 workers on strike in November, down from 48,100 in October.

This shows a total of 10,500 workers on strike in November, down from 48,100 in October.Inflation Adjusted House Prices 3.0% Below Peak; Price-to-rent index is 6.9% below recent peak

by Calculated Risk on 12/01/2023 11:09:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.0% Below Peak; Price-to-rent index is 6.9% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the September Case-Shiller house price index released this week, the seasonally adjusted National Index (SA), was reported as being 69% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $424,000 today adjusted for inflation (41% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 3.0% below the recent peak, and the Composite 20 index is 3.9% below the recent peak in 2022.

In real terms, national house prices are 9.4% above the bubble peak levels. There is an upward slope to real house prices, and it has been about 17 years since the previous peak, but real prices are historically high.

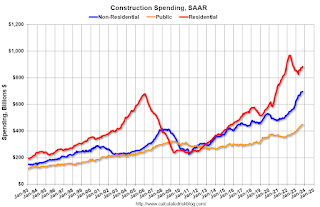

Construction Spending Increased 0.6% in October

by Calculated Risk on 12/01/2023 10:17:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during October 2023 was estimated at a seasonally adjusted annual rate of $2,027.1 billion, 0.6 percent above the revised September estimate of $2,014.7 billion. The October figure is 10.7 percent above the October 2022 estimate of $1,830.5 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,579.3 billion, 0.7 percent above the revised September estimate of $1,567.9 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $447.8 billion, 0.2 percent above the revised September estimate of $446.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 8.8% below the recent peak.

Non-residential (blue) spending is at a new peak.

Public construction spending is also at a new peak.

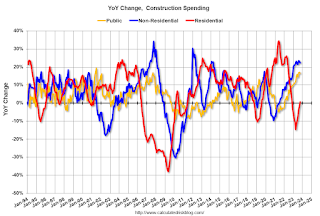

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 0.7%. Non-residential spending is up 22.4% year-over-year. Public spending is up 16.4% year-over-year.

ISM® Manufacturing index Unchanged at 46.7% in November

by Calculated Risk on 12/01/2023 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 46.7% in November, unchanged from 46.7% in October. The employment index was at 45.8%, down from 46.8% the previous month, and the new orders index was at 48.3%, up from 45.5%.

From ISM: Manufacturing PMI® at 46.7% November 2023 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in November. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 46.7 percent in November, unchanged from the 46.7 percent recorded in October. The overall economy continued in contraction for a second month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 48.3 percent, 2.8 percentage points higher than the figure of 45.5 percent recorded in October. The Production Index reading of 48.5 percent is a 1.9-percentage point decrease compared to October’s figure of 50.4 percent. The Prices Index registered 49.9 percent, up 4.8 percentage points compared to the reading of 45.1 percent in October. The Backlog of Orders Index registered 39.3 percent, 2.9 percentage points lower than the October reading of 42.2 percent. The Employment Index registered 45.8 percent, down 1 percentage point from the 46.8 percent reported in October.

emphasis added

Thursday, November 30, 2023

Friday: ISM Mfg, Construction Spending, Fed Chair Powell, Vehicle Sales

by Calculated Risk on 11/30/2023 08:34:00 PM

Friday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for 47.7%, up from 46.7%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

• At 11:00 AM, Discussion, Fed Chair Jerome Powell, Conversation with Spelman College President Helene Gayle, At a Fireside Chat at Spelman College, Atlanta, Ga.

• All day, Light vehicle sales for November. The consensus is for 15.5 million SAAR in November, unchanged from the BEA estimate of 15.5 million SAAR in October (Seasonally Adjusted Annual Rate).

Las Vegas October 2023: Visitor Traffic Down Slightly YoY; Convention Traffic Up 2%

by Calculated Risk on 11/30/2023 04:07:00 PM

From the Las Vegas Visitor Authority: October 2023 Las Vegas Visitor Statistics

Demand for sports, entertainment and conventions combined to lift room rates to record levels in October as the destination hosted more than 3.6M visitors. Complementing the signature shows and residencies of the destination were other headliner acts including P!NK, the When We Were Young music festival and Ed Sheeran, along with the Fall NASCAR race and two NFL Raider home games.

Convention attendance for the month was up 2.0% YoY, supported by various returning and rotating tradeshows as well as the TwitchCon gamers event (30k attendees) that was held in Las Vegas for the first time.

Overall hotel occupancy matched last October at 87.7% as Weekend occupancy came in at 94.2% (+0.2 pts YoY), and Midweek occupancy reached 85.4% (up 0.3 pts), and ADR and RevPAR set records at $233 and $204 respectively, beating the prior monthly record tallies from March 2023

Click on graph for larger image.

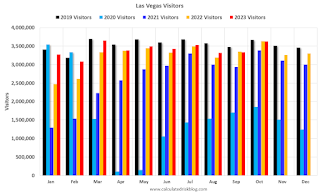

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (light blue), 2021 (purple), 2022 (orange), and 2023 (red).

Visitor traffic was down 0.2% compared to last October.

Note: There was almost no convention traffic from April 2020 through May 2021.