by Calculated Risk on 12/05/2023 08:00:00 AM

Tuesday, December 05, 2023

CoreLogic: US Home Prices Increased 4.7% Year-over-year in October

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: US Home Price Growth Continues Slow But Steady Increase in October, CoreLogic Reports

• U.S. single-family home prices increased by 4.7% year over year in September, the 141st straight month of annual appreciation.

• CoreLogic projects that annual home price growth will relax to 2.9% by October 2024.

• Northeastern states again led the country for annual appreciation in October, while four Western states saw slight losses.

...

U.S. single-family home price growth continued to increase modestly in October, posting a 4.7% year over-year increase. On a regional level, the Northeast again showed the biggest price rebound. The top five states with the highest annual appreciation in October are in that area of the country, with growth ranging from 10.3% in Connecticut to 9.3% in Maine and New Hampshire. The Northeast could be enjoying renewed home price gains in part due to a largely hybrid American workforce, in which employees need to be relatively close to major urban areas to allow for commutes to the office a few times per week.

“Home price growth maintained its upward momentum in October, which continues to reflect gains from the strong spring season and contrasts with last year's home price declines,” said Dr. Selma Hepp, chief economist for CoreLogic. “But even with high mortgage rates, October's price gains line up with historical trends and speak to the strength of some potential buyers’ purchasing power, as they continue to outnumber available homes for sale. Metros that are seeing relatively stronger price gains are those with higher job growth, as well as those with an influx of higher-income, in-migrating households.”

emphasis added

Monday, December 04, 2023

Tuesday: Job Openings, ISM Services

by Calculated Risk on 12/04/2023 07:06:00 PM

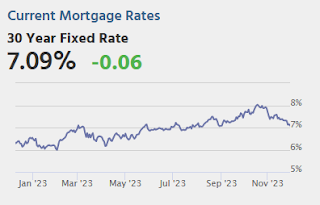

Apart from this past Friday, you'd have to go back to September 1st to see lower mortgage rates than today. ... the incoming economic data has the potential to send rates significantly higher or lower. ... The first key report is CPI, the consumer price index, which serves as the most widely traded update on inflation. The last release was on November 14th and it sent rates quickly lower. [30 year fixed 7.11%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for October.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

• Also at 10:00 AM, the ISM Services Index for November. The consensus is for 52.5, up from 51.8.

Update: Lumber Prices Up Slightly YoY

by Calculated Risk on 12/04/2023 01:42:00 PM

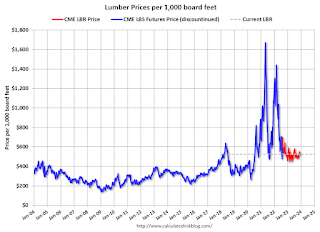

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

ICE (Black Knight) Mortgage Monitor: "Home prices continued sending mixed signals in October"

by Calculated Risk on 12/04/2023 10:12:00 AM

Today, in the Calculated Risk Real Estate Newsletter: IICE (Black Knight) Mortgage Monitor: "Home prices continued sending mixed signals in October"

A brief excerpt:

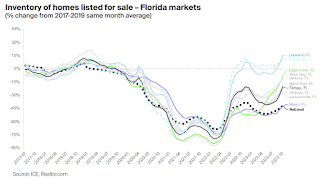

And on Florida inventory:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Florida has experienced some of the largest inventory gains in recent months

• In fact, six of the nine markets seeing the strongest inventory growth over the past three months – Palm Bay (+22pp), Lakeland (+21pp), Tampa (+19pp), Cape Coral (+18pp), North Port (+16pp) and Orlando (+14pp) – are located in the Sunshine State

• Inventory in Lakeland is now 15% above 2017-2019 averages, surpassing Austin for the largest surplus of homes for sale compared to prepandemic levels

• While Miami has also shown inventory improvements it continues to have the deepest inventory deficit in the state with 42% fewer homes for sale compared to 2017-2019 same-month averages, in line with the national average

• Florida will be worth watching in coming months to determine if rising inventory levels lead to softening prices

emphasis added

Housing December 4th Weekly Update: Inventory Down 1.8% Week-over-week, Up 1.0% Year-over-year

by Calculated Risk on 12/04/2023 08:16:00 AM

Click on graph for larger image.

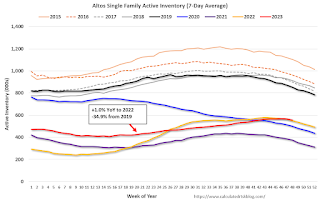

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, December 03, 2023

Sunday Night Futures

by Calculated Risk on 12/03/2023 11:40:00 PM

Weekend:

• Schedule for Week of December 3, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 7 and DOW futures are up 22 (fair value).

Oil prices were down over the last week with WTI futures at $74.07 per barrel and Brent at $78.88 per barrel. A year ago, WTI was at $80, and Brent was at $87 - so WTI oil prices were down 7% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.23 per gallon. A year ago, prices were at $3.37 per gallon, so gasoline prices are down $0.14 year-over-year.

Hotels: Occupancy Rate Decreased 1.4% Year-over-year

by Calculated Risk on 12/03/2023 09:33:00 AM

As expected due to the Thanksgiving holiday, U.S. hotel performance fell from the previous week, according to CoStar’s latest data through 25 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

19-25 November 2023 (percentage change from comparable week in 2022):

• Occupancy: 49.4% (-1.4%)

• Average daily rate (ADR): US$138.29 (+0.9%)

• Revenue per available room (RevPAR): US$68.32 (-0.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, December 02, 2023

Real Estate Newsletter Articles this Week: New Home Sales decrease to 679,000 Annual Rate in October

by Calculated Risk on 12/02/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales decrease to 679,000 Annual Rate in October

• Case-Shiller: National House Price Index Up 3.9% year-over-year in September; New all-time High

• Freddie Mac House Price Index Increased in October to New High; Up 6.0% Year-over-year

• Fannie and Freddie Serious Delinquencies in October: Single Family Declined, Multi-Family Increased

• Final Look at Local Housing Markets in October

• Inflation Adjusted House Prices 3.0% Below Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of December 3, 2023

by Calculated Risk on 12/02/2023 08:11:00 AM

The key report this week is the November employment report on Friday.

No major economic releases scheduled.

8:00 AM: Corelogic House Price index for October.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 9.55 million from 9.50 million in August.

10:00 AM: the ISM Services Index for November. The consensus is for 52.5, up from 51.8.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 120,000 jobs added, up from 113,000 in October.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $63.0 billion. The U.S. trade deficit was at $61.5 billion in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand, up from 218 thousand last week.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 150,000 jobs added in October, and the unemployment rate was at 3.9%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

Friday, December 01, 2023

Dec 1st COVID Update: Deaths and Hospitalizations Increased

by Calculated Risk on 12/01/2023 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 15,290 | 14,127 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,190 | 1,143 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

And here is a new graph I'm following on COVID in wastewater:

Note the recent surge in the Midwest.

Note the recent surge in the Midwest.This appears to be a leading indicator for COVID hospitalizations and deaths.