by Calculated Risk on 12/10/2023 08:21:00 AM

Sunday, December 10, 2023

FOMC Preview: No Change to Policy Expected

Most analysts expect there will be no change to FOMC policy at this meeting, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.7% in November. The FOMC's unemployment rate projection for Q4 was probably close.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of October 2023, PCE inflation increased 3.0 percent year-over-year (YoY), down from 3.4 percent YoY in September, and down from the recent peak of 7.1 percent in June 2022. So, the FOMC projection for Q4 2023 was too high.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 3.5 percent YoY, down from 3.7 percent in September, and down from the recent peak of 5.6 percent in February 2022. This remains a concern for the FOMC, however this includes shelter that was up 6.9% YoY in October (even though asking rents are slightly negative YoY). Also, core PCE inflation was fairly high in November and December 2022 - increasing at a 4.1% annual rate - and it seems likely YoY core PCE inflation will be below the low end of the FOMC Q4 projection.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

Saturday, December 09, 2023

Real Estate Newsletter Articles this Week: The "Home ATM" Mostly Closed in Q3

by Calculated Risk on 12/09/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Mostly Closed in Q3

• Q3 Update: Delinquencies, Foreclosures and REO

• 1st Look at Local Housing Markets in November with Comparison to 2019

• Asking Rents Down 1.1% Year-over-year

• ICE (Black Knight) Mortgage Monitor: "Home prices continued sending mixed signals in October"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of December 10, 2023

by Calculated Risk on 12/09/2023 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November Industrial Production, and the December New York Fed survey will be released this week.

The FOMC meets this week and no change to policy is expected.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for no change in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.1% year-over-year and core CPI to be up 4.0% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% decrease in retail sales.

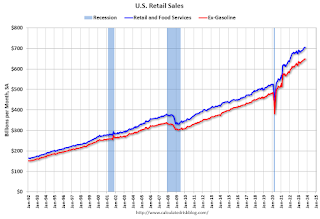

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand, unchanged from 220 thousand last week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 3.5, down from 9.1.

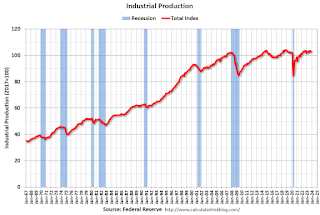

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

Friday, December 08, 2023

Dec 8th COVID Update: Hospitalizations Increased

by Calculated Risk on 12/08/2023 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 17,479 | 15,516 | ≤3,0001 | |

| Deaths per Week2 | 1,197 | 1,291 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

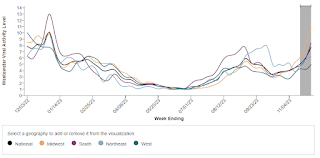

And here is a new graph I'm following on COVID in wastewater:

Note the recent surge in COVID.

Note the recent surge in COVID.This appears to be a leading indicator for COVID hospitalizations and deaths, and both will likely increase over the next several weeks.

AAR: November Carloads Down Slightly YoY; Intermodal Up

by Calculated Risk on 12/08/2023 04:30:00 PM

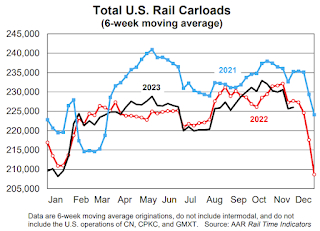

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

In the first 11 months of 2023, total carloads were 10.82 million, up 0.2% (21,700 carloads) over last year and up 0.5% (53,682 carloads) over 2021. ... In 2023 through November, intermodal originations totaled 11.68 million, down 6.0% (748,046 units) from 2022 and down 10.6% (1.39 million units) from 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2023:

Total originated carloads on U.S. railroads fell 0.01%, or 102 carloads, in November 2023 from the equivalent period in 2022. It was the fifth year-over-year decline for total carloads in the past six months, but most of those declines have been very small in percentage terms. Total carloads averaged 225,715 per week in November 2023, the fourth lowest of the 11 months so far this year. The Thanksgiving holiday typically holds down rail volumes in November.

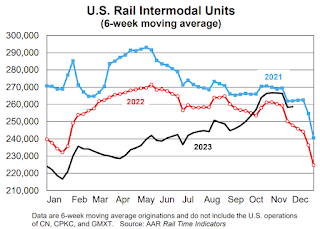

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):U.S. intermodal volume was up 5.0% in November 2023, its third straight year-over-year gain after 18 straight declines and the biggest year-over-year percentage gain for intermodal in 29 months. U.S. railroads averaged 255,981 originated containers and trailers per week in November 2023. That’s the fourth highest average intermodal volume for November on record (2017, 2018, and 2020 were higher).

Q4 GDP Tracking: Close to 1%

by Calculated Risk on 12/08/2023 02:00:00 PM

From BofA:

Our 4Q GDP tracking estimate remains at 1.0% q/q saar as higher than expected October construction spending was offset by lower than expected vehicle sales in November and a small downward revision in core capital goods orders in the final October print. [Dec 6th estimate]From Goldman:

emphasis added

We lowered our Q4 GDP tracking estimate by 0.1pp to +1.4% (qoq ar). Our Q4 domestic final sales estimate remains at +2.1% (qoq ar). [Dec 7th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on December 7, down from 1.3 percent on December 6 after rounding. [Dec th estimate]

Q3 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 12/08/2023 12:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Q3 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. And there was a slight increase.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

However, I argued this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes.

...

Here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q2 2023 (Q3 2023 data will be released in a few weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.9% of loans are under 3%, 60.3% are under 4%, and 79.9% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Comments on November Employment Report

by Calculated Risk on 12/08/2023 09:27:00 AM

The headline jobs number in the November employment report was at expectations, however employment for the previous two months was revised down by 35,000, combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.7%.

In October, the year-over-year employment change was 2.79 million jobs.

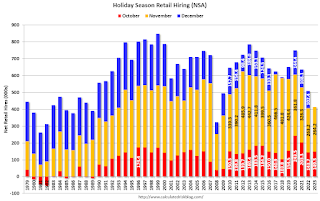

Seasonal Retail Hiring

Typically, retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. Note: I expect the long-term trend will be down with more and more internet holiday shopping.

This graph really shows the collapse in retail hiring in 2008. Since then, seasonal hiring had increased back close to more normal levels. Note: I expect the long-term trend will be down with more and more internet holiday shopping.Retailers hired 264 thousand workers Not Seasonally Adjusted (NSA) net in November. This was about the same as last year and suggests similar real retail sales this holiday season as last year.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate was unchanged in November at 83.3% from 83.3% in October, and the 25 to 54 employment population ratio declined to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.0% YoY in November.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons decreased by 295,000 to 4.0 million in November. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in November to 3.99 million from 4.28 million in October. This is below pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.0% from 7.2% in the previous month. This is down from the record high in April 2020 of 22.9% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is at the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.150 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.282 million the previous month.

This is at pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20231 | 35 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was at consensus expectations; however, employment for the previous two months was revised down by 35,000, combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.7%.

November Employment Report: 199 thousand Jobs, 3.7% Unemployment Rate

by Calculated Risk on 12/08/2023 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.

...

he change in total nonfarm payroll employment for September was revised down by 35,000, from +297,000 to +262,000, and the change for October remained at +150,000. With these revisions, employment in September and October combined is 35,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for September and October were revised down 35 thousand, combined.

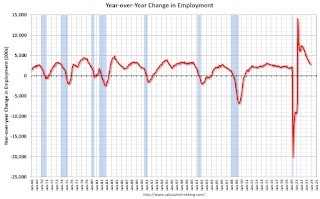

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.79 million jobs. Employment was up solidly year-over-year but has slowed to more normal levels of job growth recently.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.8% in November, from 62.7% in October. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.8% in November, from 62.7% in October. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.5% from 60.2% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

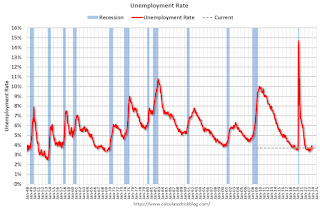

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased to 3.7% in November from 3.9% in October.

This was at consensus expectations, however, September and October payrolls were revised down by 35,000 combined.

Thursday, December 07, 2023

Friday: Employment Report

by Calculated Risk on 12/07/2023 07:24:00 PM

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for December).