by Calculated Risk on 12/11/2023 10:30:00 AM

Monday, December 11, 2023

Why 25 to 54 is the Prime Working Age group for the Participation Rate

A reader asks if we could look at the participation rate for 25 to 64, as opposed to 25 to 54, since many people work until they receive Social Security and Medicare.

First, the BLS provides seasonally adjusted data for the "Prime" working age group (25 to 54), but only NSA data for the 55 to 64 cohort. So, this makes tracking a larger Prime+ group more difficult.

Second, the reason we use the 25 to 54 group is that the participation rate is fairly steady across the entire age spectrum.

Housing December 11th Weekly Update: Inventory Down 1.7% Week-over-week, Up 1.9% Year-over-year

by Calculated Risk on 12/11/2023 08:19:00 AM

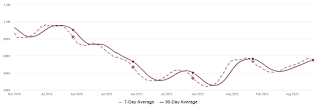

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, December 10, 2023

Sunday Night Futures

by Calculated Risk on 12/10/2023 06:16:00 PM

Weekend:

• Schedule for Week of December 10, 2023

• FOMC Preview: No Change to Policy Expected

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 4 and DOW futures are up 38 (fair value).

Oil prices were down over the last week with WTI futures at $71.23 per barrel and Brent at $75.84 per barrel. A year ago, WTI was at $73, and Brent was at $78 - so WTI oil prices were down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago, prices were at $3.22 per gallon, so gasoline prices are down $0.10 year-over-year.

Realtor.com Reports Active Inventory UP 3.1% YoY; New Listings up 5.6% YoY

by Calculated Risk on 12/10/2023 04:00:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending December 2, 2023

• Active inventory increased slightly, with for-sale homes 3.1% above year ago levels. Active listings exceeded last year’s levels again this week, with the rate of increase picking up steam from the previous week (+3.1% year-over-year vs +1.8%). However, on an absolute basis, active inventory continued to fall below its peak earlier in the month, as is seasonally typical.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 5.6% from one year ago. New listings registered lower than prior year levels from mid-2022 through roughly 6 weeks ago, as the mortgage rate lock-in effect froze homeowners with low-rate existing mortgages in place. More recently the trend has reversed as new listings during the week outpaced the same week in the previous year by 5.6%.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 4th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

FOMC Preview: No Change to Policy Expected

by Calculated Risk on 12/10/2023 08:21:00 AM

Most analysts expect there will be no change to FOMC policy at this meeting, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | |

| June 2023 | 0.7 to 1.2 | 0.9 to 1.5 | 1.6 to 2.0 | |

The unemployment rate was at 3.7% in November. The FOMC's unemployment rate projection for Q4 was probably close.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | |

| June 2023 | 4.0 to 4.3 | 4.3 to 4.6 | 4.3 to 4.6 | |

As of October 2023, PCE inflation increased 3.0 percent year-over-year (YoY), down from 3.4 percent YoY in September, and down from the recent peak of 7.1 percent in June 2022. So, the FOMC projection for Q4 2023 was too high.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | |

| June 2023 | 3.0 to 3.5 | 2.3 to 2.8 | 2.0 to 2.4 | |

PCE core inflation increased 3.5 percent YoY, down from 3.7 percent in September, and down from the recent peak of 5.6 percent in February 2022. This remains a concern for the FOMC, however this includes shelter that was up 6.9% YoY in October (even though asking rents are slightly negative YoY). Also, core PCE inflation was fairly high in November and December 2022 - increasing at a 4.1% annual rate - and it seems likely YoY core PCE inflation will be below the low end of the FOMC Q4 projection.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | |

| June 2023 | 3.7 to 4.2 | 2.5 to 3.1 | 2.0 to 2.4 | |

Saturday, December 09, 2023

Real Estate Newsletter Articles this Week: The "Home ATM" Mostly Closed in Q3

by Calculated Risk on 12/09/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Mostly Closed in Q3

• Q3 Update: Delinquencies, Foreclosures and REO

• 1st Look at Local Housing Markets in November with Comparison to 2019

• Asking Rents Down 1.1% Year-over-year

• ICE (Black Knight) Mortgage Monitor: "Home prices continued sending mixed signals in October"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of December 10, 2023

by Calculated Risk on 12/09/2023 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November Industrial Production, and the December New York Fed survey will be released this week.

The FOMC meets this week and no change to policy is expected.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for no change in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.1% year-over-year and core CPI to be up 4.0% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

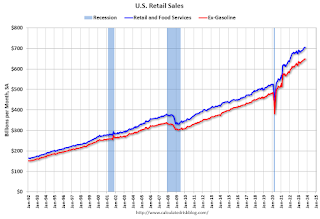

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% decrease in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand, unchanged from 220 thousand last week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 3.5, down from 9.1.

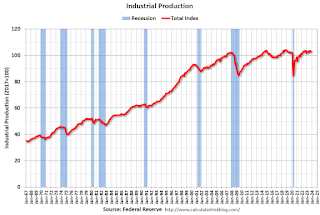

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

Friday, December 08, 2023

Dec 8th COVID Update: Hospitalizations Increased

by Calculated Risk on 12/08/2023 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 17,479 | 15,516 | ≤3,0001 | |

| Deaths per Week2 | 1,197 | 1,291 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

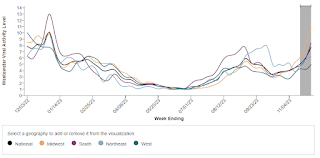

And here is a new graph I'm following on COVID in wastewater:

Note the recent surge in COVID.

Note the recent surge in COVID.This appears to be a leading indicator for COVID hospitalizations and deaths, and both will likely increase over the next several weeks.

AAR: November Carloads Down Slightly YoY; Intermodal Up

by Calculated Risk on 12/08/2023 04:30:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

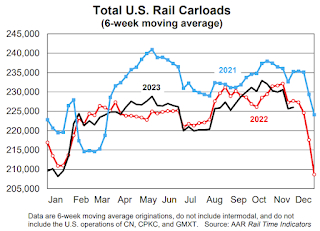

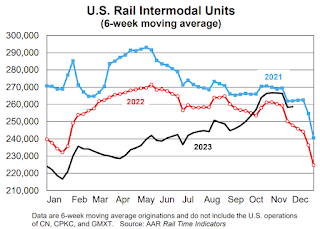

In the first 11 months of 2023, total carloads were 10.82 million, up 0.2% (21,700 carloads) over last year and up 0.5% (53,682 carloads) over 2021. ... In 2023 through November, intermodal originations totaled 11.68 million, down 6.0% (748,046 units) from 2022 and down 10.6% (1.39 million units) from 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2023:

Total originated carloads on U.S. railroads fell 0.01%, or 102 carloads, in November 2023 from the equivalent period in 2022. It was the fifth year-over-year decline for total carloads in the past six months, but most of those declines have been very small in percentage terms. Total carloads averaged 225,715 per week in November 2023, the fourth lowest of the 11 months so far this year. The Thanksgiving holiday typically holds down rail volumes in November.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):U.S. intermodal volume was up 5.0% in November 2023, its third straight year-over-year gain after 18 straight declines and the biggest year-over-year percentage gain for intermodal in 29 months. U.S. railroads averaged 255,981 originated containers and trailers per week in November 2023. That’s the fourth highest average intermodal volume for November on record (2017, 2018, and 2020 were higher).

Q4 GDP Tracking: Close to 1%

by Calculated Risk on 12/08/2023 02:00:00 PM

From BofA:

Our 4Q GDP tracking estimate remains at 1.0% q/q saar as higher than expected October construction spending was offset by lower than expected vehicle sales in November and a small downward revision in core capital goods orders in the final October print. [Dec 6th estimate]From Goldman:

emphasis added

We lowered our Q4 GDP tracking estimate by 0.1pp to +1.4% (qoq ar). Our Q4 domestic final sales estimate remains at +2.1% (qoq ar). [Dec 7th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on December 7, down from 1.3 percent on December 6 after rounding. [Dec th estimate]