by Calculated Risk on 12/18/2023 07:31:00 PM

Monday, December 18, 2023

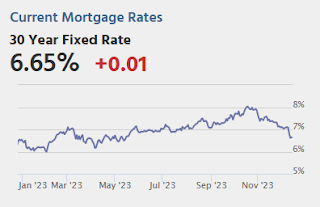

Tuesday: Housing Starts

Little--if anything--happened to create any meaningful movement in the underlying bond market. Treasury yields have also flat-lined since last Thursday afternoon. Financial markets will now be waiting until the first week of January for the next piece of economic data that could truly be considered "top tier" (a description that arguably only applies to the jobs report and the Consumer Price Index these days). [30 year fixed 6.65%]Tuesday:

emphasis added

• At 8:30 AM ET, Housing Starts for November. The consensus is for 1.360 million SAAR, down from 1.372 million SAAR

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.26% in November"

by Calculated Risk on 12/18/2023 04:29:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.26% in November

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of November 30, 2023. According to MBA’s estimate, 130,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In November 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 2 basis points to 0.16%. Ginnie Mae loans in forbearance decreased 5 basis points to 0.47%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 2 basis points to 0.30%.

“Nearly 96 percent of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Meanwhile, the performance of loan workouts is solid, but declined last month. Roughly 70 percent of loan workouts initiated since 2020 are current.”

Added Walsh, “MBA forecasts an economic downturn in 2024, and there are signs of early distress in other credit types such as car loans and credit cards. Those borrowers who struggled in making their mortgage payments in the past may find themselves in similar situations in a softening economy and rising unemployment.”

emphasis added

Click on graph for larger image.

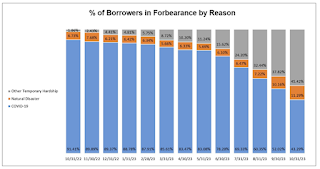

Click on graph for larger image.This graph shows the reasons for forbearance: COVID-19, Naturnal Disaster, other Temporary Hardship.

From the MBA:

• By reason, 53.6% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 34.3% of borrowers are in forbearance because of COVID-19. Another 12.1% are in forbearance because of a natural disaster.At the end of November, there were about 130,000 homeowners in forbearance plans.

Early Read on Existing Home Sales in November; Treasury and MBS Yields: There and Back Again

by Calculated Risk on 12/18/2023 02:13:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Early Read on Existing Home Sales in November

Excerpt:

From housing economist Tom Lawler:There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

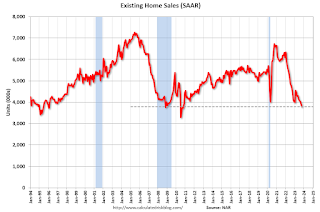

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.87 million in November, up 2.1% from October’s preliminary pace and down 6.1% from last November’s seasonally adjusted pace.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 4.5% from last November.

CR Note: The National Association of Realtors (NAR) is scheduled to release November existing home sales on Wednesday, December 20, 2023, at 10:00 AM ET. The consensus is for 3.78 million SAAR.

NAHB: Builder Confidence Increased in December

by Calculated Risk on 12/18/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 37, up from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Rises on Falling Interest Rates

Falling mortgage rates helped end a four-month decline in builder confidence, and recent economic data signal improving housing conditions heading into 2024.

Builder confidence in the market for newly built single-family homes rose three points to 37 in December, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“With mortgage rates down roughly 50 basis points over the past month, builders are reporting an uptick in traffic as some prospective buyers who previously felt priced out of the market are taking a second look,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “With the nation facing a considerable housing shortage, boosting new home production is the best way to ease the affordability crisis, expand housing inventory and lower inflation.”

“The housing market appears to have passed peak mortgage rates for this cycle, and this should help to spur home buyer demand in the coming months, with the HMI component measuring future sales expectations up six points in December,” said NAHB Chief Economist Robert Dietz.

Dietz added that the recent pessimism in builder confidence this fall has been somewhat counter to gains for the pace of single-family permits and starts during this time frame.

“Our statistical analysis indicates that temporary and outsized differences between builder sentiment and starts occur after short-term interest rates rise dramatically, increasing the cost of land development and builder loans used by private builders,” Dietz noted. “In turn, higher financing costs for home builders and land developers add another headwind for housing supply in a market low on resale inventory. While the Federal Reserve is fighting inflation, state and local policymakers could also help by reducing the regulatory burdens on the cost of land development and home building, thereby allowing more attainable housing supply to the market. Looking forward, as rates moderate, this temporary difference between sentiment and construction activity will decline.”

But with mortgage rates still running above 7% throughout November, per Freddie Mac data, many builders continue to reduce home prices to boost sales. In December, 36% of builders reported cutting home prices, tying the previous month’s high point for 2023. The average price reduction in December remained at 6%, unchanged from the previous month. Meanwhile, 60% of builders provided sales incentives of all forms in December, the same as November but down slightly from 62% in October.

...

The HMI index gauging traffic of prospective buyers in December rose three points 24, the component measuring sales expectations in the next six months increased six points to 45 and the component charting current sales condition held steady at 40.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 51, the Midwest fell one point to 34, the South dropped three points to 39 and the West posted a four-point decline to 31.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Housing December 18th Weekly Update: Inventory Down 1.4% Week-over-week, Up 3.0% Year-over-year

by Calculated Risk on 12/18/2023 08:12:00 AM

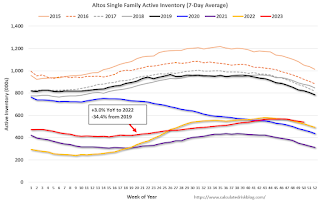

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, December 17, 2023

Sunday Night Futures

by Calculated Risk on 12/17/2023 06:11:00 PM

Weekend:

• Schedule for Week of December 17, 2023

Monday:

• At 10:00 AM ET, The December NAHB homebuilder survey. The consensus is for a reading of 37, up from 34. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $71.43 per barrel and Brent at $76.55 per barrel. A year ago, WTI was at $74, and Brent was at $80 - so WTI oil prices were down 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.04 per gallon. A year ago, prices were at $3.10 per gallon, so gasoline prices are down $0.06 year-over-year.

Hotels: Occupancy Rate Decreased 1.1% Year-over-year

by Calculated Risk on 12/17/2023 08:17:00 AM

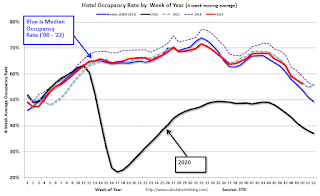

U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 9 December. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

3-9 December 2023 (percentage change from comparable week in 2022):

• Occupancy: 58.7% (-1.1%)

• Average daily rate (ADR): US$153.36 (+4.5%)

• Revenue per available room (RevPAR): US$89.98 (+3.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, December 16, 2023

Real Estate Newsletter Articles this Week: The Coming Fed Rate Cuts and the Impact on Mortgage Rates

by Calculated Risk on 12/16/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-December

• Part 2: Current State of the Housing Market; Overview for mid-December

• The Coming Fed Rate Cuts and the Impact on Mortgage Rates

• 3rd Look at Local Housing Markets in November with Comparison to 2019

• 2nd Look at Local Housing Markets in November with Comparison to 2019

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of December 17, 2023

by Calculated Risk on 12/16/2023 08:11:00 AM

The key economic reports this week are Housing Starts, New Home Sales, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 37, up from 34. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for November.

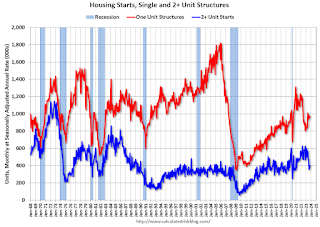

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.360 million SAAR, down from 1.372 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 3.78 million SAAR, down from 3.79 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 3.78 million SAAR, down from 3.79 million.The graph shows existing home sales from 1994 through the report last month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand, up from 202 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2023 (Third estimate). The consensus is for real GDP at 5.2% annualized, unchanged from the second estimate of 5.2%.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of -3.0, up from -5.9.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Durable Goods Orders for November. The consensus is for a 0.1% increase..

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for no change in the PCE price index, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.8% YoY, and core PCE prices up 3.4% YoY.

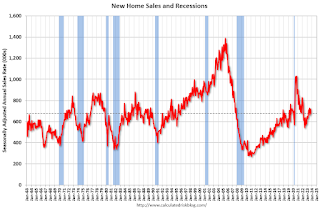

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 695 thousand SAAR, up from 679 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December).

10:00 AM: State Employment and Unemployment (Monthly) for November 2023

Friday, December 15, 2023

Dec 15th COVID Update: Hospitalizations Increased

by Calculated Risk on 12/15/2023 07:41:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 18,233 | 17,664 | ≤3,0001 | |

| Deaths per Week2 | 1,160 | 1,305 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

And here is a new graph I'm following on COVID in wastewater as of Dec 9th:

Note the recent surge in COVID.

Note the recent surge in COVID.This appears to be a leading indicator for COVID hospitalizations and deaths, and both will likely increase over the next several weeks.