by Calculated Risk on 12/20/2023 10:00:00 AM

Wednesday, December 20, 2023

NAR: Existing-Home Sales Increased to 3.82 million SAAR in November

From the NAR: Existing-Home Sales Expanded 0.8% in November, Ending Five-Month Slide

Existing-home sales grew in November, breaking a streak of five consecutive monthly declines, according to the National Association of REALTORS®. Among the four major U.S. regions, sales climbed in the Midwest and South but receded in the Northeast and West. All four regions experienced year-over-year sales decreases.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – elevated 0.8% from October to a seasonally adjusted annual rate of 3.82 million in November. Year-over-year, sales fell 7.3% (down from 4.12 million in November 2022).

...

Total housing inventory registered at the end of November was 1.13 million units, down 1.7% from October but up 0.9% from one year ago (1.12 million). Unsold inventory sits at a 3.5-month supply at the current sales pace, down from 3.6 months in October but up from 3.3 months in November 2022.

emphasis added

Click on graph for larger image.

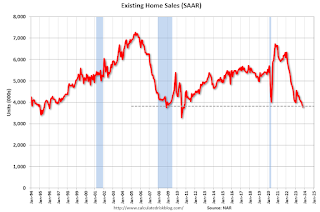

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in November (3.82 million SAAR) were up 0.8% from the previous month and were 7.3% below the November 2022 sales rate.

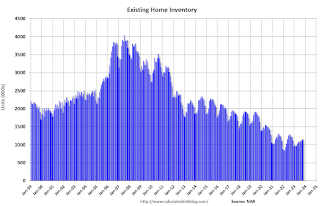

According to the NAR, inventory decreased to 1.13 million in November from 1.15 million the previous month.

According to the NAR, inventory decreased to 1.13 million in November from 1.15 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 0.9% year-over-year (blue) in November compared to November 2022.

Inventory was up 0.9% year-over-year (blue) in November compared to November 2022. Months of supply (red) decreased to 3.5 months in November from 3.6 months the previous month.

This was above the consensus forecast. I'll have more later.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 12/20/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 15, 2023.

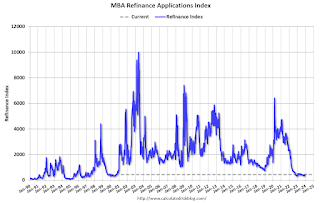

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 18 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 18 percent lower than the same week one year ago.

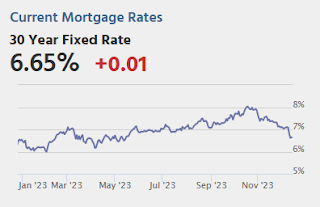

"With the positive news about the drop in inflation, and the FOMC projections proclaiming a pivot towards rate cuts, the 30-year fixed mortgage rate reached its lowest level since June 2023, declining to 6.83 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. "At least as of last week, borrowers' response to this rate move was rather tepid. VA refinance applications jumped 18 percent for the week, but otherwise, both refinance and purchase applications showed small declines."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.83 percent from 7.07 percent, with points increasing to 0.60 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

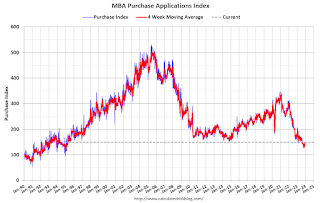

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

Tuesday, December 19, 2023

Wednesday: Existing Home Sales

by Calculated Risk on 12/19/2023 07:43:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 3.78 million SAAR, down from 3.79 million.

4th Look at Local Housing Markets in November, California Home Sales Down 6% YoY in October

by Calculated Risk on 12/19/2023 02:57:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in November

A brief excerpt:

The National Association of Realtors (NAR) is scheduled to release November existing home sales tomorrow, Wednesday, December 20, 2023, at 10:00 AM ET. The consensus is for 3.78 million SAAR. Housing economist Tom Lawler expects the NAR to report sales of 3.87 million SAAR.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The cycle low was last month at 3.79 million.

NOTE: The tables for active listings, new listings and closed sales all include a comparison to November 2019 for each local market (some 2019 data is not available).

This is the fourth look at several early reporting local markets in November. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in November were mostly for contracts signed in September and October. Since 30-year fixed mortgage rates were in the 7.2% in September, and 7.6% in October, compared to the mid-6% range the previous year, closed sales were down year-over-year in November.

...

And a table of November sales.

In November, sales in these markets were down 6.0% YoY. In October, these same markets were down 9.2% YoY Not Seasonally Adjusted (NSA). Note that sales were up YoY in Austin, Houston and mid-Florida.

Sales in all of these markets are down compared to November 2019, although sales in Houston were close to 2019 levels.

...

The data released so far suggests the November existing home sales report will show another YoY decline, likely above the cycle low of 3.79 million SAAR last month. This will be the 27th consecutive month with a YoY decline in sales.

Note that the low during the housing bust was 3.30 million in July 2010.

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

Single Family Starts Increase Sharply in November, Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 12/19/2023 09:21:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Single Family Starts Increase Sharply in November, Near Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Total starts were up 9.3% in November compared to November 2022. And starts year-to-date are down 9.9% compared to last year.

Starts were down year-over-year for 16 of the last 19 months (May, July and now November 2023 were the exceptions), and total starts will be down this year - although the year-over-year comparisons are easier in December.

Housing Starts Increased to 1.560 million Annual Rate in November

by Calculated Risk on 12/19/2023 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in November were at a seasonally adjusted annual rate of 1,560,000. This is 14.8 percent above the revised October estimate of 1,359,000 and is 9.3 percent above the November 2022 rate of 1,427,000. Single‐family housing starts in November were at a rate of 1,143,000; this is 18.0 percent above the revised October figure of 969,000. The November rate for units in buildings with five units or more was 404,000.

Building Permits:

Privately‐owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,460,000. This is 2.5 percent below the revised October rate of 1,498,000, but is 4.1 percent above the November 2022 rate of 1,402,000. Single‐family authorizations in November were at a rate of 976,000; this is 0.7 percent above the revised October figure of 969,000. Authorizations of units in buildings with five units or more were at a rate of 435,000 in November.

emphasis added

Click on graph for larger image.

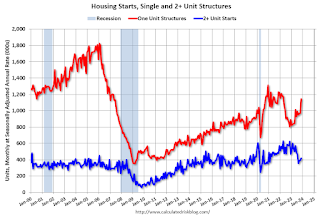

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in November compared to October. Multi-family starts were down 33.1% year-over-year in October.

Single-family starts (red) increased sharply in November and were up 42.2% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in November were well above expectations, however, starts in September and October were revised down slightly, combined.

I'll have more later …

Monday, December 18, 2023

Tuesday: Housing Starts

by Calculated Risk on 12/18/2023 07:31:00 PM

Little--if anything--happened to create any meaningful movement in the underlying bond market. Treasury yields have also flat-lined since last Thursday afternoon. Financial markets will now be waiting until the first week of January for the next piece of economic data that could truly be considered "top tier" (a description that arguably only applies to the jobs report and the Consumer Price Index these days). [30 year fixed 6.65%]Tuesday:

emphasis added

• At 8:30 AM ET, Housing Starts for November. The consensus is for 1.360 million SAAR, down from 1.372 million SAAR

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.26% in November"

by Calculated Risk on 12/18/2023 04:29:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.26% in November

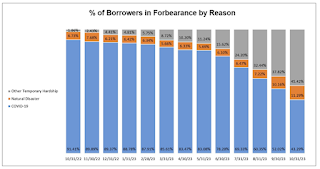

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of November 30, 2023. According to MBA’s estimate, 130,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In November 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 2 basis points to 0.16%. Ginnie Mae loans in forbearance decreased 5 basis points to 0.47%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 2 basis points to 0.30%.

“Nearly 96 percent of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Meanwhile, the performance of loan workouts is solid, but declined last month. Roughly 70 percent of loan workouts initiated since 2020 are current.”

Added Walsh, “MBA forecasts an economic downturn in 2024, and there are signs of early distress in other credit types such as car loans and credit cards. Those borrowers who struggled in making their mortgage payments in the past may find themselves in similar situations in a softening economy and rising unemployment.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the reasons for forbearance: COVID-19, Naturnal Disaster, other Temporary Hardship.

From the MBA:

• By reason, 53.6% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 34.3% of borrowers are in forbearance because of COVID-19. Another 12.1% are in forbearance because of a natural disaster.At the end of November, there were about 130,000 homeowners in forbearance plans.

Early Read on Existing Home Sales in November; Treasury and MBS Yields: There and Back Again

by Calculated Risk on 12/18/2023 02:13:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Early Read on Existing Home Sales in November

Excerpt:

From housing economist Tom Lawler:There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.87 million in November, up 2.1% from October’s preliminary pace and down 6.1% from last November’s seasonally adjusted pace.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 4.5% from last November.

CR Note: The National Association of Realtors (NAR) is scheduled to release November existing home sales on Wednesday, December 20, 2023, at 10:00 AM ET. The consensus is for 3.78 million SAAR.

NAHB: Builder Confidence Increased in December

by Calculated Risk on 12/18/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 37, up from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Rises on Falling Interest Rates

Falling mortgage rates helped end a four-month decline in builder confidence, and recent economic data signal improving housing conditions heading into 2024.

Builder confidence in the market for newly built single-family homes rose three points to 37 in December, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“With mortgage rates down roughly 50 basis points over the past month, builders are reporting an uptick in traffic as some prospective buyers who previously felt priced out of the market are taking a second look,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “With the nation facing a considerable housing shortage, boosting new home production is the best way to ease the affordability crisis, expand housing inventory and lower inflation.”

“The housing market appears to have passed peak mortgage rates for this cycle, and this should help to spur home buyer demand in the coming months, with the HMI component measuring future sales expectations up six points in December,” said NAHB Chief Economist Robert Dietz.

Dietz added that the recent pessimism in builder confidence this fall has been somewhat counter to gains for the pace of single-family permits and starts during this time frame.

“Our statistical analysis indicates that temporary and outsized differences between builder sentiment and starts occur after short-term interest rates rise dramatically, increasing the cost of land development and builder loans used by private builders,” Dietz noted. “In turn, higher financing costs for home builders and land developers add another headwind for housing supply in a market low on resale inventory. While the Federal Reserve is fighting inflation, state and local policymakers could also help by reducing the regulatory burdens on the cost of land development and home building, thereby allowing more attainable housing supply to the market. Looking forward, as rates moderate, this temporary difference between sentiment and construction activity will decline.”

But with mortgage rates still running above 7% throughout November, per Freddie Mac data, many builders continue to reduce home prices to boost sales. In December, 36% of builders reported cutting home prices, tying the previous month’s high point for 2023. The average price reduction in December remained at 6%, unchanged from the previous month. Meanwhile, 60% of builders provided sales incentives of all forms in December, the same as November but down slightly from 62% in October.

...

The HMI index gauging traffic of prospective buyers in December rose three points 24, the component measuring sales expectations in the next six months increased six points to 45 and the component charting current sales condition held steady at 40.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 51, the Midwest fell one point to 34, the South dropped three points to 39 and the West posted a four-point decline to 31.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.