by Calculated Risk on 12/22/2023 08:30:00 AM

Friday, December 22, 2023

Personal Income increased 0.4% in November; Spending increased 0.2%

The BEA released the Personal Income and Outlays report for November:

Personal income increased $81.6 billion (0.4 percent at a monthly rate) in November, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $71.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $46.7 billion (0.2 percent).The November PCE price index increased 2.6 percent year-over-year (YoY), down from 2.9 percent YoY in October, and down from the recent peak of 7.1 percent in June 2022.

The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI increased 0.4 percent in November and real PCE increased 0.3 percent; goods increased 0.5 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through November 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was slightly below expectations.

Using the two-month method to estimate Q4 real PCE growth, real PCE was increasing at a 2.3% annual rate in Q4 2023. (Using the mid-month method, real PCE was increasing at 3.1%). This suggests solid PCE growth in Q4.

Thursday, December 21, 2023

Friday: Personal Income and Outlays, Durable Goods, New Home Sales

by Calculated Risk on 12/21/2023 07:35:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for November. The consensus is for a 0.1% increase..

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for no change in the PCE price index, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.8% YoY, and core PCE prices up 3.4% YoY.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for 695 thousand SAAR, up from 679 thousand in October.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for December).

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for November 2023

December Vehicle Sales Forecast: 15.7 million SAAR, Up 16% YoY

by Calculated Risk on 12/21/2023 04:00:00 PM

From WardsAuto: December U.S. Light-Vehicle Sales Tracking to End Year on Positive Note (pay content). Brief excerpt:

Higher inventory and increased discounting, combined with a rebound in fleet deliveries, will lead December's results. With Q4 totaling a 15.5 million-unit annualized rate, sales in entire-2023 will total a 4-year-high 15.4 million units. Inventory will enter 2024 31% higher than a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for December (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.7 million SAAR, would be up 2.5% from last month, and up 16% from a year ago.

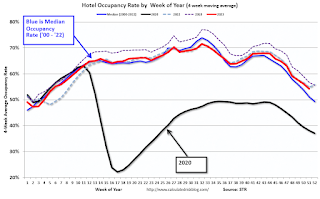

Hotels: Occupancy Rate Increased 1.1% Year-over-year

by Calculated Risk on 12/21/2023 02:10:00 PM

U.S. hotel performance was expectedly lower from the previous week, but year-over-year comparisons were positive, according to CoStar’s latest data through 16 December. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

10-16 December 2023 (percentage change from comparable week in 2022):

• Occupancy: 54.7% (+1.1%)

• Average daily rate (ADR): US$142.62 (+4.7%)

• Revenue per available room (RevPAR): US$77.99 (+5.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

ICE: Mortgage Delinquency Rate Increased Slightly in November

by Calculated Risk on 12/21/2023 10:01:00 AM

From ICE (formerly Black Knight): ICE First Look at November Mortgage Performance: Delinquencies Historically Low Despite Seasonal Rise; Performance of Recent Originations Worth Watching

• The national delinquency rate edged higher to 3.39% in November – down 10 basis points (bps) from the same time last year – but remains 64 bps below pre-pandemic levels

• Likewise, early-stage delinquencies among VA loans hit their highest non-pandemic levels since 2009, as rising interest rates have begun to impact performance among recently originated loans

• Serious delinquencies (90+ days past due) rose to 459K, but remain down 123K (-21%) from November 2022

• Foreclosure starts decreased -12.2% in November to 29K with active foreclosure inventory falling to 216K, some 23% and 24% below 2019 levels respectively

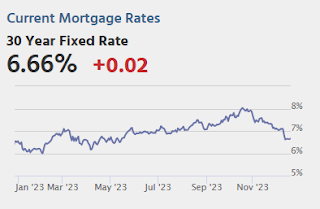

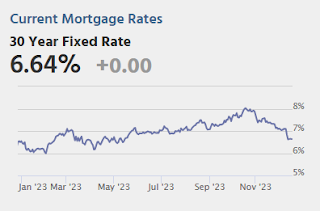

• Prepayment activity fell again under continued pressure from seasonal homebuying patterns along with the residual effects of 30-year rates climbing above 7.75% the month prior

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2023 | Oct 2023 | Nov 2022 | Nov 2019 | |

| Delinquent | 3.39% | 3.26% | 3.01% | 3.53% |

| In Foreclosure | 0.41% | 0.41% | 0.37% | 0.47% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,804,000 | 1,734,000 | 1,734,000 | 1,868,000 |

| Number of properties in foreclosure pre-sale inventory: | 216,000 | 217,000 | 196,000 | 248,000 |

| Total Properties | 2,020,000 | 1,951,000 | 1,808,000 | 2,116,000 |

Q3 GDP Growth Revised down to 4.9% Annual Rate

by Calculated Risk on 12/21/2023 08:38:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, Third Quarter 2023

Real gross domestic product (GDP) increased at an annual rate of 4.9 percent in the third quarter of 2023, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.6% to 3.1%. Residential investment was revised up from 6.2% to 6.7%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 5.2 percent. The update primarily reflected a downward revision to consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down (refer to "Updates to GDP").

The increase in real GDP reflected increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment. Imports increased.

emphasis added

Weekly Initial Unemployment Claims Increase to 205,000

by Calculated Risk on 12/21/2023 08:30:00 AM

The DOL reported:

In the week ending December 16, the advance figure for seasonally adjusted initial claims was 205,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 202,000 to 203,000. The 4-week moving average was 212,000, a decrease of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 213,250 to 213,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,000.

The previous week was revised up.

Weekly claims were well below the consensus forecast.

Wednesday, December 20, 2023

Thursday: GDP, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 12/20/2023 07:52:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 218 thousand, up from 202 thousand last week.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2023 (Third estimate). The consensus is for real GDP at 5.2% annualized, unchanged from the second estimate of 5.2%.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of -3.0, up from -5.9.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

Review: Ten Economic Questions for 2023

by Calculated Risk on 12/20/2023 02:05:00 PM

At the end of each year, I post Ten Economic Questions for the following year (2023). I followed up with a brief post on each question. Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments.

I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong. As an example, when the pandemic hit, I switched from being mostly positive on the economy to calling a recession in early March 2020.

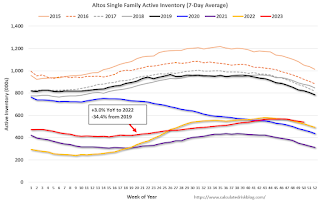

10) Question #10 for 2023: Will inventory increase further in 2023?

"The bottom line is inventory will probably increase year-over-year in 2023."

Here is a graph from Altos Research showing active single-family inventory through December 15, 2023.

The red line is for 2023. The black line is for 2019. Note that inventory is up from the record low for the same week in 2021, but still well below normal levels.

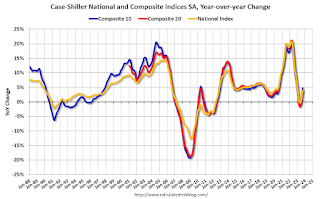

9) Question #9 for 2023: What will happen with house prices in 2023?

"[M]ost homeowners have substantial equity, and a low fixed-rate mortgage, and they can afford the monthly payments. So, it is extremely unlikely that we see a surge in distressed sales like happened after the housing bubble. And that means prices probably won’t decline sharply like in 2008 when prices fell about 12% according to the Case-Shiller National Index.

So, based on my inventory and mortgage rate forecasts, my guess is that year-over-year house prices will decrease in 2023, probably in the low-to-mid single digit range. "

I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!

I was correct about prices not falling sharply, but house prices actually increased in 2023. That is why I changed my mind!As of September, the National Case-Shiller index SA was up 3.9% year-over-year. (Case-Shiller for October will be released next week).

It appears prices will still be up mid-single digits in December.

8) Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

"[M]y guess is that new home sales will bottom for this cycle in 2023, down another 15% to 20% from 2022 levels.

My guess is multi-family starts will decline in 2023 as rents soften and as the record number of housing units under construction are completed. Total starts will likely be down around 15% to 20% year-over-year in 2023, depending on how quickly multifamily starts slow down."

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.

I was expecting further weakness for new home sales early in the year, and new home sales actually bottomed in July 2022.This graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in October 2023 were up 17.7% from October 2022. Year-to-date sales are up 4.6% compared to the same period in 2022.

The low level of existing home inventory, combined with mortgage rate buydowns, helped new home sales increase in 2023.

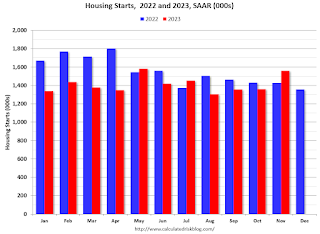

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).

The next graph shows housing starts for 2022 and 2023 by month (Seasonally Adjusted Annual Rate).Total starts year-to-date are down 9.9% compared to last year.

This was a somewhat smaller decline for total starts than I expected.

7) Question #7 for 2023: How much will wages increase in 2023?

"My sense is nominal wages will increase in the 3.0% to 3.5% YoY range in 2023 according to the CES."

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.0% YoY in November.

6) Question #6 for 2023: What will the Fed Funds rate be in December 2023?

"My guess is there will be around 2 rate hikes in 2023, and if there are more, the FOMC will be under pressure later in 2023 to cut rates putting the Fed Funds rate under 5% at the end of 2023."There were 4 rate hikes in 2023 with the Fed Funds rate target range at 5-1/4 to 5-1/2 percent in December 2023. The Fed is now expected to cut rates in 2024.

5) Question #5 for 2023: What will the YoY core inflation rate be in December 2023?

"My guess is core PCE inflation (year-over-year) will decrease in 2023 (from the current 4.7%), and I think core PCE inflation will be below 3% by the end of 2023."According to the October Personal Income and Outlays report, the October PCE price index increased 3.0 percent year-over-year and the October PCE price index, excluding food and energy, increased 3.5 percent year-over-year. And PCE measures of inflation are expected to slow further in November and December.

4) Question #4 for 2023: What will the participation rate be in December 2023?

"There are probably a few more people that will return to the workforce in 2023, pushing up the participation rate. However, demographics will be pushing the rate down. So, my guess is the participation rate will be mostly unchanged year-over-year, around 62.3%."My guess was somewhat low since more people entered the labor force than I expected (also impacting job growth). The Labor Force Participation Rate was at 62.8% in November.

3) Question #3 for 2023: What will the unemployment rate be in December 2023?

"[M]y guess is the unemployment rate will increase to around 4% in December 2023 from the current 3.5%. (Lower than the FOMC forecast of 4.4% to 4.7%)."The unemployment rates was at 3.7% in November (this guess was looking good in October when the unemployment rate hit 3.9%).

2) Question #2 for 2023: How much will job growth slow in 2023? Or will the economy lose jobs?

"My sense is the FOMC is overly pessimistic, and my guess is there will be something like 400 to 800 thousand jobs added in 2023."

This graph shows the jobs added per month since January 2021.

This graph shows the jobs added per month since January 2021.Through November the economy has added 2.55 million jobs, well above my guess. At least I was much closer than the Fed!

1) Question #1 for 2023: How much will the economy grow in 2023? Will there be a recession in 2023?

"My sense is growth will stay sluggish in 2023, but the economy will avoid recession. ... My guess is that real GDP growth will probably be positive in the 1.0% range in 2023.I was correct about no recession, but growth will likely be closer to 2.7% or so in 2023.

I was more optimistic than most analysts (no recession, positive job growth, inflation falling), but not optimistic enough!

NAR: Existing-Home Sales Increased to 3.82 million SAAR in November; Months-of-Supply Close to 2019 Levels

by Calculated Risk on 12/20/2023 10:58:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Increased to 3.82 million SAAR in November

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

The fourth graph shows existing home sales by month for 2022 and 2023.

Sales declined 7.3% year-over-year compared to November 2022. This was the twenty-seventh consecutive month with sales down year-over-year. This was just above the cycle low of 3.79 million SAAR last month.