by Calculated Risk on 12/26/2023 09:00:00 AM

Tuesday, December 26, 2023

Case-Shiller: National House Price Index Up 4.8% year-over-year in October

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3-month average of August, September and October closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Accelerates in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.8% annual change in October, up from a 4% change in the previous month. The 10-City Composite showed an increase of 5.7%, up from a 4.8% increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.9%, up from a 3.9% increase in the previous month. Detroit reported the highest year-over-year gain among the 20 cities with an 8.1% increase in October, followed again by San Diego with a 7.2% increase. Portland fell 0.6% and remained the only city reporting lower prices in October versus a year ago.

...

Before seasonal adjustment, the U.S. National Index and 10-City Composite, posted 0.2% month-over-month increases in October, while the 20-City composite posted 0.1% increase.

After seasonal adjustment, the U.S. National Index, the 10-City and 20-City Composites each posted month-over-month increases of 0.6%.

"U.S. home prices accelerated at their fastest annual rate of the year in October”, says Brian D. Luke, Head of Commodities, Real & Digital assets at S&P DJI. Our National Composite rose by 0.2% in October, marking nine consecutive monthly gains and the strongest national growth rate since 2022.”

“Detroit kept pace as the fastest growing market for the second month in a row, registering an 8.1% annual gain. San Diego maintained the second spot with 7.2% annual gains, following by New York with a 7.1% gain. We are experiencing broad based home price appreciation across the country, with steady gains seen in nineteen of twenty cities. This month’s report reflects trendline growth compared to historical returns and little disparity among cities and regions.”

“Each of our 10-city, 20-city and National Index, remain at all-time highs, with 8 of 20 cities registering all-time highs (Miami, Atlanta, Chicago, Boston, Detroit, Charlotte, New York and Cleveland). While Portland remains slightly down compared to last year’s gains, Phoenix and Las Vegas have flipped to year over year gains. The Midwest and the Northeast region are fastest growing markets, while the Southwest and West regions have lagged other regions for over a year. A solid, if unspectacular report, this month’s index reflects a rising tide across nearly all markets.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.6% in October (SA) and is at a new all-time high.

The Composite 20 index is up 0.6% (SA) in October and is also at a new all-time high.

The National index is up 0.6% (SA) in October and is also at a new all-time high.

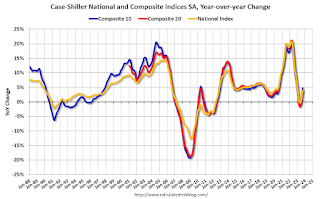

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 5.7% year-over-year. The Composite 20 SA is up 4.9% year-over-year.

The National index SA is up 4.8% year-over-year.

Annual price changes were close to expectations. I'll have more later.

FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

by Calculated Risk on 12/26/2023 08:00:00 AM

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

A brief excerpt:

Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q3 2023 (released last Friday).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023.

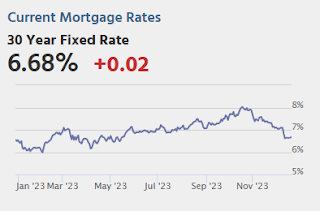

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.4% (now at 59.4%), and the percent under 5% peaked at 85.7% (now at 78.7%). These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are so low.

The percent of loans over 6% bottomed in Q2 2022 at 7.1% and has increased to 11.5% in Q3 2023.

Monday, December 25, 2023

Tuesday: Case-Shiller House Prices

by Calculated Risk on 12/25/2023 07:34:00 PM

Weekend:

• Ten Economic Questions for 2024

• Schedule for Week of December 24, 2023

Tuesday:

• At 8:30 AM ET, Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for October. The consensus is for an 5.0% year-over-year increase in the National index for October.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for December.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 67 (fair value).

Oil prices were up over the last week with WTI futures at $73.56 per barrel and Brent at $79.07 per barrel. A year ago, WTI was at $80, and Brent was at $82 - so WTI oil prices were down 8% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.09 per gallon. A year ago, prices were at $3.06 per gallon, so gasoline prices are up slightly year-over-year.

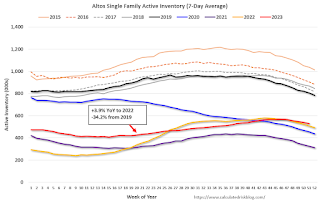

Housing December 25th Weekly Update: Inventory Down 1.9% Week-over-week, Up 3.9% Year-over-year

by Calculated Risk on 12/25/2023 10:48:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Happy Holidays!

by Calculated Risk on 12/25/2023 09:21:00 AM

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Enjoy the season!

Sunday, December 24, 2023

Ten Economic Questions for 2024

by Calculated Risk on 12/24/2023 09:19:00 AM

Here is a review of the Ten Economic Questions for 2023

Below are my ten questions for 2024 (I've been doing this online every year for almost 20 years!). These are just questions; I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework of how the U.S. economy will likely perform in 2024, and if there are surprises - like in 2020 with the pandemic - to adjust my thinking.

2) Employment: Through November 2023, the economy added 2.6 million jobs in 2023. This is down from 4.8 million jobs added in 2022, and 7.3 million in 2021 (the two best years ever), but still a solid year for employment gains. How much will job growth slow in 2024? Or will the economy lose jobs?

3) Unemployment Rate: The unemployment rate was at 3.7% in November, up from 3.6% in November 2022. Currently the FOMC is forecasting the unemployment rate will increase to the 4.0% to 4.2% range in Q4 2024. What will the unemployment rate be in December 2024?

4) Participation Rate: In November 2023, the overall participation rate was at 62.8%, up year-over-year from 62.2% in November 2022, but still below the pre-pandemic level of 63.3%. Long term, the BLS is projecting the overall participation rate will decline to 60.4% by 2032 due to demographics. What will the participation rate be in December 2024?

5) Inflation: Core PCE was up 3.2% YoY through November. This was down from a peak of 5.6% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 2.4% to 2.7% range in Q4 2024. Will the core inflation rate decrease further in 2024, and what will the YoY core inflation rate be in December 2024?

6) Monetary Policy: To slow inflation, the FOMC raised the federal funds rate four times in 2023 from "4-1/4 to 4-1/2 percent" at the beginning of 2023, to "5-1/4 to 5-1/2" at the end of the year. Most FOMC participants expect around three 25 bp rate cuts in 2024. What will the Fed Funds rate be in December 2024?

7) Wage Growth: Wage growth was solid in 2023, up 4.0% year-over-year as of November, but down from 4.8% YoY in 2022. How much will wages increase in 2024?

8) Residential Investment: Residential investment (RI) was slightly negative through the first three quarters of 2023 as the housing market appeared to bottom. Through November, starts were down 9.9% year-to-date compared to the same period in 2021. New home sales were up 3.9% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2024? How about housing starts and new home sales in 2024?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, FHFA, and Freddie Mac) - will be up mid-single digits in 2023. What will happen with house prices in 2024?

10) Housing Inventory: Housing inventory decreased sharply during the pandemic to record lows in early 2022. Since then, inventory has increased, but is still well below pre-pandemic levels. Will inventory increase further in 2024?

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

Saturday, December 23, 2023

Real Estate Newsletter Articles this Week: New Home Sales decrease to 590,000 Annual Rate in November

by Calculated Risk on 12/23/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales decrease to 590,000 Annual Rate in November

• NAR: Existing-Home Sales Increased to 3.82 million SAAR in November

• Single Family Starts Increase Sharply in November, Near Record Number of Multi-Family Housing Units Under Construction

• Final Look at Local Housing Markets in November

• Early Read on Existing Home Sales in November

• 4th Look at Local Housing Markets in November

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of December 24, 2023

by Calculated Risk on 12/23/2023 08:11:00 AM

Happy Holidays and Merry Christmas!

The key indicator this week is Case-Shiller House Prices for October.

All US markets will be closed in observance of the Christmas Holiday.

8:30 AM: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:00 AM: FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for an 5.0% year-over-year increase in the National index for October.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand, up from 205 thousand last week.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.9% increase in the index.

9:45 AM: Chicago Purchasing Managers Index for December.

Friday, December 22, 2023

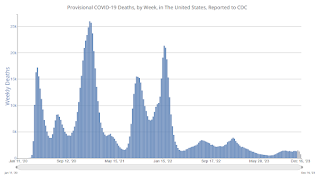

Dec 22nd COVID Update: Hospitalizations Increased

by Calculated Risk on 12/22/2023 07:41:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 19,686 | 18,708 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,467 | 1,295 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

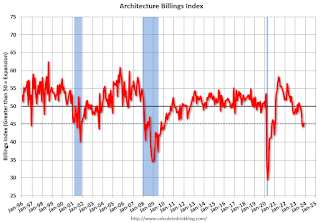

AIA: "Architecture firm billings continue to decline in November"; Multi-family Billings Decline for 16th Consecutive Month

by Calculated Risk on 12/22/2023 03:20:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI November 2023: Business conditions remain soft at architecture firms

Business conditions remained soft at architecture firms in November, as the AIA/Deltek Architecture Billings Index (ABI) remained below 50 with a score of 45.3 for the month (any score below 50 indicates declining billings). The score increased by one point from October, indicating that slightly fewer firms reported a decline in billings in November, but the majority of firms continued to report weak business for the fourth consecutive month, and the seventh month so far this year. However, there are still some encouraging signs of potential work in the pipeline as inquiries bounced back in November after declining in October. And while the value of new signed design contracts continued to decrease in November, fewer firms reported a decline than in October.• Regional averages: Northeast (44.4); South (46.7); Midwest (49.0); West (39.5)

Billings also remained weak at firms around the country in November, with firms in all regions reporting a decline for the fourth consecutive month. Business conditions remained softest at firms located in the West, which has been the case since March. And firms of all specializations also reported declining billings this month, with conditions remaining weakest at firms with a multifamily residential specialization. Billings also continued to decline further at firms with an institutional specialization, which was the strongest sector earlier this year.

emphasis added

• Sector index breakdown: commercial/industrial (45.7); institutional (46.6); multifamily residential (42.1)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.3 in November, up from 44.3 in October. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.