by Calculated Risk on 1/04/2024 08:30:00 AM

Thursday, January 04, 2024

Weekly Initial Unemployment Claims Decrease to 202,000

The DOL reported:

In the week ending December 30, the advance figure for seasonally adjusted initial claims was 202,000, a decrease of 18,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 218,000 to 220,000. The 4-week moving average was 207,750, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,000 to 212,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 207,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

ADP: Private Employment Increased 164,000 in December

by Calculated Risk on 1/04/2024 08:15:00 AM

Private sector employment increased by 164,000 jobs in December and annual pay was up 5.4 percent year-over-year, according to the December ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.This was above the consensus forecast of 130,000. The BLS report will be released Friday, and the consensus is for 158 thousand non-farm payroll jobs added in November.

...

“We're returning to a labor market that's very much aligned with pre-pandemic hiring,” said Nela Richardson, chief economist, ADP. “While wages didn't drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared.”

emphasis added

Wednesday, January 03, 2024

Thursday: ADP Employment, Unemployment Claims

by Calculated Risk on 1/03/2024 08:14:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 130,000, up from 103,000 jobs added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released.

Vehicles Sales increase to 15.83 million SAAR in December; Up 17% YoY

by Calculated Risk on 1/03/2024 06:00:00 PM

Wards Auto released their estimate of light vehicle sales for December: December U.S. Light-Vehicle Sales Hit 5-Month High; Entire 2023 Totals 4-Year Best 15.5 Million (pay site).

Labor-related plant shutdowns in the U.S. that covered the latter half of September and most of October negatively impacted deliveries in November. Combined sales of the vehicles impacted by shutdowns fell 15% year-over-year in November. If those vehicles had matched year-ago results, sales would have totaled a 15.9 million-unit SAAR. While CUVs accounted for over half the market for the second time ever, vehicles impacted by the strikes were largely behind weakness in pickups, SUVs and vans.

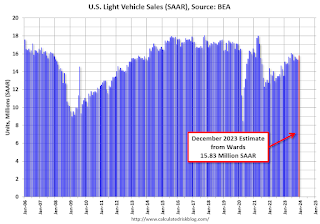

Click on graph for larger image.

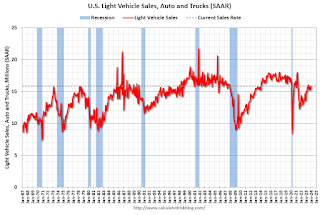

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for December (red).

Sales in December were up 3.3% from November, and up 16.8% from December 2022.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.Sales in December were above the consensus forecast.

FOMC Minutes: "A lower target range for the federal funds rate would be appropriate by the end of 2024"

by Calculated Risk on 1/03/2024 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 12-13, 2023. Excerpt:

In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves. Participants pointed to the decline in inflation seen during 2023, noting the recent shift down in six-month inflation readings in particular, and to growing signs of demand and supply coming into better balance in product and labor markets as informing that view. Several participants remarked that the Committee's past policy actions were having their intended effect of helping to slow the growth of aggregate demand and cool labor market conditions. They judged that, in combination with improvements in the supply situation, these developments were helping to bring inflation back to 2 percent over time. Most participants noted that, as indicated in their submissions to the SEP, they expected the Committee's restrictive policy stance to continue to soften household and business spending, helping to promote further reductions in inflation over the next few years.

In their submitted projections, almost all participants indicated that, reflecting the improvements in their inflation outlooks, their baseline projections implied that a lower target range for the federal funds rate would be appropriate by the end of 2024. Participants also noted, however, that their outlooks were associated with an unusually elevated degree of uncertainty and that it was possible that the economy could evolve in a manner that would make further increases in the target range appropriate. Several also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated. Participants generally stressed the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee's objective.

emphasis added

Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

by Calculated Risk on 1/03/2024 11:36:00 AM

Today, in the Real Estate Newsletter: Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article.

I'm adding some thoughts, and maybe some predictions for each question.

...

8) Residential Investment: Residential investment (RI) was slightly negative through the first three quarters of 2023 as the housing market appeared to bottom. Through November, starts were down 9.9% year-to-date compared to the same period in 2021. New home sales were up 3.9% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2024? How about housing starts and new home sales in 2024?

...

Here is a table showing single and multi-family housing starts and new home sales since 2000. Note that single family starts, and new home sales declined sharply for several years following the housing bubble. The dynamics in this cycle are very different, and there will not be significant distressed sales in this cycle. Also new home sales were not as elevated prior to the downturn, so the decline wasn’t as sharp.

The decline in single-family starts and new home sales was not as severe or persistent as during the housing bust. Multi-family starts will likely be down significantly year-over-year in 2024.

BLS: Job Openings Little Changed at 8.8 million in November

by Calculated Risk on 1/03/2024 10:03:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings changed little at 8.8 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations decreased to 5.5 million and 5.3 million, respectively. Within separations, quits (3.5 million) edged down and layoffs and discharges (1.5 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November; the employment report this Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in November to 8.79 million from 8.85 million in October.

The number of job openings (black) were down 18% year-over-year.

Quits were down 16% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

ISM® Manufacturing index Increased to 47.4% in December

by Calculated Risk on 1/03/2024 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 47.4% in December, up from 46.7% in November. The employment index was at 48.1%, up from 45.8% the previous month, and the new orders index was at 47.1%, down from 48.3%.

From ISM: Manufacturing PMI® at 47.4% December 2023 Manufacturing ISM® Report On Business®

conomic activity in the manufacturing sector contracted in December for the 14th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in December. This was slightly above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 47.4 percent in December, up 0.7 percentage point from the 46.7 percent recorded in November. The overall economy continued in contraction for a third month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 47.1 percent, 1.2 percentage points lower than the figure of 48.3 percent recorded in November. The Production Index reading of 50.3 percent is a 1.8-percentage point increase compared to November’s figure of 48.5 percent. The Prices Index registered 45.2 percent, down 4.7 percentage points compared to the reading of 49.9 percent in November. The Backlog of Orders Index registered 45.3 percent, 6 percentage points higher than the November reading of 39.3 percent. The Employment Index registered 48.1 percent, up 2.3 percentage points from the 45.8 percent reported in November.

emphasis added

MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest Weekly Survey

by Calculated Risk on 1/03/2024 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest MBA Weekly Survey

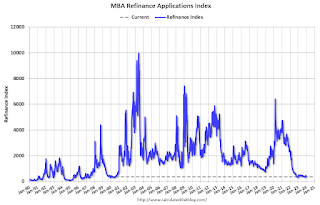

Mortgage applications decreased 9.4 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 29, 2023. The results include adjustments to account for the holidays.

The Market Composite Index, a measure of mortgage loan application volume, decreased 9.4 percent on a seasonally adjusted basis from two weeks earlier. On an unadjusted basis, the Index decreased 38 percent compared with two weeks ago. The unadjusted Refinance Index decreased 43 percent from two weeks ago and was 15 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent compared with two weeks ago. The unadjusted Purchase Index decreased 34 percent compared with two weeks ago and was 12 percent lower than the same week one year ago.

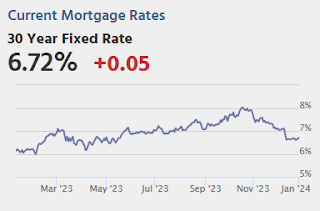

“Markets continued to digest the impact of slowing inflation and potential rate cuts from the Federal Reserve, helping mortgage rates to stay at levels close to the lowest since mid-2023. The 30-year fixed mortgage rate edged higher last week and ended 2023 at 6.76 percent, over a percentage point lower than its recent peak of 7.9 percent in October 2023,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The recent decline in rates has given the housing market some cause for optimism going into 2024, but purchase applications have not yet picked up in response, with the overall level of purchase activity 12 percent lower than a year ago. Refinance applications were still at very low levels, but were 15 percent higher than a year ago.”

Added Kan, “The housing market has been hampered by a limited supply of homes for sale, but the recent strength in new residential construction will continue to help ease inventory shortages in the months in come.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.76 percent from 6.71 percent, with points increasing to 0.61 from 0.55 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

Tuesday, January 02, 2024

Wednesday: Job Openings, ISM Mfg, FOMC Minutes

by Calculated Risk on 1/02/2024 07:27:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. (Two weeks!)

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

• Also at 10:00 AM, ISM Manufacturing Index for December. The consensus is for the ISM to be at 47.1, up from 46.7 in November.

• At 2:00 PM, FOMC Minutes, Meeting of December 12-13, 2023

• Late, Light vehicle sales for December. The Wards forecast is for 15.7 million SAAR in December, up from the BEA estimate of 15.32 million SAAR in November (Seasonally Adjusted Annual Rate).