by Calculated Risk on 1/04/2024 07:31:00 PM

Thursday, January 04, 2024

Friday: Employment Report

Friday:

• At 8:30 AM ET, Employment Report for December. The consensus is for 158,000 jobs added, and for the unemployment rate to increase to 3.8%.

• At 10:00 AM, the ISM Services Index for December

December Employment Preview

by Calculated Risk on 1/04/2024 01:27:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 158,000 jobs added, and for the unemployment rate to increase to 3.8%.

There were 199,000 jobs added in November, and the unemployment rate was at 3.7%.

From Goldman Sachs:

"We expect an above-consensus 190k increase in payrolls and a below-consensus 3.7% unemployment rate on Friday."• ADP Report: The ADP employment report showed 164,000 private sector jobs were added in December. This suggests job gains above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in December to 48.1%, down from 45.8% last month. This would suggest about 30,000 jobs lost in manufacturing. The ADP report indicated 13,000 manufacturing jobs lost in December.

The ISM® services employment index will be released after the employment report on Friday.

• Unemployment Claims: The weekly claims report showed a smaller number of initial unemployment claims during the reference week (the 3rd through the 9th in December) from 203,000 in November to 235,000 in December. This suggests fewer layoffs in December compared to November.

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 1/04/2024 10:01:00 AM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through November 2023, except CoreLogic is through October and Apartment List is through December 2023.There is much more in the article.

The CoreLogic measure is up 2.5% YoY in October, down from 2.6% in September, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 3.3% YoY in November, mostly unchanged from 3.2% YoY in October, and down from a peak of 16.1% YoY in March 2022.

The ApartmentList measure is down 1.0% YoY as of December, up from -1.1% in November, and down from a peak of 18.2% YoY November 2021.

...

OER and CPI shelter will decline further in the CPI release next week.

Weekly Initial Unemployment Claims Decrease to 202,000

by Calculated Risk on 1/04/2024 08:30:00 AM

The DOL reported:

In the week ending December 30, the advance figure for seasonally adjusted initial claims was 202,000, a decrease of 18,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 218,000 to 220,000. The 4-week moving average was 207,750, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,000 to 212,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 207,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

ADP: Private Employment Increased 164,000 in December

by Calculated Risk on 1/04/2024 08:15:00 AM

Private sector employment increased by 164,000 jobs in December and annual pay was up 5.4 percent year-over-year, according to the December ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.This was above the consensus forecast of 130,000. The BLS report will be released Friday, and the consensus is for 158 thousand non-farm payroll jobs added in November.

...

“We're returning to a labor market that's very much aligned with pre-pandemic hiring,” said Nela Richardson, chief economist, ADP. “While wages didn't drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared.”

emphasis added

Wednesday, January 03, 2024

Thursday: ADP Employment, Unemployment Claims

by Calculated Risk on 1/03/2024 08:14:00 PM

Thursday:

• At 8:15 AM ET, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 130,000, up from 103,000 jobs added in November.

• At 8:30 AM, The initial weekly unemployment claims report will be released.

Vehicles Sales increase to 15.83 million SAAR in December; Up 17% YoY

by Calculated Risk on 1/03/2024 06:00:00 PM

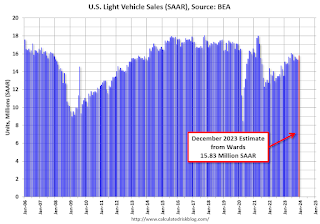

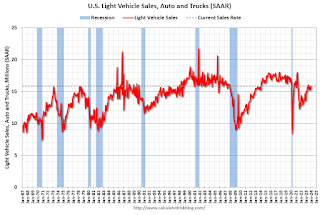

Wards Auto released their estimate of light vehicle sales for December: December U.S. Light-Vehicle Sales Hit 5-Month High; Entire 2023 Totals 4-Year Best 15.5 Million (pay site).

Labor-related plant shutdowns in the U.S. that covered the latter half of September and most of October negatively impacted deliveries in November. Combined sales of the vehicles impacted by shutdowns fell 15% year-over-year in November. If those vehicles had matched year-ago results, sales would have totaled a 15.9 million-unit SAAR. While CUVs accounted for over half the market for the second time ever, vehicles impacted by the strikes were largely behind weakness in pickups, SUVs and vans.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for December (red).

Sales in December were up 3.3% from November, and up 16.8% from December 2022.

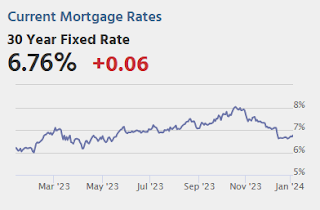

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.Sales in December were above the consensus forecast.

FOMC Minutes: "A lower target range for the federal funds rate would be appropriate by the end of 2024"

by Calculated Risk on 1/03/2024 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 12-13, 2023. Excerpt:

In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves. Participants pointed to the decline in inflation seen during 2023, noting the recent shift down in six-month inflation readings in particular, and to growing signs of demand and supply coming into better balance in product and labor markets as informing that view. Several participants remarked that the Committee's past policy actions were having their intended effect of helping to slow the growth of aggregate demand and cool labor market conditions. They judged that, in combination with improvements in the supply situation, these developments were helping to bring inflation back to 2 percent over time. Most participants noted that, as indicated in their submissions to the SEP, they expected the Committee's restrictive policy stance to continue to soften household and business spending, helping to promote further reductions in inflation over the next few years.

In their submitted projections, almost all participants indicated that, reflecting the improvements in their inflation outlooks, their baseline projections implied that a lower target range for the federal funds rate would be appropriate by the end of 2024. Participants also noted, however, that their outlooks were associated with an unusually elevated degree of uncertainty and that it was possible that the economy could evolve in a manner that would make further increases in the target range appropriate. Several also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated. Participants generally stressed the importance of maintaining a careful and data-dependent approach to making monetary policy decisions and reaffirmed that it would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee's objective.

emphasis added

Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

by Calculated Risk on 1/03/2024 11:36:00 AM

Today, in the Real Estate Newsletter: Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article.

I'm adding some thoughts, and maybe some predictions for each question.

...

8) Residential Investment: Residential investment (RI) was slightly negative through the first three quarters of 2023 as the housing market appeared to bottom. Through November, starts were down 9.9% year-to-date compared to the same period in 2021. New home sales were up 3.9% year-to-date through November. Note: RI is mostly investment in new single-family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI change in 2024? How about housing starts and new home sales in 2024?

...

Here is a table showing single and multi-family housing starts and new home sales since 2000. Note that single family starts, and new home sales declined sharply for several years following the housing bubble. The dynamics in this cycle are very different, and there will not be significant distressed sales in this cycle. Also new home sales were not as elevated prior to the downturn, so the decline wasn’t as sharp.

The decline in single-family starts and new home sales was not as severe or persistent as during the housing bust. Multi-family starts will likely be down significantly year-over-year in 2024.

BLS: Job Openings Little Changed at 8.8 million in November

by Calculated Risk on 1/03/2024 10:03:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings changed little at 8.8 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations decreased to 5.5 million and 5.3 million, respectively. Within separations, quits (3.5 million) edged down and layoffs and discharges (1.5 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November; the employment report this Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in November to 8.79 million from 8.85 million in October.

The number of job openings (black) were down 18% year-over-year.

Quits were down 16% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").