by Calculated Risk on 1/09/2024 08:00:00 AM

Tuesday, January 09, 2024

CoreLogic: US Home Prices Increased 5.2% Year-over-year in November

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Home Price Growth Speeds Up Again in November

• U.S. home prices increased by 5.2% year over year in November, the strongest annual growth rate recorded since January 2023.

• Annual home price growth is projected to slow to 2.3% in the spring of 2024 before stabilizing for the rest of the year.

• Detroit was the nation’s fastest-appreciating metro area in November at 8.7%, ending Miami’s 16-month run in the top spot.

• Northeastern states again posted the nation’s largest price gains, with Rhode Island, Connecticut and New Jersey showing increases that were more than double the national rate.

...

“Home price appreciation continued to push forward in November, despite the new highs in mortgage rates seen over the year,” said Dr. Selma Hepp, chief economist for CoreLogic. “And while the annual growth reflects comparison with last year's declines, seasonal gains remain in line with historical averages. However, in some metro areas, such as those in the Mountain West and the Northwest, higher interest rates are having a greater impact on homebuyers’ budgets, which is contributing to a larger seasonal slump.

“This continued strength remains remarkable amid the nation’s affordability crunch but speaks to the pent-up demand that is driving home prices higher,” Hepp continued. “Markets where the prolonged inventory shortage has been exacerbated by the lack of new homes for sale recorded notable price gains over the course of 2023.”

emphasis added

Monday, January 08, 2024

Tuesday: Trade Deficit, CoreLogic House Prices

by Calculated Risk on 1/08/2024 07:10:00 PM

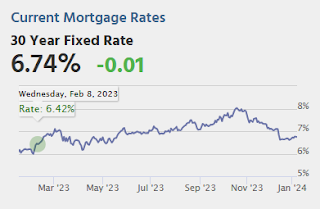

Thursday's Consumer Price Index (CPI) will be the week's most potentially consequential event. The most widely traded inflation report, CPI has been at the scene of many of the biggest interest rate changes of the past 2 years, but notably, such reactions require a result that is far from the consensus among economic forecasters. [30 year fixed 6.74%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 8:00 AM, CoreLogic House prices for November.

• At 8:30 AM: Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $65.0 billion. The U.S. trade deficit was at $64.3 billion in October.

Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

by Calculated Risk on 1/08/2024 02:50:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

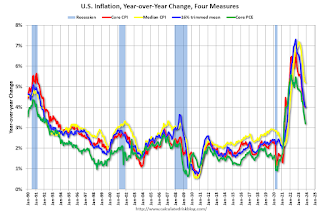

5) Inflation: Core PCE was up 3.2% YoY through November. This was down from a peak of 5.6% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 2.4% to 2.7% range in Q4 2024. Will the core inflation rate decrease further in 2024, and what will the YoY core inflation rate be in December 2024?

Although there are different measures for inflation, they all show inflation above the Fed's 2% inflation target on a year-over-year basis.

Note: I follow several measures of inflation, including median CPI and trimmed-mean CPI from the Cleveland Fed. Also core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for four key measures of inflation.

PCE Price Index: 2.0%

Core PCE Prices: 1.9%

Here are the Ten Economic Questions for 2024 and a few predictions:

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

Moody's: Apartment Vacancy Rate increased in Q4; Office Vacancy Rate in "Uncharted Territory" at Record High

by Calculated Risk on 1/08/2024 11:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate increased in Q4; Office Vacancy Rate in "Uncharted Territory" at Record High

A brief excerpt:

From Moody’s:There is much more in the article.The national office vacancy rate rose 40 bps to a record-breaking 19.6%, shattering the previous record of 19.3% set twice previously: once in 1986 driven by a five-year period of significant inventory expansion and the other in 1991 during the Savings and Loans Crisis. This surge represented the largest quarterly increase since Q1 2021, setting the latest office vacancy 280 bps higher than its pre-pandemic level. ...Moody’s Analytics reported that the office vacancy rate was at 19.6% in Q4 2023, up from 18.8% in Q4 2022. This is a new record high, and above the 19.3% during the S&L crisis.

Wholesale Used Car Prices Decreased 0.5% in December; Down 7.0% Year-over-year

by Calculated Risk on 1/08/2024 10:58:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decrease in December, End Year Down 7.0%

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 0.5% in December from November. The Manheim Used Vehicle Value Index (MUVVI) dropped to 204.0, down 7.0% from a year ago. Compared to December 2021, used-vehicle values are down nearly 21%.

“December’s decline brought a volatile year to a close,” said Jeremy Robb, senior director of Economic and Industry Insights for Cox Automotive. “The spring bounce was much more pronounced than expected in 2023, and prices slid just as rapidly after that bounce, finishing more calmly in December as expected. The 7.0% year-over-year loss was larger than our original forecast, but it pales in comparison to the nearly 15% decline we had a year earlier. 2024 is looking to be less volatile than 2023, but we’ve been taught to expect the unexpected in the wholesale market.”

The seasonal adjustment reduced the December decrease. The non-adjusted price in December declined by 2.0% compared to November, moving the unadjusted average price down 7.7% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing January 8th Weekly Update: Inventory Down 2.7% Week-over-week, Up 5.7% Year-over-year

by Calculated Risk on 1/08/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, January 07, 2024

Sunday Night Futures

by Calculated Risk on 1/07/2024 07:08:00 PM

Weekend:

• Schedule for Week of January 7, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up slightly and DOW futures are down 43 (fair value).

Oil prices were up over the last week with WTI futures at $73.81 per barrel and Brent at $78.76 per barrel. A year ago, WTI was at $74, and Brent was at $76 - so WTI oil prices were mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.06 per gallon. A year ago, prices were at $3.26 per gallon, so gasoline prices are down $0.20 year-over-year.

Question #6 for 2024: What will the Fed Funds rate be in December 2024?

by Calculated Risk on 1/07/2024 09:57:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

6) Monetary Policy: To slow inflation, the FOMC raised the federal funds rate four times in 2023 from "4-1/4 to 4-1/2 percent" at the beginning of 2023, to "5-1/4 to 5-1/2" at the end of the year. Most FOMC participants expect around three 25 bp rate cuts in 2024. What will the Fed Funds rate be in December 2024?

| 25 bp Rate Cuts | FOMC Members 2024 |

|---|---|

| No Change | 2 |

| One Rate Cut | 1 |

| Two Rate Cuts | 5 |

| Three Rate Cuts | 6 |

| Four Rate Cuts | 4 |

| More than Four | 1 |

The main view of the FOMC is for two to four rate cuts in 2024.

“We are aware of the risk that we would hang on too long. We know that is a risk and we are very focused on not making that mistake.”

Here are the Ten Economic Questions for 2024 and a few predictions:

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

Saturday, January 06, 2024

Real Estate Newsletter Articles this Week: What will happen with house prices in 2024?

by Calculated Risk on 1/06/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Question #9 for 2024: What will happen with house prices in 2024?

• Asking Rents Mostly Unchanged Year-over-year

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of January 7, 2024

by Calculated Risk on 1/06/2024 08:11:00 AM

The key reports this week are December CPI and the November trade deficit.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for December.

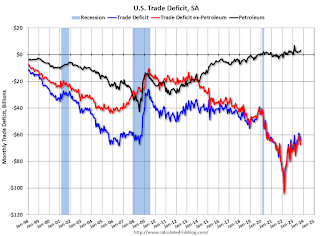

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $65.0 billion. The U.S. trade deficit was at $64.3 billion in October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand, up from 202 thousand.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 3.2% year-over-year and core CPI to be up 3.9% YoY.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.