by Calculated Risk on 1/10/2024 12:32:00 PM

Wednesday, January 10, 2024

Part 1: Current State of the Housing Market; Overview for mid-January 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-January 2024

A brief excerpt:

This 2-part overview for mid-January provides a snapshot of the current housing market. This includes sales, house prices, inventory, mortgage rates, rents and more.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s December 2023 Monthly Housing Market Trends Report showing new listings were up 9.1% year-over-year in December. New listings finished 2023 up year-over-year mostly because new listings collapsed in the 2nd half of 2022. From Realtor.com:

Providing a boost to overall inventory, sellers turned out in higher numbers this December as newly listed homes were 9.1% above last year’s levels. This marked the second month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings. It seems very likely that new listings will be up year-over-year in 2024, but we will have to wait for the March data to see how close new listings are to normal levels.

Leading Index for Commercial Real Estate Increased in December, Down 11% from Peak

by Calculated Risk on 1/10/2024 11:52:00 AM

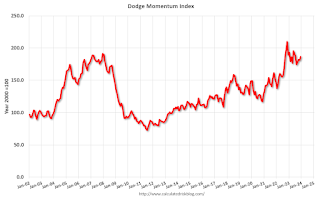

From Dodge Data Analytics: Dodge Momentum Index Improves 3% in December

The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN), rose 3% in December to 186.6 (2000=100) from the revised November reading of 181.5. Over the month, commercial planning grew 1.0% and institutional planning improved 6.1%.

“The Momentum Index ended the year 11% below the November 2022 peak, ultimately stabilizing as the year progressed. Regardless, the DMI averaged a reading of 184.3 in 2023, hitting levels of activity that haven’t been recorded since 2008,” stated Sarah Martin, associate director of forecasting for DCN. “While ongoing labor and construction cost issues will persist in 2024, a substantive amount of projects are sitting in the planning queue and will support construction spending going into 2025.”

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 186.6 in December, up from 181.5 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests some slowdown in 2024.

Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

by Calculated Risk on 1/10/2024 09:47:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November 2023, the economy added 2.6 million jobs in 2023. This is down from 4.8 million jobs added in 2022, and 7.3 million in 2021 (the two best years ever), but still a solid year for employment gains. How much will job growth slow in 2024? Or will the economy lose jobs?

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,406 | 3,211 | 195 |

| 1998 | 3,048 | 2,735 | 313 |

| 1999 | 3,181 | 2,720 | 461 |

| 2000 | 1,938 | 1,674 | 264 |

| 2001 | -1,733 | -2,284 | 551 |

| 2002 | -515 | -748 | 233 |

| 2003 | 125 | 167 | -42 |

| 2004 | 2,038 | 1,891 | 147 |

| 2005 | 2,528 | 2,342 | 186 |

| 2006 | 2,092 | 1,883 | 209 |

| 2007 | 1,145 | 857 | 288 |

| 2008 | -3,549 | -3,729 | 180 |

| 2009 | -5,041 | -4,967 | -74 |

| 2010 | 1,027 | 1,243 | -216 |

| 2011 | 2,066 | 2,378 | -312 |

| 2012 | 2,174 | 2,241 | -67 |

| 2013 | 2,293 | 2,360 | -67 |

| 2014 | 2,998 | 2,871 | 127 |

| 2015 | 2,717 | 2,567 | 150 |

| 2016 | 2,325 | 2,118 | 207 |

| 2017 | 2,113 | 2,033 | 80 |

| 2018 | 2,284 | 2,157 | 127 |

| 2019 | 1,959 | 1,747 | 212 |

| 2020 | -9,289 | -8,237 | -1,052 |

| 2021 | 7,267 | 6,882 | 385 |

| 2022 | 4,793 | 4,518 | 275 |

| 2023 | 2,697 | 2,025 | 672 |

The good news is job market still has momentum heading into 2024.

Click on graph for larger image.

Click on graph for larger image.The bad news - for job growth - is that a combination of a slowing economy, demographics and a labor market near full employment suggests fewer jobs will be added in 2024.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 144 | 207 |

| 2012 | 113 | 158 |

| 2013 | 208 | 123 |

| 2014 | 361 | 209 |

| 2015 | 337 | 70 |

| 2016 | 188 | -7 |

| 2017 | 273 | 178 |

| 2018 | 305 | 263 |

| 2019 | 132 | 5 |

| 2020 | -173 | -602 |

| 2021 | 239 | 385 |

| 2022 | 265 | 390 |

| 2023 | 197 | 12 |

For manufacturing, there will probably be some growth in the auto sector in 2024, and possibly in other manufacturing sectors. However, for construction, multi-family construction will slow in 2024, and so will several commercial real estate sectors (based on both the Architecture Billings Index and the Dodge Momentum Index.

So, my forecast is for gains of around 1.0 million to 1.5 million jobs in 2024. This would be another solid year for employment gains given current demographics.

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 1/10/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

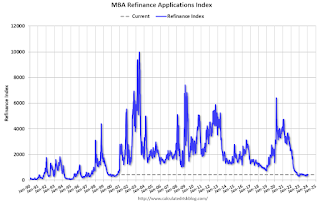

Mortgage applications increased 9.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 5, 2024. The results include an adjustment to account for the New Year’s holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 9.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 45 percent compared with the previous week. The holiday adjusted Refinance Index increased 19 percent from the previous week and was 30 percent higher than the same week one year ago. The unadjusted Refinance Index increased 53 percent from the previous week and was 17 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 40 percent compared with the previous week and was 16 percent lower than the same week one year ago.

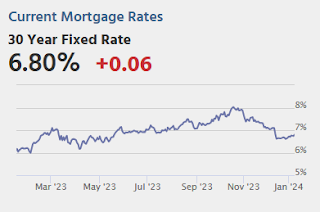

“Despite an uptick in mortgage rates to start 2024, applications increased after adjusting for the holiday,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The increase in purchase and refinance applications for both conventional and government loans is promising to start the year but was likely due to some catch-up in activity after the holiday season and year-end rate declines. Mortgage rates and applications have been volatile in recent weeks and overall activity remains low.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.81 percent from 6.76 percent, with points remaining unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

Tuesday, January 09, 2024

Wednesday: Mortgage Applications

by Calculated Risk on 1/09/2024 07:48:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Question #3 for 2024: What will the unemployment rate be in December 2024?

by Calculated Risk on 1/09/2024 04:08:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 3.7% in November, up from 3.6% in November 2022. Currently the FOMC is forecasting the unemployment rate will increase to the 4.0% to 4.2% range in Q4 2024. What will the unemployment rate be in December 2024?

Here is a graph of the unemployment rate over time. Note the period in the late '60s when the unemployment rate was mostly below 4% for four consecutive years.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate is from the household survey (CPS), and the rate was mostly flat in 2023. The unemployment rate increased in December to 3.7%, up from 3.5% in December 2022.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate (previous question).

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.8% | -0.1 | 5.6% |

| 2015 | 62.7% | -0.1 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 2018 | 63.0% | 0.3 | 3.9% |

| 2019 | 63.3% | 0.3 | 3.6% |

| 2020 | 61.5% | -1.8 | 6.7% |

| 2021 | 62.0% | 0.5 | 3.9% |

| 2022 | 62.3% | 0.3 | 3.5% |

| 2023 | 62.5% | 0.2 | 3.7% |

Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will remain in the mid-to-high 3% range in December 2024. (Lower than the FOMC forecast of 4.0% to 4.2%).

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

1st Look at Local Housing Markets in December

by Calculated Risk on 1/09/2024 02:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in December

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in December were mostly for contracts signed in October and November.

...

And a table of December sales.

In December, sales in these markets were down 7.9%. In November, these same markets were down 11.3% YoY Not Seasonally Adjusted (NSA).

Sales in all of these markets are down sharply compared to December 2019.

...

This was just several early reporting markets. Many more local markets to come!

Question #4 for 2024: What will the participation rate be in December 2024?

by Calculated Risk on 1/09/2024 11:11:00 AM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2024. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts, and maybe some predictions for each question.

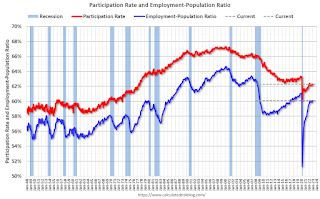

4) Participation Rate: In November 2023, the overall participation rate was at 62.8%, up year-over-year from 62.2% in November 2022, but still below the pre-pandemic level of 63.3%. Long term, the BLS is projecting the overall participation rate will decline to 60.4% by 2032 due to demographics. What will the participation rate be in December 2024?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long-term trends.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 83.2% in December 2023 Red), slightly above the pre-pandemic level of 83.0%. This suggests most of the prime age workers have returned to the labor force.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 83.2% in December 2023 Red), slightly above the pre-pandemic level of 83.0%. This suggests most of the prime age workers have returned to the labor force.Here are the Ten Economic Questions for 2024 and a few predictions:

• Question #1 for 2024: How much will the economy grow in 2024? Will there be a recession in 2024?

• Question #2 for 2024: How much will job growth slow in 2024? Or will the economy lose jobs?

• Question #3 for 2024: What will the unemployment rate be in December 2024?

• Question #4 for 2024: What will the participation rate be in December 2024?

• Question #5 for 2024: What will the YoY core inflation rate be in December 2024?

• Question #6 for 2024: What will the Fed Funds rate be in December 2024?

• Question #7 for 2024: How much will wages increase in 2024?

• Question #8 for 2024: How much will Residential investment change in 2024? How about housing starts and new home sales in 2024?

• Question #9 for 2024: What will happen with house prices in 2024?

• Question #10 for 2024: Will inventory increase further in 2024?

Trade Deficit decreased to $63.2 Billion in November

by Calculated Risk on 1/09/2024 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $63.2 billion in November, down $1.3 billion from $64.5 billion in October, revised.

November exports were $253.7 billion, $4.8 billion less than October exports. November imports were $316.9 billion, $6.1 billion less than October imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports decreased in November.

Exports are up 0.4% year-over-year; imports are unchanged year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports are moving sideways recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $21.6 billion from $21.1 billion a year ago.

CoreLogic: US Home Prices Increased 5.2% Year-over-year in November

by Calculated Risk on 1/09/2024 08:00:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Home Price Growth Speeds Up Again in November

• U.S. home prices increased by 5.2% year over year in November, the strongest annual growth rate recorded since January 2023.

• Annual home price growth is projected to slow to 2.3% in the spring of 2024 before stabilizing for the rest of the year.

• Detroit was the nation’s fastest-appreciating metro area in November at 8.7%, ending Miami’s 16-month run in the top spot.

• Northeastern states again posted the nation’s largest price gains, with Rhode Island, Connecticut and New Jersey showing increases that were more than double the national rate.

...

“Home price appreciation continued to push forward in November, despite the new highs in mortgage rates seen over the year,” said Dr. Selma Hepp, chief economist for CoreLogic. “And while the annual growth reflects comparison with last year's declines, seasonal gains remain in line with historical averages. However, in some metro areas, such as those in the Mountain West and the Northwest, higher interest rates are having a greater impact on homebuyers’ budgets, which is contributing to a larger seasonal slump.

“This continued strength remains remarkable amid the nation’s affordability crunch but speaks to the pent-up demand that is driving home prices higher,” Hepp continued. “Markets where the prolonged inventory shortage has been exacerbated by the lack of new homes for sale recorded notable price gains over the course of 2023.”

emphasis added