by Calculated Risk on 1/15/2024 11:03:00 AM

Monday, January 15, 2024

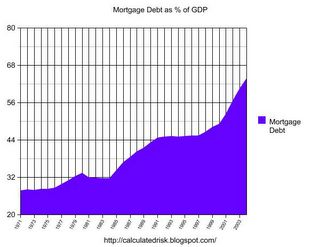

The Housing Bubble and Mortgage Debt as a Percent of GDP

Today, in the Calculated Risk Real Estate Newsletter: Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

A year ago, I wrote The Housing Bubble and Mortgage Debt as a Percent of GDP. Here is an update to a couple of graphs. The bottom line remains the same: There will not be cascading price declines in this cycle due to distressed sales.There is much more in the article.

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from February 2005 (19 years ago!):The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

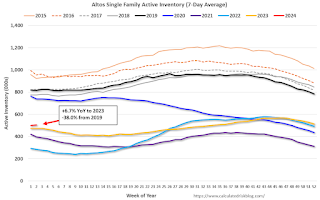

Housing January 15th Weekly Update: Inventory Up 1.2% Week-over-week, Up 6.7% Year-over-year

by Calculated Risk on 1/15/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, January 14, 2024

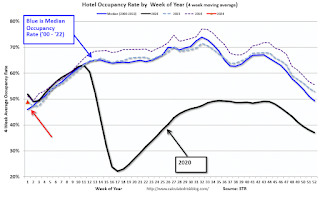

Hotels: Occupancy Rate Decreased 0.7% Year-over-year

by Calculated Risk on 1/14/2024 08:11:00 AM

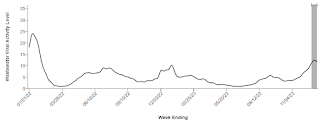

U.S. hotel performance decreased from the previous week, while year-over-year comparisons improved, according to CoStar’s latest data through 6 January. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

31 December 2023 through 6 January 2024 (percentage change from comparable week in 2023):

• Occupancy: 46.8% (-0.7%)

• Average daily rate (ADR): US$152.17 (+7.2%)

• Revenue per available room (RevPAR): US$71.28 (+6.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, January 13, 2024

Real Estate Newsletter Articles this Week: 2023 Annual Sales Likely Lowest Since 1995

by Calculated Risk on 1/13/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in December It appears annual sales for 2023 will be at the lowest level since 1995

• Moody's: Apartment Vacancy Rate increased in Q4; Office Vacancy Rate in "Uncharted Territory" at Record High

• Part 1: Current State of the Housing Market; Overview for mid-January 2024

• Part 2: Current State of the Housing Market; Overview for mid-January 2024

• 1st Look at Local Housing Markets in December

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of January 14, 2024

by Calculated Risk on 1/13/2024 08:11:00 AM

The key reports this week are December retail sales, housing starts and existing home sales.

For manufacturing, the December Industrial Production report and the January New York and Philly Fed manufacturing surveys will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of -7.1, up from -14.5.

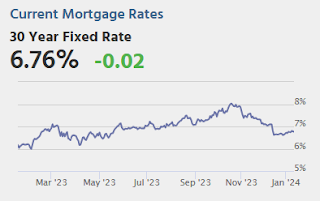

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

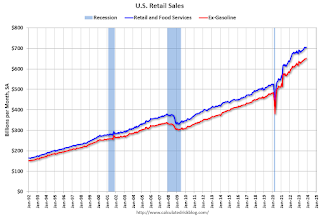

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

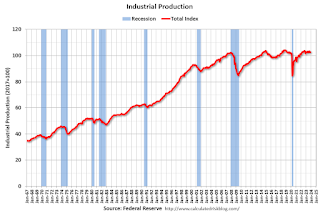

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 78.6%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 38, up from 37 in December. Any number below 50 indicates that more builders view sales conditions as poor than good.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 204 thousand, up from 202 thousand.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.415 million SAAR, down from 1.560 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for January.

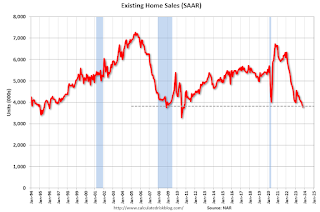

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.84 million SAAR, up from 3.82 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.84 million SAAR, up from 3.82 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January).

Friday, January 12, 2024

Jan 12th COVID Update: Hospitalizations Increased

by Calculated Risk on 1/12/2024 07:54:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 29,285 | 26,079 | ≤3,0001 | |

| Deaths per Week2 | 1,500 | 1,689 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

And here is a new graph I'm following on COVID in wastewater as of Jan 11th:

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q4 GDP Tracking: 1.3% to 2.2% Range

by Calculated Risk on 1/12/2024 01:00:00 PM

From BofA:

Overall, since our last weekly publication, our 4Q US GDP tracking estimate is up two-tenths to 1.3% q/q saar, while 3Q GDP finalized at 4.9% q/q saar in the third estimate. [Jan 12th estimate]From Goldman:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +1.5% (qoq ar) and our Q4 domestic final sales growth forecast unchanged at +2.2% (qoq ar). [Jan 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.2 percent on January 10, unchanged from January 9 after rounding. [Jan 10th estimate]

2nd Look at Local Housing Markets in December

by Calculated Risk on 1/12/2024 09:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in December

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the second look at several early reporting local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in December were mostly for contracts signed in October and November.

...

And a table of December sales.

In December, sales in these markets were down 6.8%. In November, these same markets were down 5.2% YoY Not Seasonally Adjusted (NSA).

Sales in almost all of these markets are down sharply compared to December 2019.

...

It appears annual sales for 2023 will be at the lowest level since 1995.

Many more local markets to come!

AAR: December Carloads and Intermodal Up YoY

by Calculated Risk on 1/12/2024 08:11:00 AM

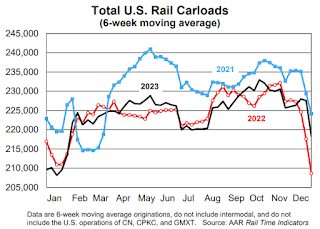

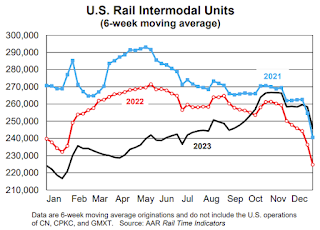

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. railroads originated 11.70 million total carloads in 2023 — up 0.7% (81,504 carloads) over 2022, up 0.7% (78,633 carloads) over 2021, and the most for a full year since 2019.

For all of 2023, U.S. intermodal originations totaled 12.67 million containers and trailers — down 4.9% (657,165 units) from 2022, down 9.6% (1.35 million) from 2021, and the lowest annual volume since 2013. In 2023, containers were 94.9% of U.S. intermodal units, a record high.

2023 is only the second year in our records (1996 was the other) in which total carloads were up over the previous year but intermodal was down.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2023:

Total carloads in December 2023 were up 7.3% over December 2022, the biggest year-over-year monthly percentage gain since February 2022. Total carloads were up 2.0% in Q4 2023 over Q4 2022, their best year-over-year quarterly percentage gain since Q1 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2021, 2022 and 2023: (using intermodal or shipping containers):In December 2023, U.S. intermodal volume was up 10.2% over December 2022, intermodal’s biggest monthly year-over-year percentage gain since June 2021. Intermodal was up 5.5% in Q4 2023 over Q4 2022, its biggest quarterly gain since Q2 2021.

Thursday, January 11, 2024

Friday: PPI

by Calculated Risk on 1/11/2024 07:33:00 PM

Friday:

• At 8:30 AM ET, The Producer Price Index for December from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.