by Calculated Risk on 1/17/2024 07:00:00 AM

Wednesday, January 17, 2024

MBA: Mortgage Applications Increased in Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

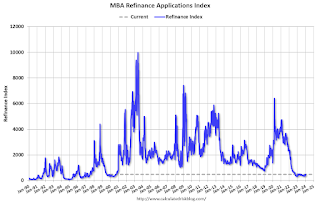

Mortgage applications increased 10.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 12, 2024. Last week’s results included an adjustment to account for the New Year’s holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 10.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 26 percent compared with the previous week. The Refinance Index increased 11 percent from the previous week and was 10 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 28 percent compared with the previous week and was 20 percent lower than the same week one year ago.

“Mortgage rates declined across all loan types as Treasury yields moved lower last week on incoming inflation data, which helped to support a rise in mortgage applications. The 30-year fixed rate decreased six basis points to 6.75 percent, the lowest rate in three weeks,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Compared to a holiday-adjusted week, both purchase and refinance applications were up, and the increases were heavily driven by the conventional market. Although purchase activity is lagging year-ago levels, refinance applications have improved from their recent low point and have been showing year-over-year gains, albeit at low levels. If rates continue to ease, MBA is cautiously optimistic that home purchases will pick up in the coming months.”

...

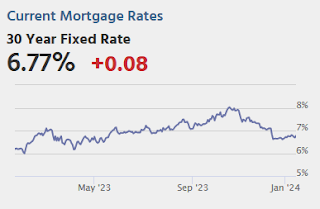

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.75 percent from 6.81 percent, with points increasing to 0.62 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 20% year-over-year unadjusted.

Tuesday, January 16, 2024

Wednesday: Retail Sales, Industrial Production, Homebuilder Survey, Beige Book

by Calculated Risk on 1/16/2024 08:03:00 PM

[R]ates were near 8% when the Nov/Dec rally began and fell into the 6.6s by December 14th. They're currently still well under 7%, meaning that a vast majority of the improvement has been retained despite the modest erosion. [30 year fixed 6.77%]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for December is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 78.6%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 38, up from 37 in December. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3rd Look at Local Housing Markets in December

by Calculated Risk on 1/16/2024 12:59:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in December

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at several local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

...

NOTE: The NAR is scheduled to report December existing home sales on Friday, January 19th. The consensus is for 3.84 million SAAR, up from 3.82 million in November.

...

And a table of December sales.

In December, sales in these markets were down 7.5%. In November, these same markets were down 5.6% YoY Not Seasonally Adjusted (NSA).

Sales in almost all of these markets are down sharply compared to December 2019.

...

Annual sales for 2023 will be at the lowest level since 1995.

More local markets to come!

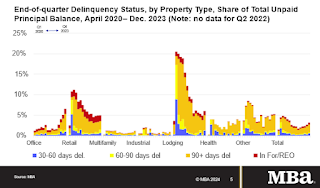

MBA: "Office properties drove increase" in Q4 Commercial Real Estate Delinquencies

by Calculated Risk on 1/16/2024 10:45:00 AM

From the MBA: Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2023

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2023, according to the Mortgage Bankers Association's (MBA) latest commercial real estate finance (CREF) Loan Performance Survey.

"Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023," said Jamie Woodwell, MBA's Head of Commercial Real Estate Research. "Delinquency rates jumped to 6.5 percent of balances for loans backed by office properties and to 6.1 percent for lodging-backed loans. Delinquencies for loans backed by retail properties remain elevated from the onset of the pandemic but were unchanged during the quarter. Delinquency rates for multifamily and industrial property loans both increased marginally but remain much lower.”

Woodwell continued, “Long-term interest rates have come down from their highs of last year, which should provide some relief to some loans, but many properties and loans still face higher rates, uncertainty about property values and – for some properties – changes in fundamentals. Each loan and property faces a different set of circumstances, which will come into play as the market works through loans that mature this year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Loans backed by office properties drove the increase.

• 6.5% of the balance of office property loan balances were 30 days or more days delinquent, up from 5.1% at the end of last quarter.

• 6.1% of the balance of lodging loans were delinquent, up from 4.9%.

• 5.0% of retail balances were delinquent, flat from the previous quarter.

• 1.2% of multifamily balances were delinquent, up from 0.9%.

• 0.9% of the balance of industrial property loans were delinquent, up from 0.6%.

Annual Light Vehicle Sales Increase 12% in 2023; Heavy Trucks Sales up 6% YoY

by Calculated Risk on 1/16/2024 08:17:00 AM

Earlier the BEA released their estimate of light vehicle sales for December. The BEA estimates sales of 15.83 million SAAR in December 2023 (Seasonally Adjusted Annual Rate), up 3.3% from the November sales rate, and up 16.8% from December 2022.

Click on graph for larger image.

Click on graph for larger image.The first graph shows annual sales since 1976.

Sales in 2020 were impacted by the pandemic, and then sales rebounded slightly in 2021. However, sales in 2022 were impacted significantly by supply chain disruptions.

The second graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2023 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

Monday, January 15, 2024

Tuesday: NY Fed Mfg

by Calculated Risk on 1/15/2024 07:11:00 PM

Weekend:

• Schedule for Week of January 14, 2024

Tuesday:

• 8:30 AM ET, The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of -7.1, up from -14.5.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 8 and DOW futures are down 57 (fair value).

Oil prices were down over the last week with WTI futures at $72.48 per barrel and Brent at $78.15 per barrel. A year ago, WTI was at $80, and Brent was at $83 - so WTI oil prices were down 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.05 per gallon. A year ago, prices were at $3.28 per gallon, so gasoline prices are down $0.23 year-over-year.

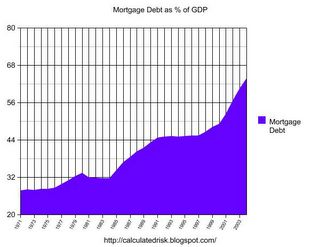

The Housing Bubble and Mortgage Debt as a Percent of GDP

by Calculated Risk on 1/15/2024 11:03:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

A year ago, I wrote The Housing Bubble and Mortgage Debt as a Percent of GDP. Here is an update to a couple of graphs. The bottom line remains the same: There will not be cascading price declines in this cycle due to distressed sales.There is much more in the article.

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from February 2005 (19 years ago!):The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

Housing January 15th Weekly Update: Inventory Up 1.2% Week-over-week, Up 6.7% Year-over-year

by Calculated Risk on 1/15/2024 08:21:00 AM

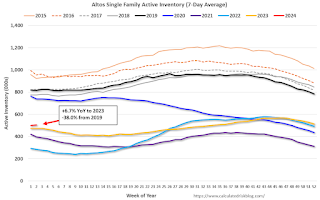

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, January 14, 2024

Hotels: Occupancy Rate Decreased 0.7% Year-over-year

by Calculated Risk on 1/14/2024 08:11:00 AM

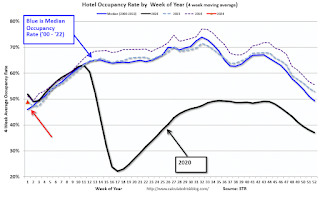

U.S. hotel performance decreased from the previous week, while year-over-year comparisons improved, according to CoStar’s latest data through 6 January. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

31 December 2023 through 6 January 2024 (percentage change from comparable week in 2023):

• Occupancy: 46.8% (-0.7%)

• Average daily rate (ADR): US$152.17 (+7.2%)

• Revenue per available room (RevPAR): US$71.28 (+6.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, January 13, 2024

Real Estate Newsletter Articles this Week: 2023 Annual Sales Likely Lowest Since 1995

by Calculated Risk on 1/13/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in December It appears annual sales for 2023 will be at the lowest level since 1995

• Moody's: Apartment Vacancy Rate increased in Q4; Office Vacancy Rate in "Uncharted Territory" at Record High

• Part 1: Current State of the Housing Market; Overview for mid-January 2024

• Part 2: Current State of the Housing Market; Overview for mid-January 2024

• 1st Look at Local Housing Markets in December

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.