by Calculated Risk on 1/18/2024 12:40:00 PM

Thursday, January 18, 2024

Realtor.com Reports Active Inventory UP 7.9% YoY; New Listings up 7.0% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending January 13, 2024

• Active inventory increased, with for-sale homes 7.9% above year ago levels.

Active listings in the past week grew by 7.9% above the previous year, the 10th straight week of annual growth. Active inventory picked up slightly compared to the previous week, diverging from the typical seasonal pattern which would suggest falling inventory until the spring market picks up in March. Should the uptick in new listings persist, inventory levels could continue to improve as hesitant buyers and sellers make their move ahead of the flurry of activity in the spring.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.0% from one year ago.

After an extended period of less listing activity from sellers due to the mortgage rate lock-in effect, newly listed homes have risen above last year’s levels for the 12th week in a row. This past week, the number of newly listed homes was 7.0% higher than the same time last year. However, the pace of new listings is still expected to be below typical pre-pandemic levels. In this past week, the new listing count was still 21.3% below similar weeks in 2017 to 2020.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 10th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 1/18/2024 09:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

A brief excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the article.

Total starts were up 7.6% in December compared to December 2022. And starts in 2023 were down 9.0% compared to 2022.

Starts were down year-over-year for 16 of the last 20 months, although starts were up year-over-year in 4 of the last 8 months. The year-over-year comparisons will be easier in 2024.

Weekly Initial Unemployment Claims Decrease to 187,000

by Calculated Risk on 1/18/2024 08:42:00 AM

The DOL reported:

In the week ending January 13, the advance figure for seasonally adjusted initial claims was 187,000, a decrease of 16,000 from the previous week's revised level. This is the lowest level for initial claims since September 24, 2022 when it was 182,000. The previous week's level was revised up by 1,000 from 202,000 to 203,000. The 4-week moving average was 203,250, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 207,750 to 208,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 203,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Housing Starts Decreased to 1.460 million Annual Rate in December

by Calculated Risk on 1/18/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,460,000. This is 4.3 percent below the revised November estimate of 1,525,000, but is 7.6 percent above the December 2022 rate of 1,357,000. Single‐family housing starts in December were at a rate of 1,027,000; this is 8.6 percent below the revised November figure of 1,124,000. The December rate for units in buildings with five units or more was 417,000.

An estimated 1,413,100 housing units were started in 2023. This is 9.0 percent below the 2022 figure of 1,552,600.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,495,000. This is 1.9 percent above the revised November rate of 1,467,000 and is 6.1 percent above the December 2022 rate of 1,409,000. Single‐family authorizations in December were at a rate of 994,000; this is 1.7 percent above the revised November figure of 977,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in December.

An estimated 1,469,800 housing units were authorized by building permits in 2023. This is 11.7 percent below the 2022 figure of 1,665,100.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in December compared to November. Multi-family starts were down 7.9% year-over-year in December.

Single-family starts (red) decreased in December and were up 15.8% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in December were above expectations, however, starts in October and November were revised down, combined.

I'll have more later …

Wednesday, January 17, 2024

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 1/17/2024 07:42:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 204 thousand, up from 202 thousand.

• Also at 8:30 AM, Housing Starts for December. The consensus is for 1.415 million SAAR, down from 1.560 million SAAR.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/17/2024 02:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in December

A brief excerpt:

From housing economist Tom Lawler:There is more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.84 million in December, up 0.5% from November’s preliminary pace and down 4.7% from last December’s seasonally adjusted pace. Unadjusted sales should show a larger YOY % decline, reflecting this December’s lower business day count compared to last December’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 5.0% from last December.

For 2023 as a whole existing home sales as estimated by the NAR should come in at 4.089 million, the lowest annual sales pace since 1995.

Fed's Beige Book: "Little or no change in economic activity"

by Calculated Risk on 1/17/2024 02:00:00 PM

A majority of the twelve Federal Reserve Districts reported little or no change in economic activity since the prior Beige Book period. Of the four Districts that differed, three reported modest growth and one reported a moderate decline. Consumers delivered some seasonal relief over the holidays by meeting expectations in most Districts and by exceeding expectations in three Districts, including in New York, which noted strong holiday spending on apparel, toys, and sporting goods. In addition, seasonal demand lifted airfreight volume from ecommerce in Richmond and credit card lending in Philadelphia. Several Districts noted increased leisure travel, and a tourism contact described New York City as bustling. Contacts from nearly all Districts reported decreases in manufacturing activity. Districts continued to note that high interest rates were limiting auto sales and real estate deals; however, the prospect of falling interest rates was cited by numerous contacts in various sectors as a source of optimism. In contrast, concerns about the office market, weakening overall demand, and the 2024 political cycle were often cited as sources of economic uncertainty. Overall, most Districts indicated that expectations of their firms for future growth were positive, had improved, or both.

Seven Districts described little or no net change in overall employment levels, while the pace of job growth was described as modest to moderate in four Districts. ... Six Districts noted that their contacts had reported slight or modest price increases, and two noted moderate increases. Five Districts also noted that overall price increases had subsided to some degree from the prior period, while three others indicated no significant shift in price pressures. Firms in most Districts cited examples of steady or falling input prices, especially in the manufacturing and construction sectors, and more discounting by auto dealers

emphasis added

NAHB: Builder Confidence Increased in January

by Calculated Risk on 1/17/2024 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 44, up from 37 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Surges on Falling Interest Rates

Mortgage rates well under 7% over the past month have led to a sharp increase in builder confidence to begin the new year.

Builder confidence in the market for newly built single-family homes climbed seven points to 44 in January, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This second consecutive monthly increase in builder confidence closely tracks with a period of falling interest rates.

“Lower interest rates improved housing affordability conditions this past month, bringing some buyers back into the market after being sidelined in the fall by higher borrowing costs,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Single-family starts are expected to grow in 2024, adding much needed inventory to the market. However, builders will face growing challenges with building material cost and availability, as well as lot supply.”

“Mortgage rates have decreased by more than 110 basis points since late October per Freddie Mac, lifting the future sales expectation component in the HMI into positive territory for the first time since August,” said NAHB Chief Economist Robert Dietz. “As home building expands in 2024, the market will see growing supply-side challenges in the form of higher prices and/or shortages of lumber, lots and labor.”

Even as mortgage rates have fallen below 7% over the past month, many builders continue to reduce home prices to boost sales. In January, 31% of builders reported cutting home prices, down from 36% during the previous two months and the lowest rate since last August. The average price reduction in January remained at 6%, unchanged from the previous month. Meanwhile, 62% of builders provided sales incentives of all forms in January. This share has remained stable between 60% and 62% since October.

...

All three of the major HMI indices posted gains in January. The HMI index charting current sales conditions increased seven points to 48, the component measuring sales expectations in the next six months jumped 12 points to 57 and the component gauging traffic of prospective buyers rose five points to 29.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased four points to 55, the South increased two points to 41, the West registered a one-point gain to 32 and the Midwest held steady at 34.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Industrial Production Increased 0.1% in December

by Calculated Risk on 1/17/2024 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production moved up 0.1 percent in December and declined 3.1 percent at an annual rate in the fourth quarter. Manufacturing output edged up 0.1 percent in December after increasing 0.2 percent in November. The index for utilities declined 1.0 percent in December, while the index for mining rose 0.9 percent. At 102.5 percent of its 2017 average, total industrial production in December was 1 percent above its year-earlier level. Capacity utilization was unchanged in December at 78.6 percent, a rate that is 1.1 percentage points below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.6% is 1.1% below the average from 1972 to 2022. This was at consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.7. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Retail Sales Increased 0.6% in December

by Calculated Risk on 1/17/2024 08:30:00 AM

On a monthly basis, retail sales were up 0.6% from November to December (seasonally adjusted), and sales were up 5.6 percent from December 2022.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent from the previous month, and up 5.6 percent above December 2022. Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. ... The October 2023 to November 2023 percent change was unrevised from up 0.3 percent.

emphasis added

Click on graph for larger image.

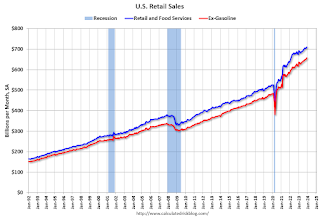

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was up 0.7% in December.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.5% on a YoY basis.

The increase in sales in December was above expectations, and sales in October and November were mostly unrevised (combined).

The increase in sales in December was above expectations, and sales in October and November were mostly unrevised (combined).