by Calculated Risk on 1/19/2024 10:00:00 AM

Friday, January 19, 2024

NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Lowest Annual Sales Since 1995

From the NAR: Existing-Home Sales Slid 1.0% in December

Existing-home sales retreated in December, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slipped in the Midwest and South, rose in the West and were unchanged in the Northeast. All four regions experienced year-over-year sales decreases.

On an annual basis, existing-home sales (4.09 million) dropped to the lowest level since 1995, while the median price reached a record high of $389,800 in 2023.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 1.0% from November to a seasonally adjusted annual rate of 3.78 million in December. Year-over-year, sales declined 6.2% (down from 4.03 million in December 2022).

...

Total housing inventory registered at the end of December was 1 million units, down 11.5% from November but up 4.2% from one year ago (960,000). Unsold inventory sits at a 3.2-month supply at the current sales pace, down from 3.5 months in November but up from 2.9 months in December 2022.

emphasis added

Click on graph for larger image.

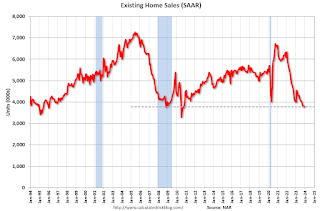

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in December (3.78 million SAAR) were down 1.0% from the previous month and were 6.2% below the December 2022 sales rate.

According to the NAR, inventory decreased to 1.00 million in December from 1.13 million the previous month.

According to the NAR, inventory decreased to 1.00 million in December from 1.13 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.2% year-over-year (blue) in December compared to December 2022.

Inventory was up 4.2% year-over-year (blue) in December compared to December 2022. Months of supply (red) decreased to 3.2 months in December from 3.5 months the previous month.

This was below the consensus forecast. I'll have more later.

Thursday, January 18, 2024

Friday: Existing Home Sales

by Calculated Risk on 1/18/2024 07:40:00 PM

Friday:

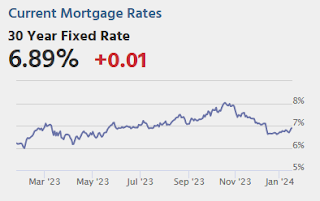

• At 10:00 AM ET, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.84 million SAAR, up from 3.82 million.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January).

4th Look at Local Housing Markets in December; California Home Sales Down 7.1% YoY in December

by Calculated Risk on 1/18/2024 04:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in December

A brief excerpt:

Here is some more local data prior to the NAR release tomorrow.There is much more in the article.

Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Friday, January 19th, at 10:00 AM ET. The consensus is the NAR will report sales of 3.84 million SAAR, up from 3.82 million in November.

Housing economist Tom Lawler expects the NAR to report sales of 3.84 million SAAR for December.

...

And a table of December sales.

In December, sales in these markets were down 7.5%. In November, these same markets were down 6.3% YoY Not Seasonally Adjusted (NSA).

Sales in almost all of these markets are down sharply compared to December 2019.

...

Annual sales for 2023 will be at the lowest level since 1995.

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

LA Port Inbound Traffic Increased Year-over-year in December

by Calculated Risk on 1/18/2024 03:15:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast (recently the drought in Panama has slowed canal traffic).

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.3% in December compared to the rolling 12 months ending in November. Outbound traffic increased 0.5% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Realtor.com Reports Active Inventory UP 7.9% YoY; New Listings up 7.0% YoY

by Calculated Risk on 1/18/2024 12:40:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending January 13, 2024

• Active inventory increased, with for-sale homes 7.9% above year ago levels.

Active listings in the past week grew by 7.9% above the previous year, the 10th straight week of annual growth. Active inventory picked up slightly compared to the previous week, diverging from the typical seasonal pattern which would suggest falling inventory until the spring market picks up in March. Should the uptick in new listings persist, inventory levels could continue to improve as hesitant buyers and sellers make their move ahead of the flurry of activity in the spring.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.0% from one year ago.

After an extended period of less listing activity from sellers due to the mortgage rate lock-in effect, newly listed homes have risen above last year’s levels for the 12th week in a row. This past week, the number of newly listed homes was 7.0% higher than the same time last year. However, the pace of new listings is still expected to be below typical pre-pandemic levels. In this past week, the new listing count was still 21.3% below similar weeks in 2017 to 2020.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 10th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 1/18/2024 09:15:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

A brief excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the article.

Total starts were up 7.6% in December compared to December 2022. And starts in 2023 were down 9.0% compared to 2022.

Starts were down year-over-year for 16 of the last 20 months, although starts were up year-over-year in 4 of the last 8 months. The year-over-year comparisons will be easier in 2024.

Weekly Initial Unemployment Claims Decrease to 187,000

by Calculated Risk on 1/18/2024 08:42:00 AM

The DOL reported:

In the week ending January 13, the advance figure for seasonally adjusted initial claims was 187,000, a decrease of 16,000 from the previous week's revised level. This is the lowest level for initial claims since September 24, 2022 when it was 182,000. The previous week's level was revised up by 1,000 from 202,000 to 203,000. The 4-week moving average was 203,250, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 207,750 to 208,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 203,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Housing Starts Decreased to 1.460 million Annual Rate in December

by Calculated Risk on 1/18/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,460,000. This is 4.3 percent below the revised November estimate of 1,525,000, but is 7.6 percent above the December 2022 rate of 1,357,000. Single‐family housing starts in December were at a rate of 1,027,000; this is 8.6 percent below the revised November figure of 1,124,000. The December rate for units in buildings with five units or more was 417,000.

An estimated 1,413,100 housing units were started in 2023. This is 9.0 percent below the 2022 figure of 1,552,600.

Building Permits:

Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,495,000. This is 1.9 percent above the revised November rate of 1,467,000 and is 6.1 percent above the December 2022 rate of 1,409,000. Single‐family authorizations in December were at a rate of 994,000; this is 1.7 percent above the revised November figure of 977,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in December.

An estimated 1,469,800 housing units were authorized by building permits in 2023. This is 11.7 percent below the 2022 figure of 1,665,100.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in December compared to November. Multi-family starts were down 7.9% year-over-year in December.

Single-family starts (red) decreased in December and were up 15.8% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in December were above expectations, however, starts in October and November were revised down, combined.

I'll have more later …

Wednesday, January 17, 2024

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 1/17/2024 07:42:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 204 thousand, up from 202 thousand.

• Also at 8:30 AM, Housing Starts for December. The consensus is for 1.415 million SAAR, down from 1.560 million SAAR.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/17/2024 02:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in December

A brief excerpt:

From housing economist Tom Lawler:There is more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.84 million in December, up 0.5% from November’s preliminary pace and down 4.7% from last December’s seasonally adjusted pace. Unadjusted sales should show a larger YOY % decline, reflecting this December’s lower business day count compared to last December’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 5.0% from last December.

For 2023 as a whole existing home sales as estimated by the NAR should come in at 4.089 million, the lowest annual sales pace since 1995.