by Calculated Risk on 1/21/2024 08:21:00 AM

Sunday, January 21, 2024

Hotels: Occupancy Rate Decreased 2.8% Year-over-year

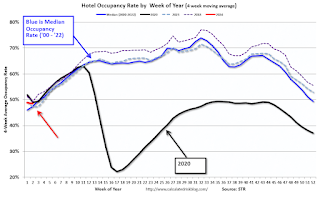

U.S. Hotel performance increased from the previous week, while year-over-year comparisons remained mixed, according to CoStar’s latest data through 13 January. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

7-13 January 2024 (percentage change from comparable week in 2023):

• Occupancy: 53.3% (-2.8%)

• Average daily rate (ADR): US$153.84 (+6.3%)

• Revenue per available room (RevPAR): US$81.96 (+3.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, January 20, 2024

Real Estate Newsletter Articles this Week: Existing Home Months-of-Supply above December 2019

by Calculated Risk on 1/20/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

• NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Months-of-Supply above December 2019

• 4th Look at Local Housing Markets in December; California Home Sales Down 7.1% YoY in December

• Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

• Lawler: Early Read on Existing Home Sales in December

• https://calculatedrisk.substack.com/p/3rd-look-at-local-housing-markets-3cd

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of January 21, 2024

by Calculated Risk on 1/20/2024 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q4 GDP, December New Home sales and December Personal Income and Outlays.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released.

No major economic releases are scheduled.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: State Employment and Unemployment (Monthly) for December 2023

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: Gross Domestic Product, 4th quarter and Year 2023 (Advance estimate). The consensus is that real GDP increased 1.8% annualized in Q4.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 187 thousand last week.

8:30 AM: Durable Goods Orders for December. The consensus is for a 0.5% increase in durable goods.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, up from 590 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for January.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.6% YoY, and core PCE prices up 3.0% YoY.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 2.0% increase in the index.

Friday, January 19, 2024

Jan 19th COVID Update: Weekly Deaths Increased

by Calculated Risk on 1/19/2024 07:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 27,882 | 29,807 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,768 | 1,712 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q4 GDP Tracking: Around 1.8%

by Calculated Risk on 1/19/2024 02:01:00 PM

The advance estimate of Q4 GDP will be released next week, and the consensus is for real GDP (SAAR) of 1.8%.

From BofA:

Overall, since our last weekly publication, our 4Q US GDP tracking estimate is up two-tenths to 1.3% q/q saar, while 3Q GDP finalized at 4.9% q/q saar in the third estimate. [Jan 12th estimate]From Goldman:

emphasis added

Following today’s data, we left our Q4 GDP tracking unchanged at +1.8% (qoq ar) and our Q4 domestic final sales growth forecast also unchanged at +2.5% (qoq ar). [Jan 19th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.4 percent on January 19, unchanged from January 18 after rounding. After this morning's existing-home sales report from the National Association of Realtors, the nowcast of fourth-quarter real residential investment growth decreased from -0.4 percent to -0.6 percent. [Jan 19th estimate]

NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Months-of-Supply above December 2019

by Calculated Risk on 1/19/2024 10:50:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Months-of-Supply above December 2019

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article.

The fourth graph shows existing home sales by month for 2022 and 2023.

Sales declined 6.2% year-over-year compared to December 2022. This was the twenty-eighth consecutive month with sales down year-over-year. This was just below the previous cycle low of 3.79 million SAAR in October.

On an annual basis, sales were down 19% from 2022 to the lowest level since 1995.

NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Lowest Annual Sales Since 1995

by Calculated Risk on 1/19/2024 10:00:00 AM

From the NAR: Existing-Home Sales Slid 1.0% in December

Existing-home sales retreated in December, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slipped in the Midwest and South, rose in the West and were unchanged in the Northeast. All four regions experienced year-over-year sales decreases.

On an annual basis, existing-home sales (4.09 million) dropped to the lowest level since 1995, while the median price reached a record high of $389,800 in 2023.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 1.0% from November to a seasonally adjusted annual rate of 3.78 million in December. Year-over-year, sales declined 6.2% (down from 4.03 million in December 2022).

...

Total housing inventory registered at the end of December was 1 million units, down 11.5% from November but up 4.2% from one year ago (960,000). Unsold inventory sits at a 3.2-month supply at the current sales pace, down from 3.5 months in November but up from 2.9 months in December 2022.

emphasis added

Click on graph for larger image.

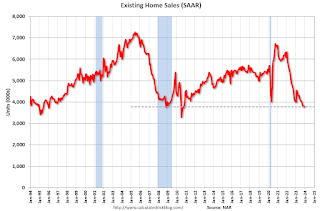

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in December (3.78 million SAAR) were down 1.0% from the previous month and were 6.2% below the December 2022 sales rate.

According to the NAR, inventory decreased to 1.00 million in December from 1.13 million the previous month.

According to the NAR, inventory decreased to 1.00 million in December from 1.13 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.2% year-over-year (blue) in December compared to December 2022.

Inventory was up 4.2% year-over-year (blue) in December compared to December 2022. Months of supply (red) decreased to 3.2 months in December from 3.5 months the previous month.

This was below the consensus forecast. I'll have more later.

Thursday, January 18, 2024

Friday: Existing Home Sales

by Calculated Risk on 1/18/2024 07:40:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 3.84 million SAAR, up from 3.82 million.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January).

4th Look at Local Housing Markets in December; California Home Sales Down 7.1% YoY in December

by Calculated Risk on 1/18/2024 04:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in December

A brief excerpt:

Here is some more local data prior to the NAR release tomorrow.There is much more in the article.

Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Friday, January 19th, at 10:00 AM ET. The consensus is the NAR will report sales of 3.84 million SAAR, up from 3.82 million in November.

Housing economist Tom Lawler expects the NAR to report sales of 3.84 million SAAR for December.

...

And a table of December sales.

In December, sales in these markets were down 7.5%. In November, these same markets were down 6.3% YoY Not Seasonally Adjusted (NSA).

Sales in almost all of these markets are down sharply compared to December 2019.

...

Annual sales for 2023 will be at the lowest level since 1995.

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

LA Port Inbound Traffic Increased Year-over-year in December

by Calculated Risk on 1/18/2024 03:15:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast (recently the drought in Panama has slowed canal traffic).

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.3% in December compared to the rolling 12 months ending in November. Outbound traffic increased 0.5% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.