by Calculated Risk on 1/23/2024 11:31:00 AM

Tuesday, January 23, 2024

NMHC and Fannie Mae Multi-Family Presentation

Yesterday, Chris Bruen, Senior Director of Research at NMHC and Kim Betancourt, CRE, Vice President, Multifamily Economics and Strategic Research at Fannie Mae presented the State of the Multi-Family Market (see video recording of presentation).

Here are a couple of slides from the presentation by Betancourt:

The vacancy rate bottomed in Q2 2022 and has steadily increased. This is due to a combination more supply and less household formation (not mentioned in the presentation).

The second graph shows annual rents and vacancy rates.

Fannie expects rent growth to be sluggish in 2024, and the for the vacancy rate to increase to 6.25%.

Fannie expects rent growth to be sluggish in 2024, and the for the vacancy rate to increase to 6.25%.There are a couple of more graph in the presentation showing coming multi-family supply and rents by metro area.

1.54 million Total Housing Completions in 2023 including Manufactured Homes; Most Since 2007

by Calculated Risk on 1/23/2024 08:37:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: 1.54 million Total Housing Completions in 2023 including Manufactured Homes; Most Since 2007

Excerpt:

Although total housing starts decreased 9.0% in 2023 compared to 2022, completions increased year-over-year. Construction delays impacted completions in 2023, and that left a near record number of housing units under construction. However, there still were 1.543 million total completions and placements in 2023, the most since 2007.There is much more in the article.

Not counting Manufactured homes, there are 1.453 million completions in 2023, up 4.5% from 1.390 million in 2022, and also the most since 2007.

This graph shows total housing completions and placements since 1968 through 2023. Note that the net addition to the housing stock is less because of demolitions and destruction of older housing units. The housing start report last week indicated 1,002.4 thousand single family completions in 2023, 11.5 thousand in 2-to-4 units, and 438.6 thousand in 5+ units (up 22% from 2022, and the most since 1987).

Monday, January 22, 2024

Tuesday: Richmond Fed Mfg

by Calculated Risk on 1/22/2024 07:10:00 PM

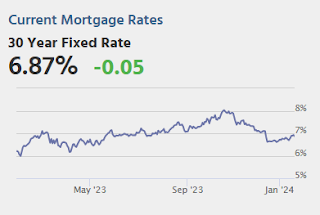

The week got off to a slow start as far as the bond market was concerned. Volume was the lowest of the year so far, even if only by a small margin. Volatility was also muted, at best. The overnight session provided modest gains and about half of the gains stuck around through the close. Even so, the improvement wasn't remotely enough to change the prevailing landscape in which bonds are in a modest uptrend in search of a short-term ceiling from which to carve out a broader sideways set-up for the more important events in the next 3 weeks. [30 year fixed 6.87%]Tuesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for December 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.23% in December"

by Calculated Risk on 1/22/2024 04:11:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.23% in December

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.26% of servicers’ portfolio volume in the prior month to 0.23% as of December 31, 2023. According to MBA’s estimate, 115,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.At the end of December, there were about 115,000 homeowners in forbearance plans.

In December 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 1 basis point to 0.15%. Ginnie Mae loans in forbearance decreased 8 basis points to 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 3 basis points to 0.27%.

“Forbearance as a loss mitigation option is diminishing,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “While forbearance is a powerful tool for delinquency surges resulting from natural disasters or major disruptions such as a pandemic, today’s borrowers are not experiencing widespread financial distress. The overall performance of servicing portfolios – particularly government loans – declined in December. Factors such as seasonality, a changing labor market, resumption of student loan payments, and the rise in balances on other forms of consumer debt are likely at play.”

...

• By reason, 61.2% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 26.8% of borrowers are in forbearance because of COVID-19. Another 12.0% are in forbearance because of a natural disaster.emphasis added

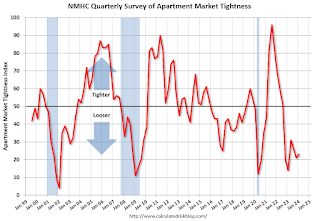

NMHC: "Apartment Market Continues to Loosen"

by Calculated Risk on 1/22/2024 01:45:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen"

Excerpt:

From the NMHC: Financing Conditions Show Signs of Improvement, Apartment Market Continues to Loosen with Decreasing Deal FlowThere is much more in the article.Apartment market conditions continued to weaken in the National Multifamily Housing Council's (NMHC) Quarterly Survey of Apartment Market Conditions for January 2024. With the exception of Debt Financing (66), which turned positive this quarter, the Market Tightness (23), Sales Volume (34), and Equity Financing (44) indexes all came in below the breakeven level (50).

...

"Yet, the apartment market continues to record decreasing rent growth and rising vacancy rates as it absorbs the highest level of new supply in more than thirty years.”• The Market Tightness Index came in at 23 this quarter – below the breakeven level (50) – indicating looser market conditions for the sixth consecutive quarter. A majority of respondents (59%) reported markets to be looser than three months ago, while only 5% thought markets have become tighter. Thirty-five percent of respondents thought market conditions had gone unchanged over the past three months.The quarterly index increased to 23 in January from 21 in October. Any reading below 50 indicates looser conditions from the previous quarter.

This index has been an excellent leading indicator for rents and vacancy rates, and this suggests higher vacancy rates and a further weakness in asking rents. This is the sixth consecutive quarter with looser conditions than the previous quarter.

Update on High Frequency Indicators: Airlines and Movie Tickets

by Calculated Risk on 1/22/2024 11:21:00 AM

I stopped the weekly updates of high frequency indicators at the end of 2022.

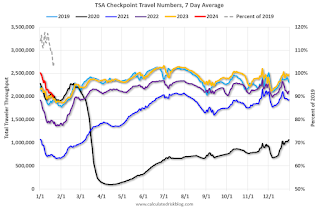

The TSA is providing daily travel numbers.

This data is as of January 21, 2024.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue), 2022 (Purple) and 2023 (Orange), and 2024 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is above the level for the same week in 2019 (104.1% of 2019). (Dashed line)

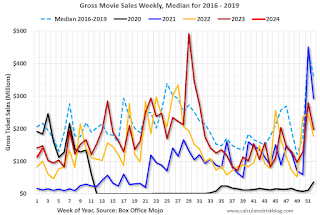

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales (dollars) have mostly been running below the pre-pandemic levels.

Housing January 22nd Weekly Update: Inventory Up 0.2% Week-over-week, Up 7.1% Year-over-year

by Calculated Risk on 1/22/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, January 21, 2024

Sunday Night Futures

by Calculated Risk on 1/21/2024 06:41:00 PM

Weekend:

• Schedule for Week of January 21, 2024

Monday:

• No major economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 5 and DOW futures are up 34 (fair value).

Oil prices were up slightly over the last week with WTI futures at $73.57 per barrel and Brent at $78.43 per barrel. A year ago, WTI was at $81, and Brent was at $87 - so WTI oil prices were down 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.05 per gallon. A year ago, prices were at $3.39 per gallon, so gasoline prices are down $0.34 year-over-year.

Hotels: Occupancy Rate Decreased 2.8% Year-over-year

by Calculated Risk on 1/21/2024 08:21:00 AM

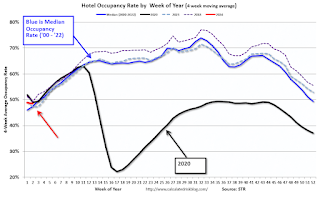

U.S. Hotel performance increased from the previous week, while year-over-year comparisons remained mixed, according to CoStar’s latest data through 13 January. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

7-13 January 2024 (percentage change from comparable week in 2023):

• Occupancy: 53.3% (-2.8%)

• Average daily rate (ADR): US$153.84 (+6.3%)

• Revenue per available room (RevPAR): US$81.96 (+3.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, January 20, 2024

Real Estate Newsletter Articles this Week: Existing Home Months-of-Supply above December 2019

by Calculated Risk on 1/20/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Up Year-over-year in December; Near Record Number of Multi-Family Housing Units Under Construction

• NAR: Existing-Home Sales Decreased to 3.78 million SAAR in December; Months-of-Supply above December 2019

• 4th Look at Local Housing Markets in December; California Home Sales Down 7.1% YoY in December

• Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

• Lawler: Early Read on Existing Home Sales in December

• https://calculatedrisk.substack.com/p/3rd-look-at-local-housing-markets-3cd

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.