by Calculated Risk on 1/24/2024 03:56:00 PM

Wednesday, January 24, 2024

ICE: Mortgage Delinquency Rate Increased in December

From ICE (formerly Black Knight): ICE First Look at Mortgage Performance: December Delinquencies Rise on Calendar Effects; Foreclosures Approach Two-year Lows

• In large part due to December ending on a Sunday, delaying the processing of payments made on the last day of the month, the national delinquency rate hit 3.57%, up 19 bps from NovemberNote: that last column below is for the same month in 2019 to show the change from pre-pandemic levels.

• Though the rise (+5.6%) was larger than an average December (+1.4%), it was milder than past Sunday-month-end Decembers, which have seen delinquencies jump +9.9% on average

• Serious delinquencies (90+ days past due) rose to 475K, but were still 19% (-108K) below where they were they ended December 2022

• December’s 24K foreclosure starts marked an 18-month low in new activity, with total active foreclosures the lowest since March 2022 (212K), still 25% below (-71K) pre-pandemic levels

• Likewise, the 5.4K foreclosure sales (completions) in December were down -17.2% from November and the fewest since February 2022 – shortly after the end of COVID-era moratoria

• Prepayment activity rose +4.9% to a single month mortality rate of 0.39% on improving interest rates, but prepays remain constrained by both seasonal and affordability pressures

emphasis added

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2023 | Nov 2023 | Dec 2022 | Dec 2019 | |

| Delinquent | 3.57% | 3.39% | 3.08% | 3.40% |

| In Foreclosure | 0.40% | 0.41% | 0.37% | 0.46% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,908,000 | 1,804,000 | 1,653,000 | 1,803,000 |

| Number of properties in foreclosure pre-sale inventory: | 212,000 | 216,000 | 198,000 | 245,000 |

| Total Properties | 2,120,000 | 2,020,000 | 1,850,000 | 2,047,000 |

Final Look at Local Housing Markets in December

by Calculated Risk on 1/24/2024 12:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in December

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in December.There is much more in the article.

I’ve added a comparison of active listings, new listings, and closings to the same month in 2019 (for markets with available data). This gives us a sense of the current low level of sales and inventory, and also shows some significant regional differences.

The big stories for December were that existing home sales were at a new cycle low on a seasonally adjusted annual rate basis (SAAR), and new listings were up YoY for the 3rd consecutive month!

...

And a table of December sales.

In December, sales in these markets were down 8.0%. In November, these same markets were down 7.6% YoY Not Seasonally Adjusted (NSA).

Sales in almost all of these markets are down sharply compared to December 2019.

...

It is possible sales will be up year-over-year in January since sales were reported at 4.00 million SAAR in January 2023. The comparison will be more difficult in February.

More local data coming in February for activity in January!

AIA: "Architecture firm billings remain soft to end the year"; Multi-family Billings Decline for 17th Consecutive Month

by Calculated Risk on 1/24/2024 09:31:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI December 2023: Architecture firm billings remain soft to end the year

Nearly one third of firms report an uptick in significantly delayed projects over the past six months• Regional averages: Northeast (45.9); South (43.4); Midwest (50.3); West (45.9)

Business conditions at architecture firms remained soft to close out 2023, with an AIA/Deltek Architecture Billings Index (ABI) score of 45.4 for December (any score below 50 indicates declining billings). Billings at firms declined for eight months of the year, with the only growth coming in some spring and summer months. However, clients largely remained interested in at least discussing potential new projects, since inquiries increased every month of the year except one. The value of new design contracts increased for only six months of the year, indicating that while clients were interested in new projects, they were generally less likely to commit to them by signing a contract. In addition, backlogs at firms remained quite strong throughout 2023, despite declining from a record-high peak in 2022. Backlogs at firms stood at an average of 6.7 months in December, indicating that most firms still have a significant amount of work in the pipeline.

Firm billings declined at firms in all regions of the country except the Midwest in December, where billings were essentially flat. Billings declined for all or nearly all months of 2023 at firms located in the West and Northeast. Firms in the South saw growth in the second quarter but otherwise declined. Only firms located in the Midwest reported increasing billings for most of the year, although conditions also softened there by late summer. Business conditions were also weak for most of the year at firms of all specializations, with firms with a multifamily residential specialization experiencing a particularly challenging year. Firms with an institutional specialization reported growth in the second quarter, but billings softened for them as well by the end of the year. Billings were flat throughout much of the year at firms with a commercial/industrial specialization and remained soft to end the year.

emphasis added

• Sector index breakdown: commercial/industrial (46.4); institutional (46.5); multifamily residential (45.8)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.4 in December, up from 45.3 in November. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 1/24/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

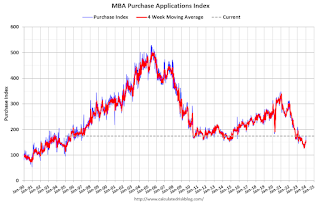

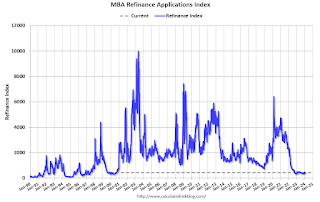

Mortgage applications increased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 19, 2024. The results include an adjustment to account for the MLK holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 3.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The holiday adjusted Refinance Index decreased 7 percent from the previous week and was 8 percent lower than the same week one year ago. The unadjusted Refinance Index decreased 16 percent from the previous week and was 8 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 18 percent lower than the same week one year ago.

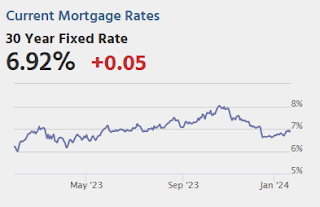

“Mortgage rates increased slightly last week but, there continues to be an upward trend in purchase activity. Conventional and FHA purchase applications drove most of the increase last week as some buyers moved to act early this season,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Refinance applications declined over the week and remained at low levels. There is still little incentive for homeowners to refinance with rates at these levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.78 percent from 6.75 percent, with points increasing to 0.63 from 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 18% year-over-year unadjusted.

Tuesday, January 23, 2024

Wednesday: Architecture Billings Index

by Calculated Risk on 1/23/2024 07:23:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

NMHC and Fannie Mae Multi-Family Presentation

by Calculated Risk on 1/23/2024 11:31:00 AM

Yesterday, Chris Bruen, Senior Director of Research at NMHC and Kim Betancourt, CRE, Vice President, Multifamily Economics and Strategic Research at Fannie Mae presented the State of the Multi-Family Market (see video recording of presentation).

Here are a couple of slides from the presentation by Betancourt:

The vacancy rate bottomed in Q2 2022 and has steadily increased. This is due to a combination more supply and less household formation (not mentioned in the presentation).

The second graph shows annual rents and vacancy rates.

Fannie expects rent growth to be sluggish in 2024, and the for the vacancy rate to increase to 6.25%.

Fannie expects rent growth to be sluggish in 2024, and the for the vacancy rate to increase to 6.25%.There are a couple of more graph in the presentation showing coming multi-family supply and rents by metro area.

1.54 million Total Housing Completions in 2023 including Manufactured Homes; Most Since 2007

by Calculated Risk on 1/23/2024 08:37:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: 1.54 million Total Housing Completions in 2023 including Manufactured Homes; Most Since 2007

Excerpt:

Although total housing starts decreased 9.0% in 2023 compared to 2022, completions increased year-over-year. Construction delays impacted completions in 2023, and that left a near record number of housing units under construction. However, there still were 1.543 million total completions and placements in 2023, the most since 2007.There is much more in the article.

Not counting Manufactured homes, there are 1.453 million completions in 2023, up 4.5% from 1.390 million in 2022, and also the most since 2007.

This graph shows total housing completions and placements since 1968 through 2023. Note that the net addition to the housing stock is less because of demolitions and destruction of older housing units. The housing start report last week indicated 1,002.4 thousand single family completions in 2023, 11.5 thousand in 2-to-4 units, and 438.6 thousand in 5+ units (up 22% from 2022, and the most since 1987).

Monday, January 22, 2024

Tuesday: Richmond Fed Mfg

by Calculated Risk on 1/22/2024 07:10:00 PM

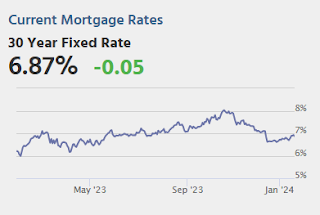

The week got off to a slow start as far as the bond market was concerned. Volume was the lowest of the year so far, even if only by a small margin. Volatility was also muted, at best. The overnight session provided modest gains and about half of the gains stuck around through the close. Even so, the improvement wasn't remotely enough to change the prevailing landscape in which bonds are in a modest uptrend in search of a short-term ceiling from which to carve out a broader sideways set-up for the more important events in the next 3 weeks. [30 year fixed 6.87%]Tuesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for December 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.23% in December"

by Calculated Risk on 1/22/2024 04:11:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.23% in December

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.26% of servicers’ portfolio volume in the prior month to 0.23% as of December 31, 2023. According to MBA’s estimate, 115,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.At the end of December, there were about 115,000 homeowners in forbearance plans.

In December 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 1 basis point to 0.15%. Ginnie Mae loans in forbearance decreased 8 basis points to 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 3 basis points to 0.27%.

“Forbearance as a loss mitigation option is diminishing,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “While forbearance is a powerful tool for delinquency surges resulting from natural disasters or major disruptions such as a pandemic, today’s borrowers are not experiencing widespread financial distress. The overall performance of servicing portfolios – particularly government loans – declined in December. Factors such as seasonality, a changing labor market, resumption of student loan payments, and the rise in balances on other forms of consumer debt are likely at play.”

...

• By reason, 61.2% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 26.8% of borrowers are in forbearance because of COVID-19. Another 12.0% are in forbearance because of a natural disaster.emphasis added

NMHC: "Apartment Market Continues to Loosen"

by Calculated Risk on 1/22/2024 01:45:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen"

Excerpt:

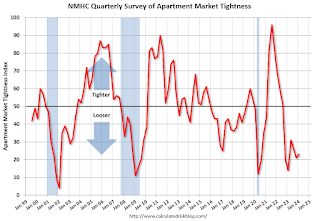

From the NMHC: Financing Conditions Show Signs of Improvement, Apartment Market Continues to Loosen with Decreasing Deal FlowThere is much more in the article.Apartment market conditions continued to weaken in the National Multifamily Housing Council's (NMHC) Quarterly Survey of Apartment Market Conditions for January 2024. With the exception of Debt Financing (66), which turned positive this quarter, the Market Tightness (23), Sales Volume (34), and Equity Financing (44) indexes all came in below the breakeven level (50).

...

"Yet, the apartment market continues to record decreasing rent growth and rising vacancy rates as it absorbs the highest level of new supply in more than thirty years.”• The Market Tightness Index came in at 23 this quarter – below the breakeven level (50) – indicating looser market conditions for the sixth consecutive quarter. A majority of respondents (59%) reported markets to be looser than three months ago, while only 5% thought markets have become tighter. Thirty-five percent of respondents thought market conditions had gone unchanged over the past three months.The quarterly index increased to 23 in January from 21 in October. Any reading below 50 indicates looser conditions from the previous quarter.

This index has been an excellent leading indicator for rents and vacancy rates, and this suggests higher vacancy rates and a further weakness in asking rents. This is the sixth consecutive quarter with looser conditions than the previous quarter.