by Calculated Risk on 1/26/2024 07:02:00 PM

Friday, January 26, 2024

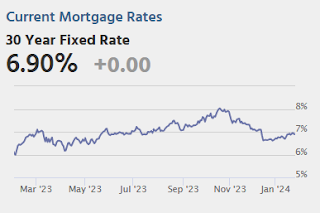

Jan 26th COVID Update: Weekly Deaths Increased

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 24,718 | 28,154 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,978 | 1,806 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

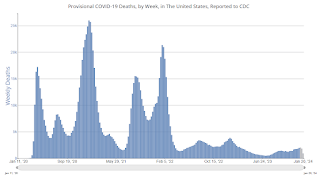

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.U.S. Courts: Bankruptcy Filings Increase 17 Percent in 2023; 42% Below Pre-Pandemic Levels

by Calculated Risk on 1/26/2024 12:59:00 PM

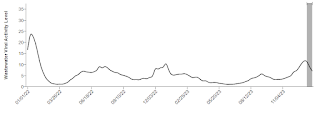

From the U.S. Courts: Bankruptcy Filings Rise 16.8 Percent

Total bankruptcy filings rose 16.8 percent, with significant increases in both business and non-business bankruptcies, in the twelve-month period ending Dec. 31, 2023. This accelerates a continuing rebound in filings after more than a decade of sharply dropping totals.

According to statistics released by the Administrative Office of the U.S. Courts, annual bankruptcy filings totaled 452,990 in the year ending December 2023, compared with 387,721 cases in the previous year.

Business filings rose 40.4 percent, from 13,481 to 18,926, in the year ending Dec. 31, 2023. Non-business bankruptcy filings rose 16 percent to 434,064, compared with 374,240 in December 2022.

Bankruptcy totals for the previous 12 months are reported four times annually.

This is the fourth straight quarter that total bankruptcy filings have risen, following a decade-plus decline. Bankruptcies fell especially sharply after the pandemic began in early 2020, despite some COVID-related disruptions to the economy.

Despite the recent increases, the newest totals remain far lower than in December 2010, when filings peaked at just less than 1.6 million.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005".

2023 was the 3rd lowest year for bankruptcy filings, and 42% below the pre-pandemic level in 2019.

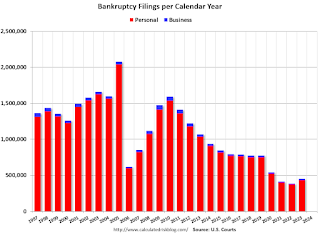

NAR: Pending Home Sales Increase 8.3% December; Up 1.3% Year-over-year

by Calculated Risk on 1/26/2024 10:00:00 AM

From the NAR: Pending Home Sales Climbed 8.3% in December

Pending home sales in December elevated 8.3%, according to the National Association of REALTORS®. The Midwest, South and West posted monthly gains in transactions while the Northeast recorded a loss. The Midwest, South and West also registered year-over-year increases while the Northeast had a decline in transactions compared to last year.This was well above expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 77.3 in December. Year over year, pending transactions were up 1.3%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI dropped 3.0% from last month to 62.3, a decline of 3.9% from December 2022. The Midwest index increased 5.6% to 80.5 in December, up 4.3% from one year ago.

The South PHSI jumped 11.9% to 93.0 in December, rising 1.5% from the prior year. The West index surged 14.0% in December to 61.0, up 1.5% from December 2022.

emphasis added

PCE Measure of Shelter Slows to 6.4% YoY in December

by Calculated Risk on 1/26/2024 08:59:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through December 2023.

Since asking rents are mostly flat year-over-year, these measures will continue to slow over coming months.

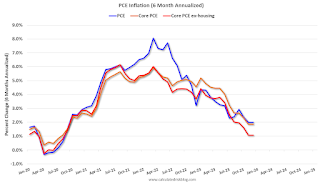

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 6 months (annualized):

Key measures are now at or below the Fed's target on a 6-month basis.

Key measures are now at or below the Fed's target on a 6-month basis.PCE Price Index: 2.0%

Core PCE Prices: 1.9%

Core minus Housing: 1.1%

Personal Income increased 0.3% in December; Spending increased 0.7%

by Calculated Risk on 1/26/2024 08:30:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $60.0 billion (0.3 percent at a monthly rate) in December, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $51.8 billion (0.3 percent) and personal consumption expenditures (PCE) increased $133.9 billion (0.7 percent).The December PCE price index increased 2.6 percent year-over-year (YoY), unchanged from 2.6 percent YoY in November, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.1 percent in December and real PCE increased 0.5 percent; goods increased 1.1 percent and services increased 0.3 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through December 2023 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was well above expectations.

Thursday, January 25, 2024

Friday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 1/25/2024 07:55:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.6% YoY, and core PCE prices up 3.0% YoY.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 2.0% increase in the index.

Realtor.com Reports Active Inventory UP 8.6% YoY; New Listings up 3.4% YoY

by Calculated Risk on 1/25/2024 02:55:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending January 20, 2024

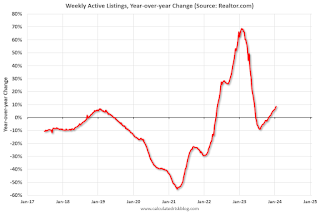

• Active inventory increased, with for-sale homes 8.6% above year ago levels.

Active listings in the past week grew by 8.6% above the previous year, the 11th straight week of annual growth with no sign yet of a slowdown as growth in inventory increased from the previous week’s 7.9% rate. Should the uptick in new listings persist, the added inventory would greatly improve availability and affordability heading into the spring homebuying season but overall inventory is still 37.5% below similar weeks in 2017 to 2020.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 3.4% from one year ago.

Newly listed homes continue to rise above last year’s levels for the 13th week in a row. However, this past week the number of newly listed homes grew by only 3.4% over last year, a slowing down of the 7.0% growth rate seen in the previous week. During the winter season, there is a smaller pool of both home buyers and sellers active in the market, which could lead to more week-to-week fluctuations. Nonetheless, this past week’s new listing count still represents a decline of 25.9% compared to similar weeks in 2017 to 2020.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 11th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

New Home Sales increase to 664,000 Annual Rate in December; Average New Home Price is Down 14% from the Peak

by Calculated Risk on 1/25/2024 10:53:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales increase to 664,000 Annual Rate in December

Brief excerpt:

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 664 thousand. The previous three months were revised up, combined.There is much more in the article.

...

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in December 2023 were up 4.4% from December 2022.

Annual new home sales in 2023 were at an estimated 668,000, up 4.2% from 641,000 in 2022.

New Home Sales increase to 664,000 Annual Rate in December

by Calculated Risk on 1/25/2024 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 664 thousand.

The previous three months were revised up, combined.

Sales of new single‐family houses in December 2023 were at a seasonally adjusted annual rate of 664,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.0 percent above the revised November rate of 615,000 and is 4.4 percent above the December 2022 estimate of 636,000.

An estimated 668,000 new homes were sold in 2023. This is 4.2 percent above the 2022 figure of 641,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 8.2 months from 8.8 months in November.

The months of supply decreased in December to 8.2 months from 8.8 months in November. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of December was 453,000. This represents a supply of 8.2 months at the current sales rate"Sales were above expectations of 650 thousand SAAR, and sales for the three previous months were revised up, combined. I'll have more later today.

BEA: Real GDP increased at 3.3% Annualized Rate in Q4

by Calculated Risk on 1/25/2024 08:31:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2023 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.3 percent in the fourth quarter of 2023, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.9 percent.PCE increased at a 2.8% annual rate, and residential investment increased at a 1.1% rate. The advance Q3 GDP report, with 3.3% annualized increase, was above expectations.

The increase in real GDP reflected increases in consumer spending, exports, state and local government spending, nonresidential fixed investment, federal government spending, private inventory investment, and residential fixed investment (table 2). Imports, which are a subtraction in the calculation of GDP, increased.

The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors were food services and accommodations as well as health care. Within goods, the leading contributors to the increase were other nondurable goods (led by pharmaceutical products) and recreational goods and vehicles (led by computer software). Within exports, both goods (led by petroleum) and services (led by financial services) increased. The increase in state and local government spending primarily reflected increases in compensation of state and local government employees and investment in structures. The increase in nonresidential fixed investment reflected increases in intellectual property products, structures, and equipment. Within federal government spending, the increase was led by nondefense spending. The increase in inventory investment was led by wholesale trade industries. Within residential fixed investment, the increase reflected an increase in new residential structures that was partly offset by a decrease in brokers' commissions. Within imports, the increase primarily reflected an increase in services (led by travel).

Compared to the third quarter of 2023, the deceleration in real GDP in the fourth quarter primarily reflected slowdowns in private inventory investment, federal government spending, residential fixed investment, and consumer spending. Imports decelerated.

emphasis added